The better tone evident in the U.S. session following a decision by the World Health Organisation to refrain from classifying the Coronavirus as a global health crisis has mostly remained in place during the Asian time zone, despite more deaths being reported this morning.

The latest numbers are 830 confirmed cases, 680 suspected cases, and 25 deaths. 7 more cities have been placed under a transportation lockdown in addition to Wuhan, affecting a total population of over 23 million people, only 1.6 million less than the entire population of Australia!!!

While the number of fatalities represents a 38% increase overnight, traders anxieties are being assuaged by regular updates from Chinese authorities and the advice that despite human to human transition, most fatalities have involved the elderly or those with existing health conditions.

In terms of economic data, the highlight today has been the NZ Q4 headline inflation coming in slightly above expectations at 0.5% q/q and notably higher than the RBNZ’s November MPS forecast of 0.2% q/q.

The annual rate of inflation at 1.9% is now only fractionally below the RBNZs inflation target, and in tandem with the recent improvement in activity and sentiment data, as well as upcoming fiscal stimulus it affords the RBNZ more time to be patient. In response, most analysts have either pushed back or removed entirely their forecasts for RBNZ interest rate cuts in 2020.

Similar to the price action in the AUDUSD post the Australian labour force report, the NZDUSD initially rallied before buyer enthusiasm waned ahead of an unpredictable weekend.

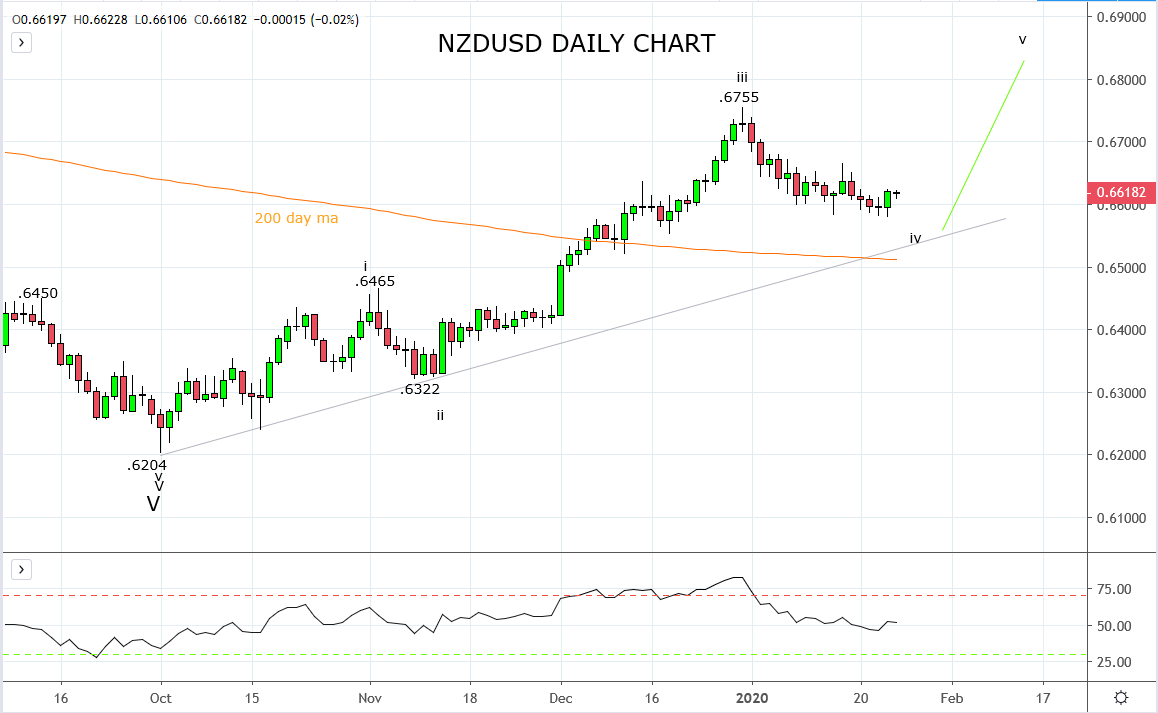

Technically, my bias is the NZDUSD will trade higher in due course. However, in the short term it is possible the current Wave iv correction may continue a little longer and lower before the uptrend returns.

Should the NZDUSD trade towards the band of support .6530/10 consisting of the 200-day moving average and uptrend support it would offer an appropriate location to assess a long NZDUSD entry looking for a retest of the December .6755 high.

Source Tradingview. The figures stated areas of the 24th of January 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation