Polling suggests that sitting New Zealand Prime Minister Jacinda Arden will enjoy a landslide victory, buoyed by the country's successful elimination of the COVID-19 virus.

Much of New Zealand’s COVID-19 elimination success was a result of Arden’s decision to “go hard and going early” by implementing the toughest “level 4” lockdown restrictions seen anywhere in the world. With only 25 recorded coronavirus deaths to date, the policy has been deemed a success.

However, it’s not come without a cost. The New Zealand economy contracted by 12.2% in the second quarter of 2020, compared with a 7% fall in the Australian economy during the same period.

The New Zealand economy's path to recovery and job creation remains patchy. Borders are likely to remain closed to tourists and international students for the foreseeable future, crimping the tourism industry that pre the pandemic was the country’s largest export earner.

To offset this, the government has provided fiscal support with a focus on infrastructure projects. Elsewhere the Reserve Bank of New Zealand cut the overnight cash rate (OCR) to just 0.25% in March and committed to buying $100bn of bonds (QE) until June 2022.

The RBNZ has continued to canvass other unconventional monetary policy options to support the recovery including taking the OCR negative, lending to banks at a rate below market rates, and buying foreign bonds.

The threat of such policy options and general risk sentiment is likely to remain the key driver of the NZDUSD rather than tomorrow's election.

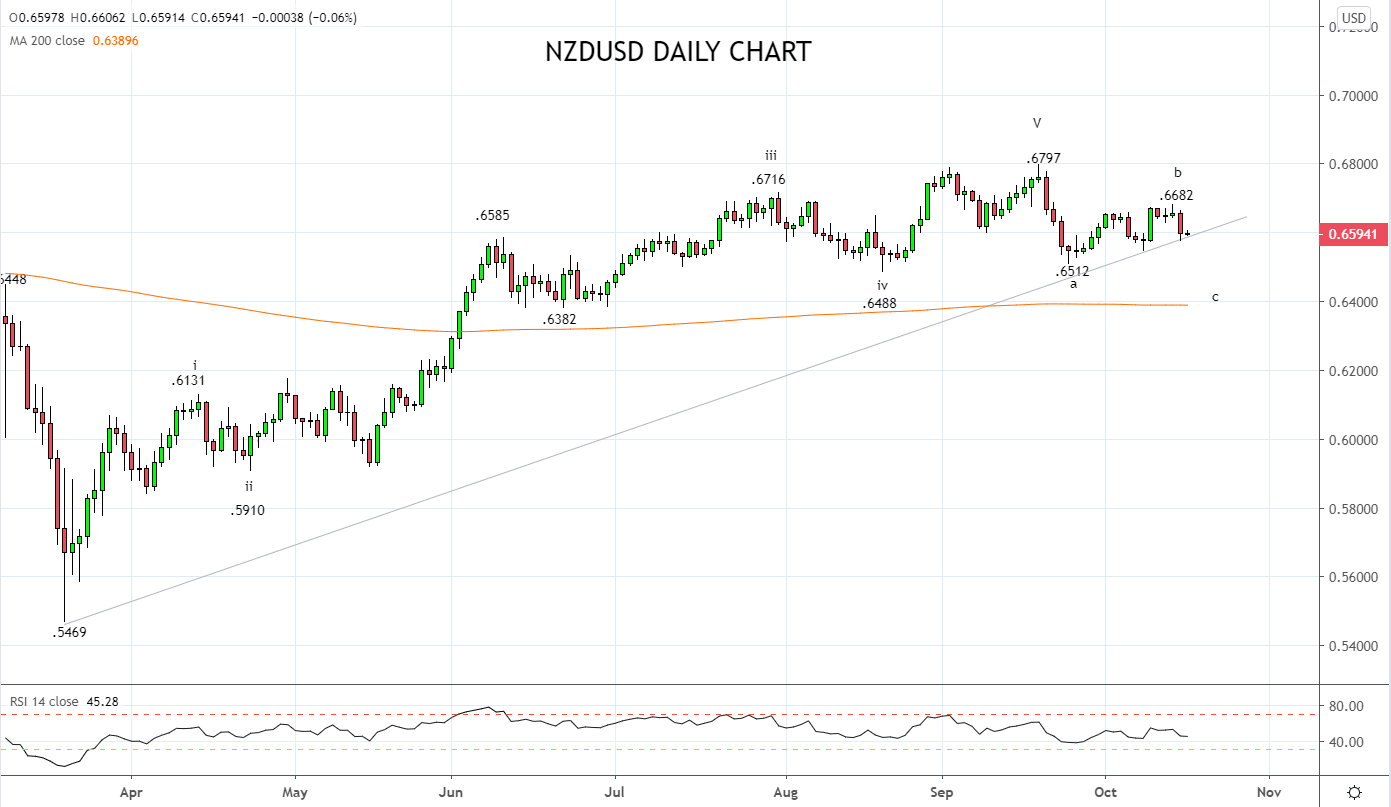

Technically, yesterday’s sell-off in the NZDUSD has resulted in a test of uptrend support at .6575 from the March .5469 low and this level needs to hold on a closing basis to keep the uptrend intact.

Keeping in mind, should the NZDUSD break and close below the aforementioned uptrend support it would warn that another corrective leg low has commenced with the potential to retest the September .6512 low, before .6400c.

Source Tradingview. The figures stated areas of the 16th of October 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation