The New Zealand economy is currently running at two differing speeds. Housing prices have surged over the last three months, prompting the reintroduction of LVR restrictions.

To further cool the housing market, the New Zealand Government has taken the unorthodox step of instructing the RBNZ to take into account housing prices when setting monetary policy, in addition to its primary inflation and employment objectives.

The inclusion of housing prices in the RBNZ’s mandate in theory works well when the economy is strong and able to accommodate higher rates designed to take the sting out of the housing market.

However, the job becomes more difficult when the property market is surging and the rest of the economy has slowed as data has shown since the end of 2020.

At the heart of the slowdown, New Zealand has endured a summer of no tourists as international borders remain closed. The absence of international tourists and students has left its mark.

As a result, Q4 GDP is expected to rise just +0.1%, following a 14% rebound in Q3. Furthermore, tepid growth is likely to continue in Q1 2021, exacerbated by two “level 3” lockdowns in Auckland over the past month.

What does this mean for the NZD/USD?

With the reflation trade still the main driver of the commodity currencies, the NZD/USD is expected to shrug off a soft GDP number on Thursday.

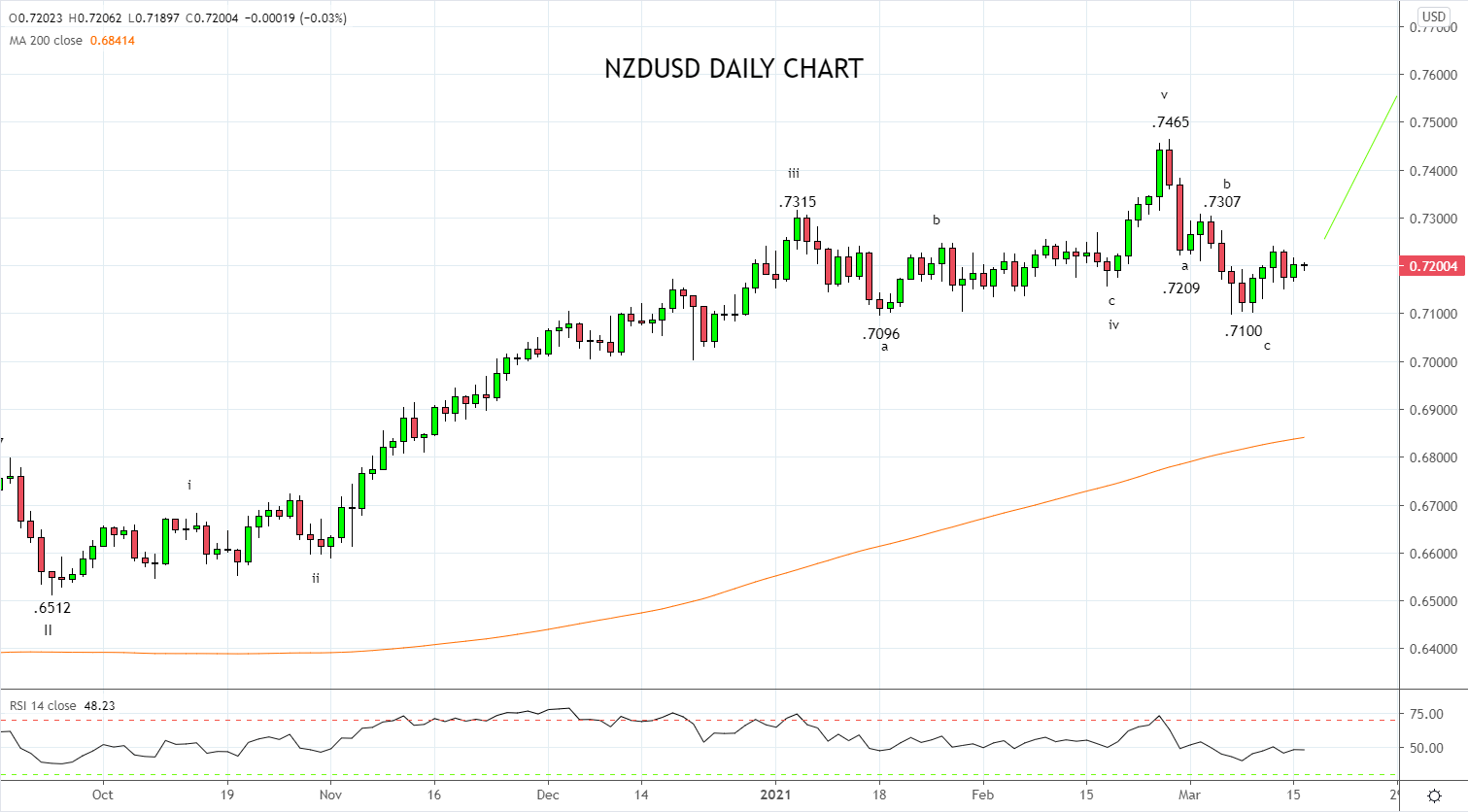

Technically, the triple bottom that formed at the .7100c lows was an initial warning that the correction from the February .7465 high was complete and that a rebound was close by.

Providing the NZD/USD does not retrace back below key support .7100c, we favour long NZD/USD positions on dips back to the .7180/60 support, in expectation of a move towards resistance at .7300/20, before a retest of the February .7465 high.

Source Tradingview. The figures stated areas of the 16th of March 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation