The three primary candidates to replace Suga are Taro Kono, Sanae Takaichi, and Fumio Kishida. All three have promised to put together a stimulus package to help regain the growth momentum in an economy struck by the third wave of Covid during July and August.

Japan’s Minister of Vaccines Taro Kano is the leading contender and is proposing a policy centered on growth. Ex-policy chief Fumio Kishida is the next preferred contender with a strategy based on redistribution of income. The approach of the third contender, Sanae Takaichi, centres on progressing Abenomics.

The Japanese population is now over 50% fully vaccinated and the 7 day rolling average of new Covid cases turned sharply lower at the end of August. These factors along with Suga's resignation have prompted institutional investors to reduce their underweight exposure to Japanese stocks and set the scene for further gains in the medium term.

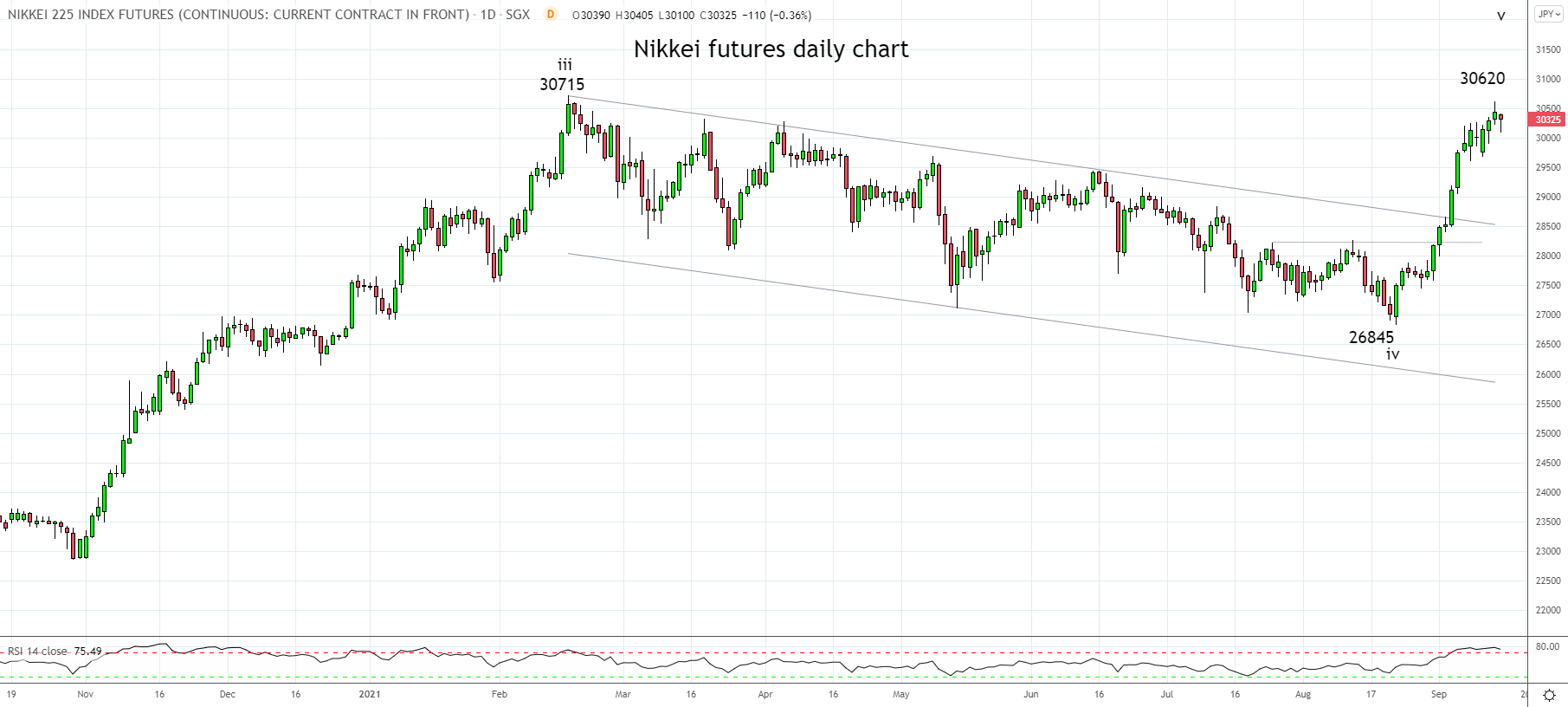

In an article in late August titled Nikkei rips higher despite softer China data we noted, “Should the Nikkei break and close above 28250/70 and then above trend channel resistance at 28,700, it would signal the correction from the February high is complete, and the uptrend has resumed. Long Nikkei positions should be considered in this instance, targeting a retest and break of the 30715 year-to-date high.”

After the Nikkei futures almost reached the 30715 high/target yesterday, the market is displaying signs of being overbought in the short term. As such, we would consider closing longs here and look to rebuy the Nikkei into weakness in coming weeks.

Source Tradingview. The figures stated areas of September 15, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation