Disappointment centred on the absence of discussion around extending the maturity of asset purchases and lukewarm enthusiasm for the implementation of yield curve control (YCC). The prospects of both have been instrumental in driving real yields lower.

Without these twin anchors, the FOMC minutes cut free the portfolio of trades that have thrived in recent weeks including long gold, short the U.S. dollar, and long equities. Mindful that the unwind in these trades is likely to have occurred on lighter volumes, found during the Northern Hemisphere summer and that moves that occur on low volumes can easily be retraced.

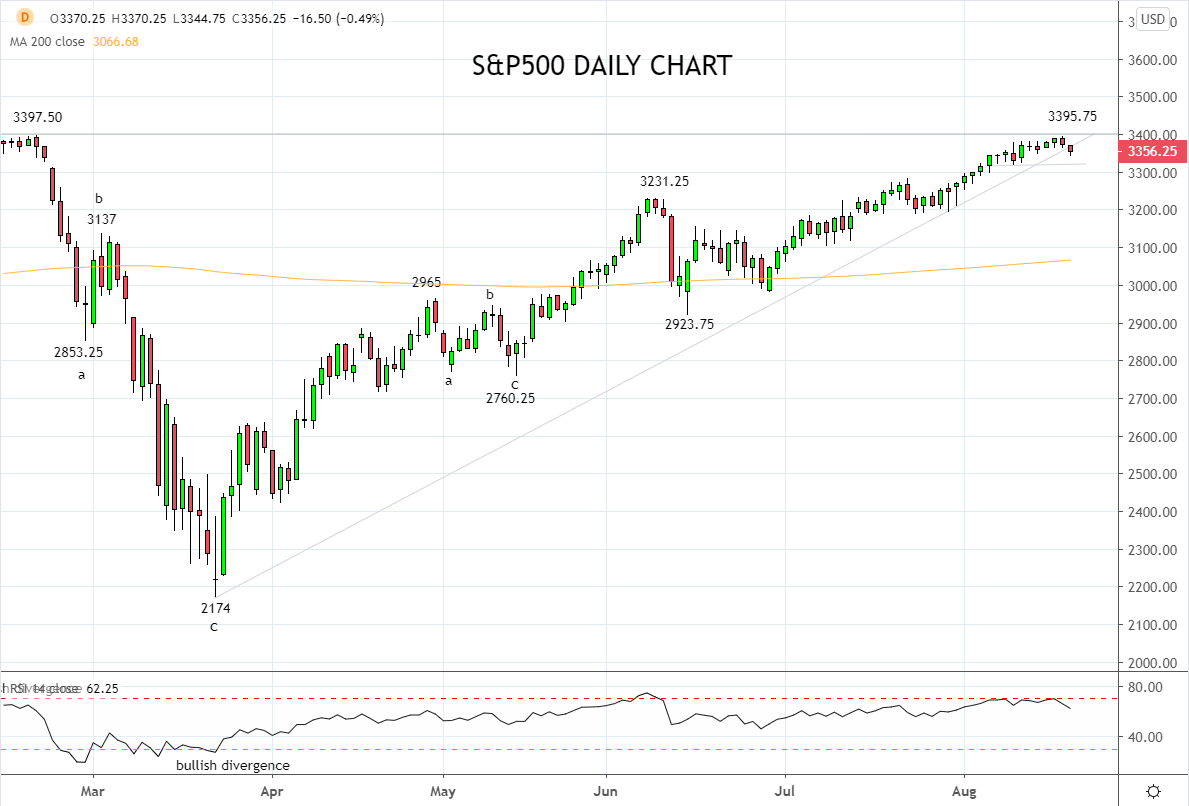

However, when viewed on a chart, the S&P500’s recent price action makes does make it somewhat difficult to be overly enthusiastic about its immediate upside prospects.

In particular, the pattern of new cycle highs on waning momentum is usually viewed at the tail end of moves, rather than midway through. Also notable the possibility of a double top at all-time highs, and the break of trendline support from the March 2174 low. Finally, the divergence between the high beta Nasdaq and the broader market is something that is frequently witnessed at turning points.

In light of the above, I am watching for a sustained break of recent lows 3320/10 to indicate the uptrend has faltered. The possibility of a corrective pullback increasing on a break below medium-term support 3280/70, and indicative that a pullback towards the 200 day moving average at 3065 is underway.

Keeping in mind that should the S&P500 continue to hold above the near term 3320/10 support and medium-term support 3280/70, allow for a retest and break of the all-time highs at 3397.50, before a move towards 3500/3600 into year-end.

Source Tradingview. The figures stated areas of the 20th of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation