Blink and you missed it. The FTSE very briefly moved higher on Tuesday before resuming the sell off. The move lower comes after the Dow closed on Monday down 12.9% in its worst one day sell off in over 3 decades. US futures are managing to cling onto gains.

This is not the first time we have seen dead cat bounce following a heavy sell off. Stocks rarely manage to maintain any gains into the afternoon session.

Central bank action and the prospect of further fiscal support are in focus on Tuesday. Rishi Sunak has announced a major bail out scheme and extra measures for businesses after Wall Street’s sell off overnight. The new package will build on the £12 billion set out in last week’s budget.

With new social distancing measures coming in and the prospect of businesses grinding to a halt over the coming weeks, the markets have made it clear that the original measures of support were inadequate. Given the resumed sell off, doubts exit over whether these measures will be able to contain the coronavirus chaos.

Too early to call a bottom

Governments across the globe put in more stringent restrictions to control the spread of coronavirus. As they do so, the greater the economic hit will be through this process. This still feels far to early to be calling the bottom of the sell off. Companies are still unable to quantify the economic hit that they expect.

Realistically we will only start to see meaningful moves higher in riskier assets when the coronavirus numbers start to improve. Until then investors will fear a recession in the first half of the year, as deep as in the financial crisis. With a depression also plausible.

Governments across the globe put in more stringent restrictions to control the spread of coronavirus. As they do so, the greater the economic hit will be through this process. This still feels far to early to be calling the bottom of the sell off. Companies are still unable to quantify the economic hit that they expect.

Realistically we will only start to see meaningful moves higher in riskier assets when the coronavirus numbers start to improve. Until then investors will fear a recession in the first half of the year, as deep as in the financial crisis. With a depression also plausible.

Data To Be Ignored

UK jobs data is due today. Expectations are for unemployment to remain steady at 3.8% in the three months to January. Average wages are expected to tick higher to 3%, up from 2.9%. However, given the data was from before the coronavirus outbreak here, it will be considered as out of date.

UK jobs data is due today. Expectations are for unemployment to remain steady at 3.8% in the three months to January. Average wages are expected to tick higher to 3%, up from 2.9%. However, given the data was from before the coronavirus outbreak here, it will be considered as out of date.

Levels to watch

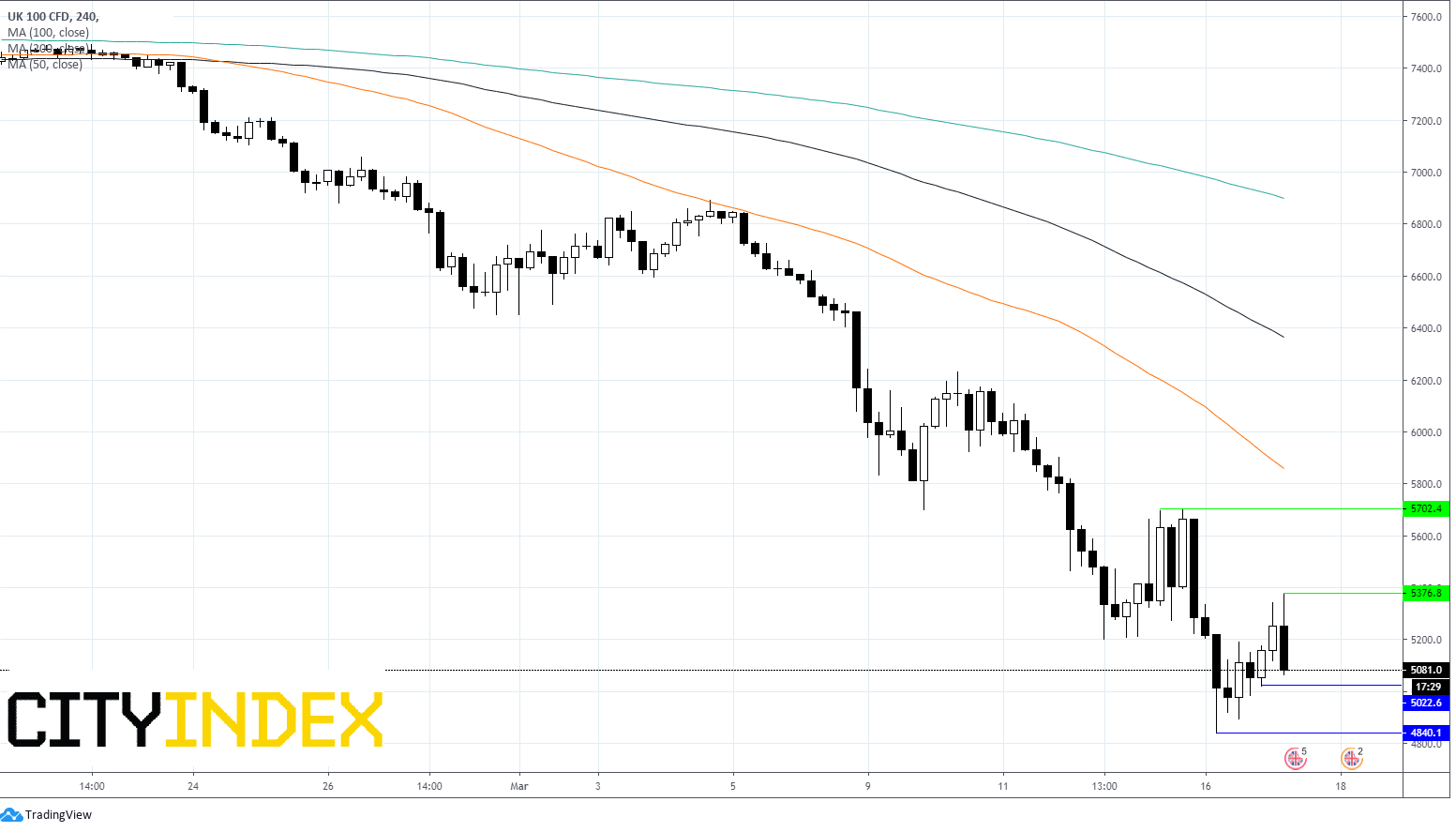

The FTSE is struggling to hold onto earlier gains. The index trades below its 50, 100 and 200 sma on 4 hour chart, a clearly bearish chart. Immediate support can be seen at 5220(today’s low) followed by 4840 (yesterday’s low).

On the flipside resistance can be seen at 5376 (today’s high) and 5700 (high 13th March). A move above this level could negate the bearish trend.

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM