No deal Brexit planning hits GBP; FOMC minutes up next

The pound fell lower in early trade and has remained in the doldrums ever since, as investors search for signs that the EU may be willing to re-negotiate the Irish backstop. Whilst Boris Johnson is due to visit Chancellor Angela Merkel, the chances of the EU ditching the most contested element of the Withdrawal Agreement are slim at best. EU Council President Donald Tusk rebuffed Johnson’s demands to reopen divorce talks on Tuesday. A no deal Brexit is starting to look inevitable.

Traders are focusing on Boris Johnson’s threat of dramatically reducing contact with the EU in 10 to concentrate on no deal preparations. Whilst the realisation that a disorderly Brexit could be just over 70 days away is unnerving pound traders. The base case scenario has been the UK leaving the EU with a deal. This is on the cusp of changing. Barclays today announced that they now see a no deal Brexit and a rate cut as the base case scenario. Surely it is only a matter of time until the BoE change their base case as well?

Without a practical solution to the Irish backstop problem and with MP’s due back from the summer recess at the beginning of September we can expect pound volatility to increase to new levels in the coming weeks. Headline trading is challenging at the best of times, headline trading weeks from Brexit will certainly result in some wild movements.

Whilst the UK economic calendar is light, investors will be looking to FOMC minutes due to be released at 18:00 BST, followed by US PMI data on Thursday and Fed Powell’s speech on Friday. Given the outdated nature of the minutes in light of the recent US - Sino trade dispute escalation and global recession fears, the reaction to the minutes could be limited.

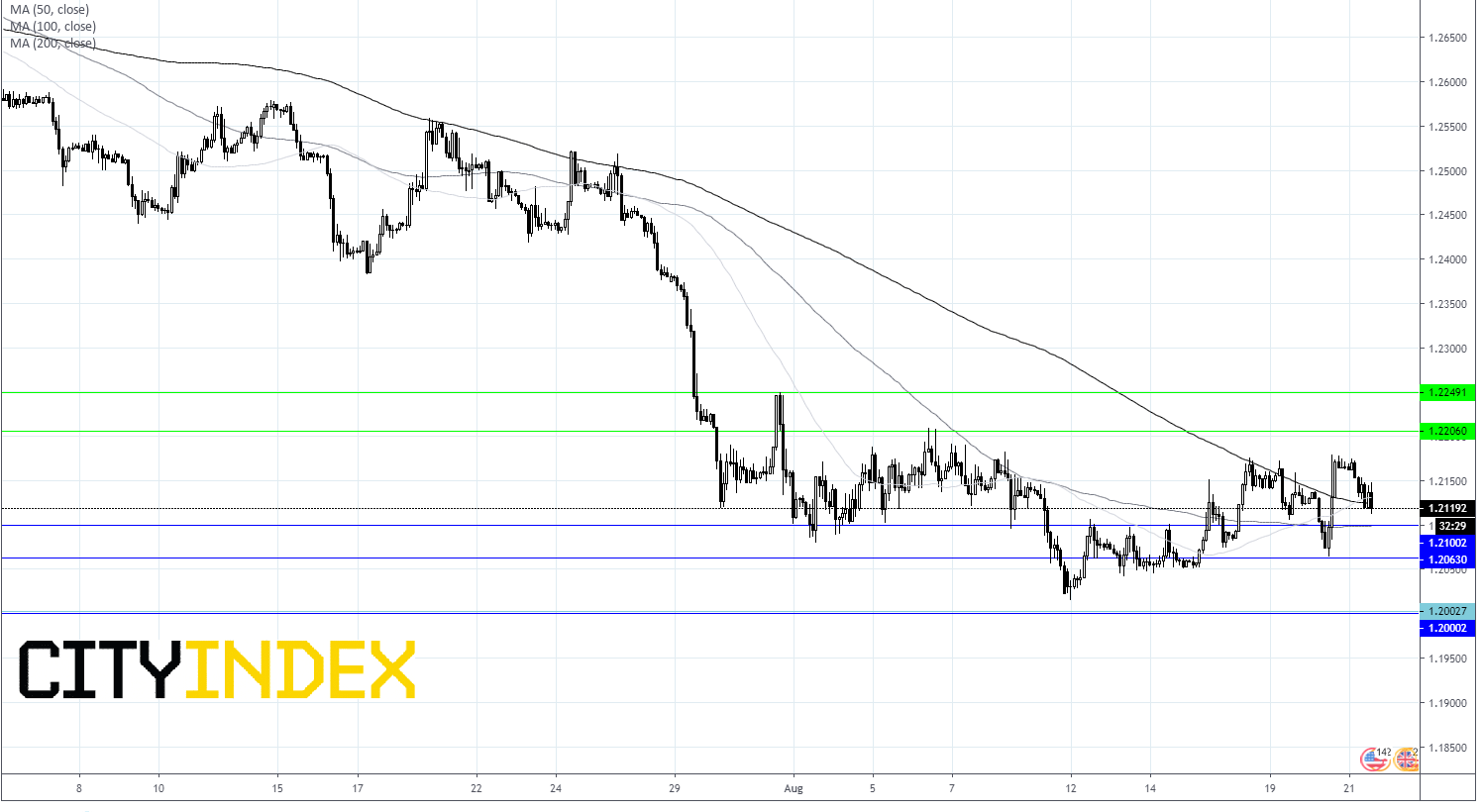

GBP/USD levels to watch:

The pound’s failure to break through $1.22 suggests that bearish momentum could be here for a while longer. Near term support can be seen at $1.2125, prior to $1.21 and $1.2065. On the upside immediate resistance is seen at $1.22, which if cleared could see the pair advance to $1.2250.