The Manufacturing PMI fell to 50.1 in August vs. consensus expectations of 50.2. The production and construction sub-index held up well, indicating limited impact from the Covid outbreak on production and construction activity. As the Delta outbreak in China is now under control, a rebound in the China PMI data is expected in September.

There is a growing sense that Federal Reserve Chairman Powell's speech at Jackson Hole was more dovish than expected. The severing of the link between tapering and rates lift-off suggests rates stay lower for longer.

Clouding the Japanese domestic picture, a fifth wave of the virus and a ruling party leadership election on September 29 after Prime Minister Yoshihide Suga's popularity plunged due to scandals and his handling of the Covid-19 pandemic.

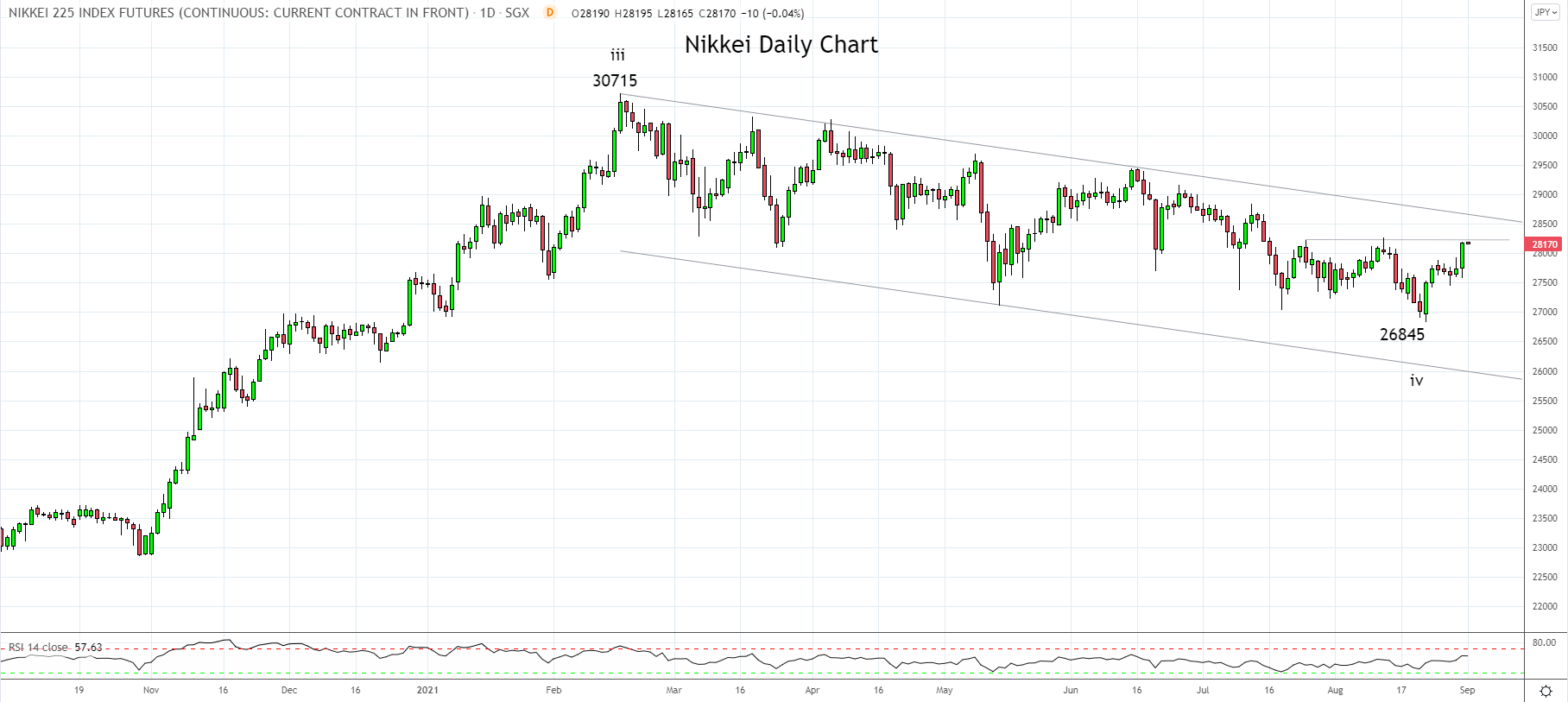

Nonetheless, the Nikkei futures have closed over 1.50% higher today at 28180, just below a layer of short-term horizontal resistance at 28250/270. Should the Nikkei break and close above 28250/70 and then above trend channel resistance at 28,700, it would signal the correction from the February high is complete, and the uptrend has resumed.

Long Nikkei positions should be considered in this instance, targeting a retest and break of the 30715 year-to-date high.

Source Tradingview. The figures stated areas of August 31, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation