Nikkei 225 Index (Short Term): Expect to Challenge 2018 High

Japan's Nikkei 225 Index rebounded around 40% from March low. Currently, the Index remains holding on the upside and expects to challenge the high of 2018.

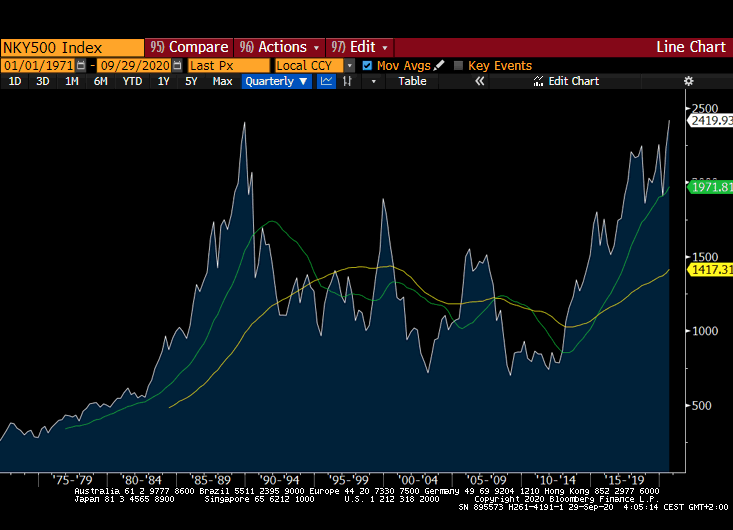

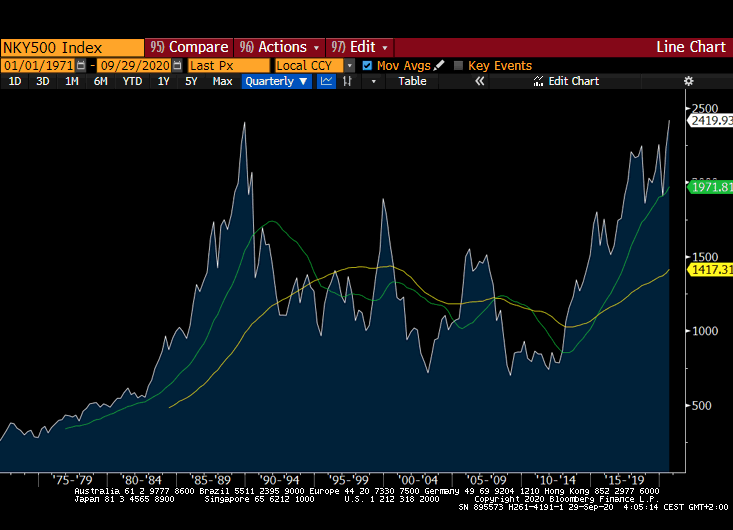

In fact, the Nikkei 500 Index, a lesser-known index in Japan, already broke above its historical high level, which recorded in 1989. The Nikkei 500 Index contains more technology and services companies to reflect current Japan's economy, but the lagged behind Nikkei 225 Index includes a lot of old economy firms.

Source: Bloomberg

On the economic front, Japan's Tokyo CPI grew 0.2% on year in September (+0.1% expected), according to the government. However, the CPI still stays at a slower growth pace, which suggests that Japan's economy still needs more stimulus to leave the stagflation in the loss of 20 years. In addition, retail sales dropped 1.9% on year in August (-1.9% expected) and industrial production decreased 13.3%.

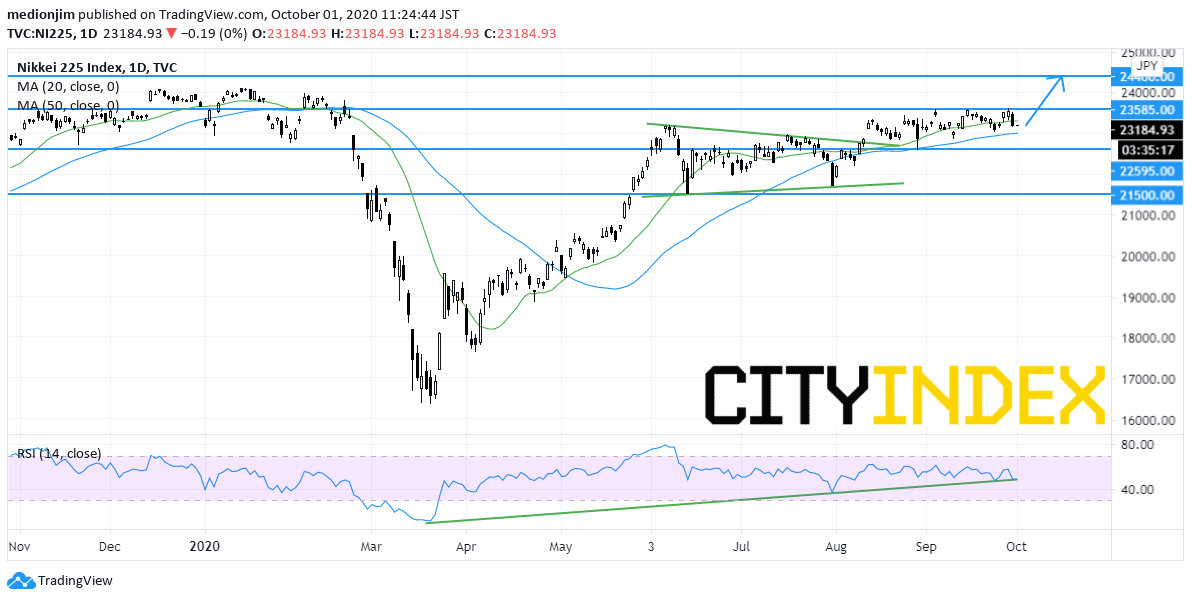

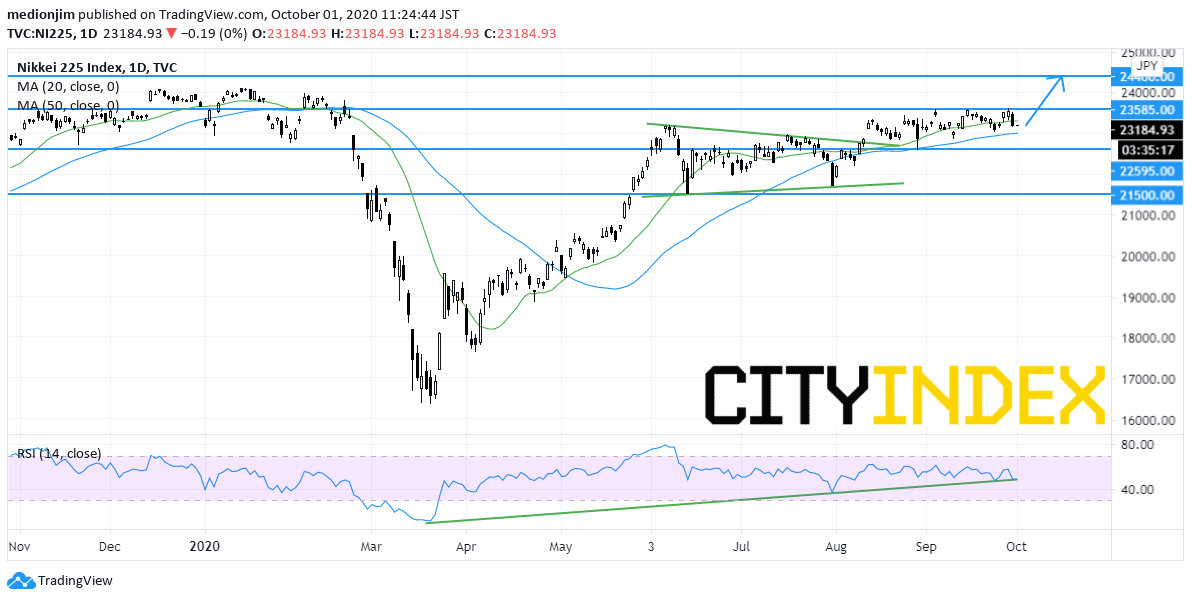

From a technical point of view, the Nikkei 225 Index is holding on the upside after breaking above the symmetric triangle pattern. Currently, the index prices are trading above both rising 20-day and 50-day moving averages. The relative strength index is supported by a rising trend line

Hence, bullish readers could set the nearest support level at 22595, while resistance levels would be located at 23585 (the previous high) and 24400 (the high of 2018).

Source: GAIN Capital, TradingView

In fact, the Nikkei 500 Index, a lesser-known index in Japan, already broke above its historical high level, which recorded in 1989. The Nikkei 500 Index contains more technology and services companies to reflect current Japan's economy, but the lagged behind Nikkei 225 Index includes a lot of old economy firms.

Source: Bloomberg

On the economic front, Japan's Tokyo CPI grew 0.2% on year in September (+0.1% expected), according to the government. However, the CPI still stays at a slower growth pace, which suggests that Japan's economy still needs more stimulus to leave the stagflation in the loss of 20 years. In addition, retail sales dropped 1.9% on year in August (-1.9% expected) and industrial production decreased 13.3%.

From a technical point of view, the Nikkei 225 Index is holding on the upside after breaking above the symmetric triangle pattern. Currently, the index prices are trading above both rising 20-day and 50-day moving averages. The relative strength index is supported by a rising trend line

Hence, bullish readers could set the nearest support level at 22595, while resistance levels would be located at 23585 (the previous high) and 24400 (the high of 2018).

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM