The New Zealand central bank, RBNZ has taken the markets by surprise by offering a bigger interest rate cut of 50 bps (25 bps cut consensus) on its official cash rate to bring it down to a record low of 1.00% today.

In addition, RBNZ governor Orr has signalled further monetary policy easing could be possible due to heightened uncertainty in the global economic outlook reinforced by the trade tension between U.S. and China. He also hinted at non-conventional easing policies.

After today’s monetary policy decision, RBNZ can be considered as the most dovish central bank among the developed countries as it was the first to cut interest rate in May and now becomes the first to enact a straight 50 bps cut within a single meeting for this on-going global monetary easing cycle.

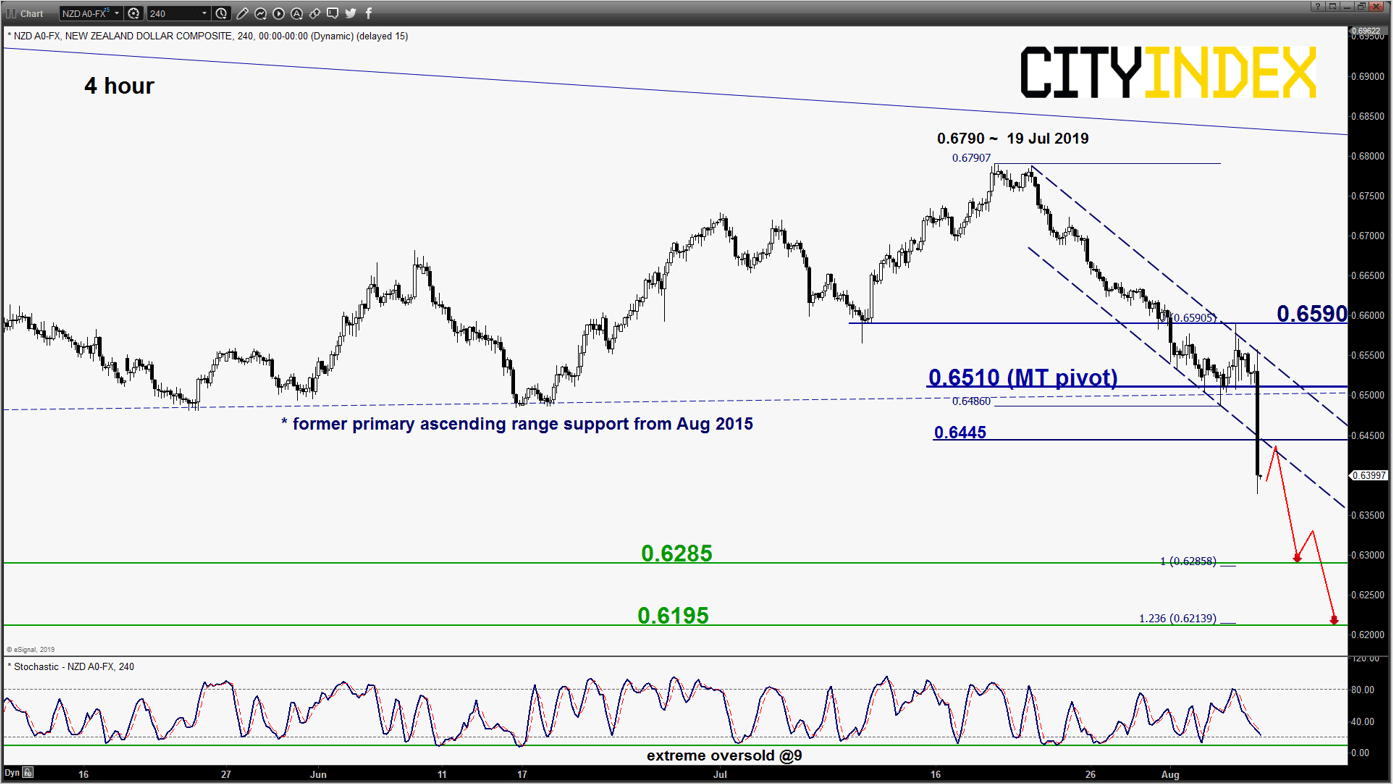

Medium-term (1-3weeks) technical analysis outlook on NZD/USD

click to enlarge charts

Key Levels (1 – 3 weeks)

Intermediate resistance: 0.6445

Pivot (key resistance): 0.6510

Supports: 0.6285 & 0.6195

Next resistance: 0.6590

Directional View (1 -3 weeks)

Minor bounce before new potential new drop. Bearish bias in any bounces below 0.6510 key medium-term pivotal resistance for another potential bearish impulsive down leg to target the next supports at 0.6285 and 0.6195.

On the other hand, a clearance with a daily close above 0.6510 negates the bearish tone a for a squeeze up to retest the next resistance at 0.6590 (also 50% Fibonacci retracement of the on-going slide from 19 Jul high to today’s intraday low of 0.6376.

Key elements

- The pair has staged a bearish breakdown below major primary ascending range support in place since Aug 2015 now turns pull-back resistance at 0.6510 which also confluences with the upper boundary of a minor descending channel in place since 19 Jul 2019 high.

- The 4-hour Stochastic oscillator has almost reached at extreme oversold level which suggests the risk of a minor rebound due to an overstretched condition in downside momentum of price action.

- The 0.6195 key medium-term support is defined by a Fibonacci projection level, the Aug 2015 swing low and the long-term secular ascending channel support in place since Oct 2000 low.

Charts are from eSignal