Investors aren’t getting carried away with half-year relief.

The shares briefly surged 7% higher for their second-best day of the year. They were last up about 3.7% and losing 8.7% this year. Nimble scheduling to minimise the impact of strikes and freak weather is now set to lower seat costs, which is better than the previous expectation that those would be unchanged. There were few further surprises. The 7.3% revenue jump on the year had an FX tailwind. The typical loss at this point in the travel year left easyJet further offside than expected—£275m in the red vs. minus £18m at H1 2018. Underlying revenue was still higher, but unexpected hits included drones, and cost inflation. Ahead, the group warns that currency effects will become a headwind into year end, and the fuel bill will rise to between £25m-£60m. That will take a hefty chunk out of a savings forecast at £100m. Although easyJet’s 2019/20 average fuel hedge still looks more favourable than Ryanair’s, longstanding pressures and persisting disruption underscore the lack of leg room the UK carrier has to lift growth in the medium term. Investment in fleet and long-term profit growth projections are still easyJet’s key investible points. With headline outlook unchanged and no hints on potential outperformance, share price recovery this year, if any, looks set to remain sluggish.

Chart thoughts

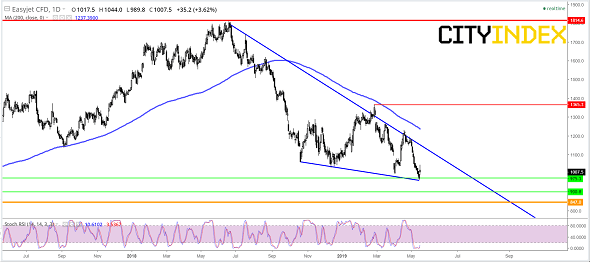

EZJ looks to be grinding out a bottom from, pretty much, a year of selling off cycle highs last May and July. A falling wedge of similar length could presage eventual continuation of the September 2017-July 2018 trend to cycle highs. But first, visible impediments must be surpassed, beginning with the declining line connecting successively lower highs since July. Above that, and 1237p 200-day moving average, this year’s 1365p peak could be the decider of an extended recovery. In the event of a stall, 975p-847p would be where buyers hope for support.

Chart: easyJet – daily

Source: City Index