The data confirms the booming state of the economy before the current Level 4 lockdown and that the contraction in Q3 will be shallow. It also reinforces the belief that the RBNZ will raise interest rates from its emergency setting of 0.25% next month.

The only question is whether it will be a 25bps lift in interest rates or a 50bp hike. While a 50bp hike appears warranted, reflecting the uncertainty provided by the current Covid outbreak, the interest rate market has settled post the GDP data to be pricing in 35bp of rate hikes for the October 6th meeting.

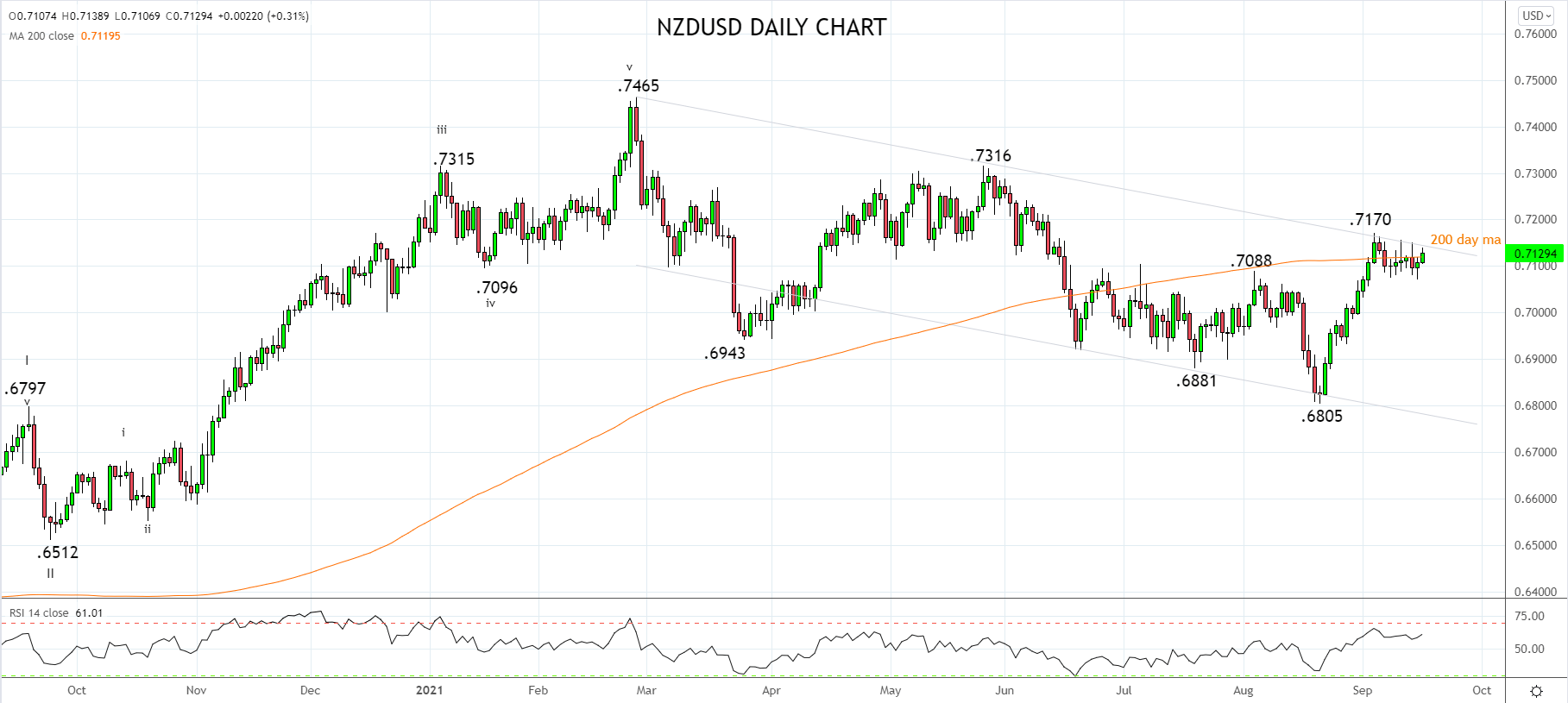

The NZDUSD (which holds one of the largest positions in G10 FX currently) rallied 20 pips after the data from .7120 to .7140 before settling back at .7130 at the time of writing.

There remains a cluster of resistance at .7140 up to .7170, including the 200-day moving average and trend channel resistance that the NZDUSD needs to clear to indicate the current correction is complete and the NZDUSD is ready to take another leg higher towards .7300c.

Source Tradingview. The figures stated areas of September 16th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation