NIO (NIO): key support level is located at $38.00

Electric car stocks have great performance in 2020. Chinese electric cars marker Nio Inc (NIO) soared more than 1500% in 2020 as investors expected that electric car would be a fast developing industry in next 10 year.

According to the China Association of Automobile Manufacturers, New Energy Vehicles sales volume reached 200,000 units in November, up 24.1% on month and 104.9% on year.

Recently, NIO (NIO) announced the pricing of the offering of 68M American depositary shares at $39.00. The raising capital will be used for research and development of new products sale and service network expansion and market penetration as well as for the general corporate purposes.

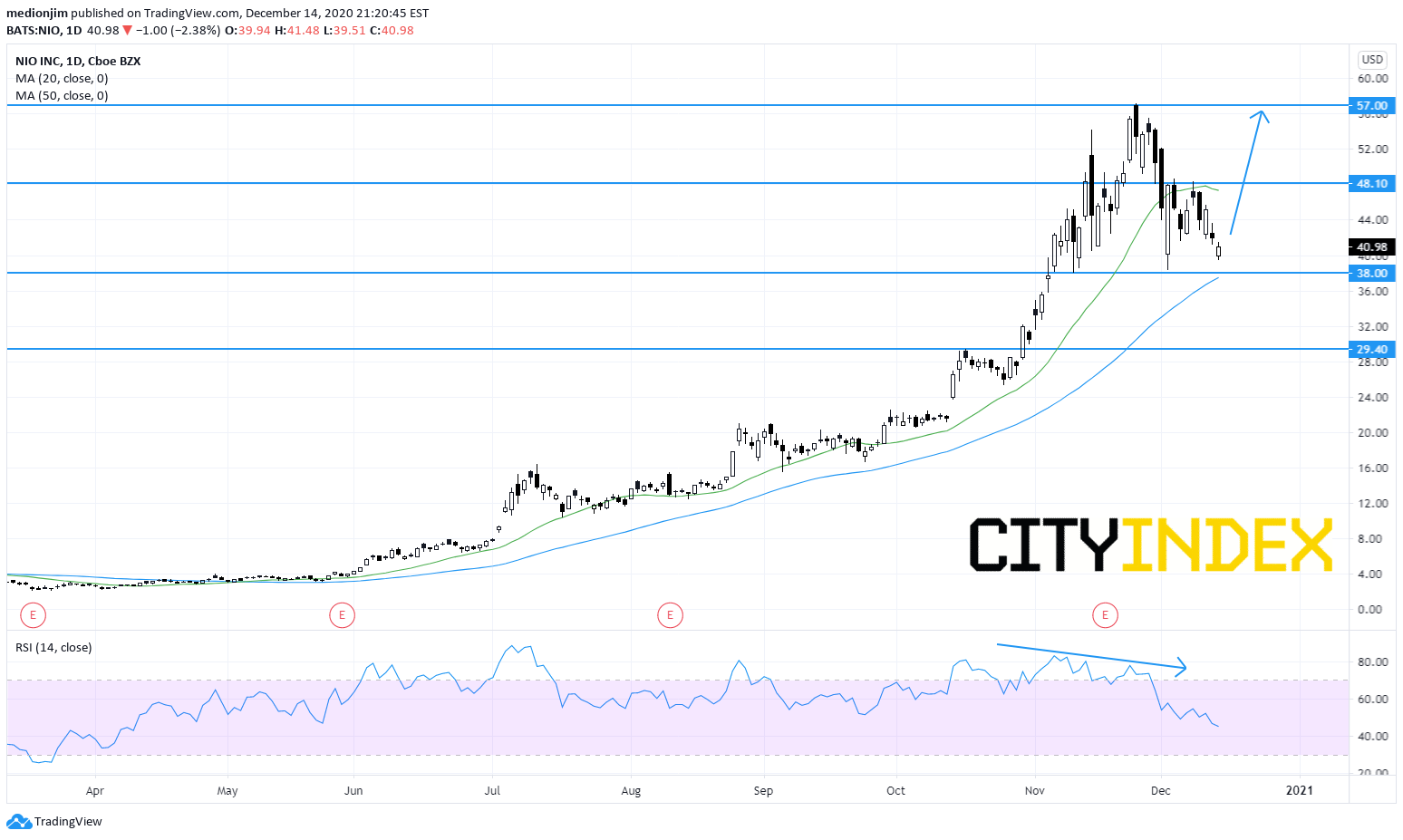

On a daily chart, the ADR share prices of NIO retreated from $57 and broke below the 20-day moving average. Investors had to notice that the relative strength index indicated a bearish divergence signal. However, the rising 50-day moving average remains acting as support. Besides, the previous low at $38.00 remains intact. Therefore, the technical outlook is still bullish but investors has to be cautious on recent price action. The support level would be located at $38.00 and $29.40, while resistance levels would be located at $48.10 and $57.00.

Source: GAIN Capital,TradingView

According to the China Association of Automobile Manufacturers, New Energy Vehicles sales volume reached 200,000 units in November, up 24.1% on month and 104.9% on year.

Recently, NIO (NIO) announced the pricing of the offering of 68M American depositary shares at $39.00. The raising capital will be used for research and development of new products sale and service network expansion and market penetration as well as for the general corporate purposes.

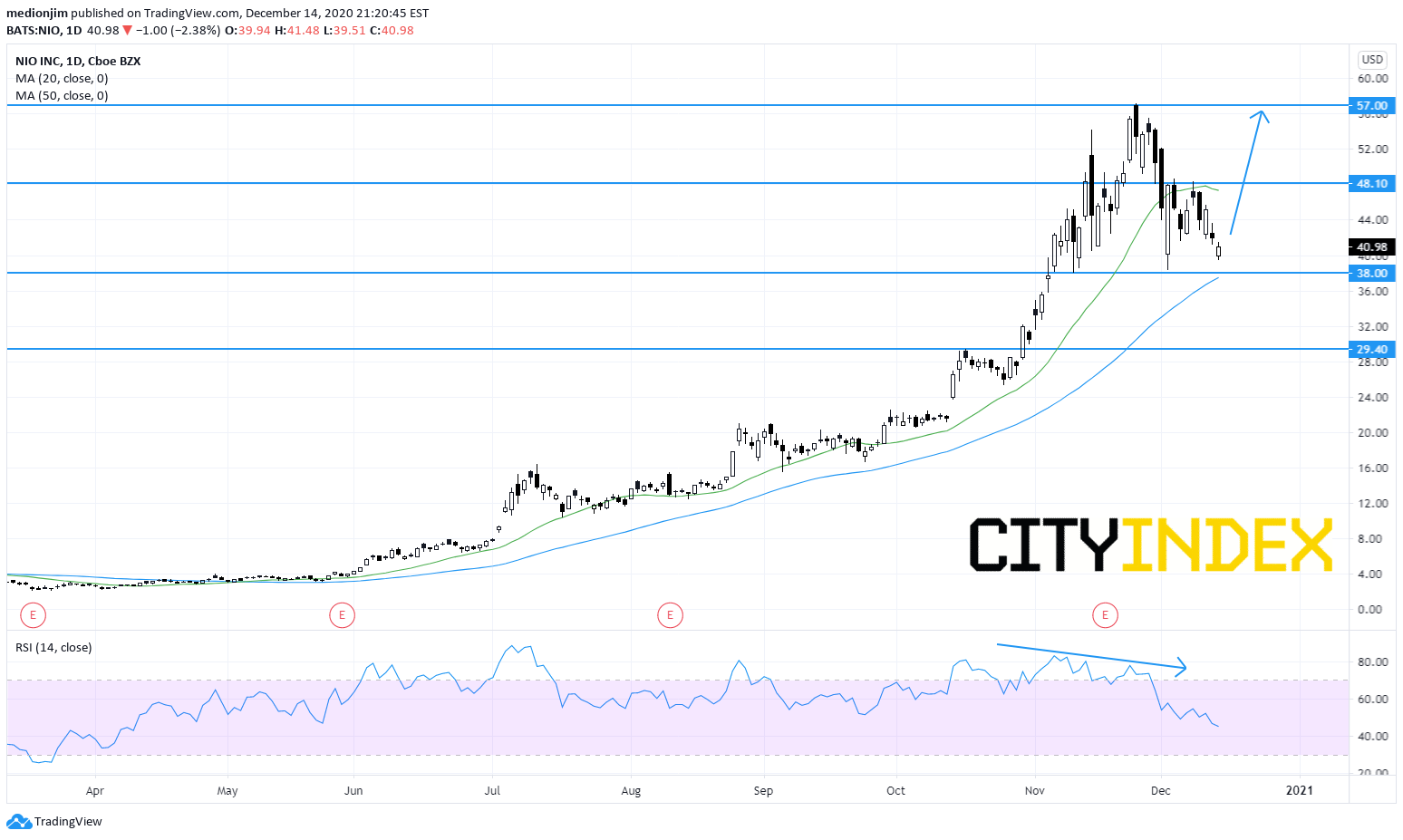

On a daily chart, the ADR share prices of NIO retreated from $57 and broke below the 20-day moving average. Investors had to notice that the relative strength index indicated a bearish divergence signal. However, the rising 50-day moving average remains acting as support. Besides, the previous low at $38.00 remains intact. Therefore, the technical outlook is still bullish but investors has to be cautious on recent price action. The support level would be located at $38.00 and $29.40, while resistance levels would be located at $48.10 and $57.00.

Source: GAIN Capital,TradingView

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM