Why US Non-Farm Payrolls could be stronger than expected

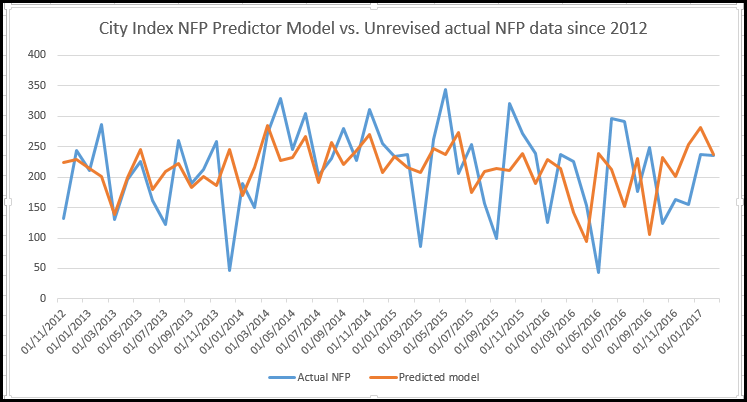

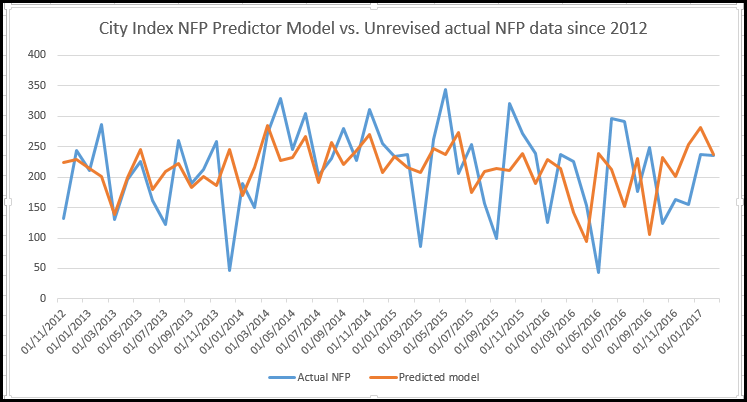

The March payrolls report is released on Friday 7th April at 1330 BST, the market is predicting a fairly tepid reading of 180k, well below the 235k reading from February. Here at City Index we have created our own proprietary model using three key data inputs which we will discuss below. Our model suggests that the broader market is under-estimating the NFP reading for March, and we predict a reading of 236k for March.

It is worth noting that our model has been above consensus for the last five months, even though we have had some fairly close readings, including being a mere 15k out for the January reading (our prediction was 253k, vs. 238k actual).

The nitty gritty…

Our model uses three independent variables to try and determine the payrolls figure, including the ADP private sector payrolls report, the 4-week moving average of jobless claims figures and the employment component of the non-manufacturing ISM. So why is our model predicting a stronger NFP reading that the broader market?

Why the ADP could be a reliable lead indicator for March NFPs

We believe it’s all down to the ADP. This month we have seen a strong ADP report, 236k vs, expectations of 185k, and a much weaker than expected employment component of the non-manufacturing ISM, which came in at 51.6, vs. 55.2 in Feb. Although our model actually puts more weight on the employment component of the non-manufacturing ISM, our model is treating last month’s sharp deterioration in the index as an anomaly, it could also suggest that the bulk of jobs created in March came from the manufacturing and construction sectors of the US economy, rather than the service sector. This is also borne out by the ADP data, which showed big gains in jobs last month for these two sectors of the economy.

Historically, there is a stronger correlation between the ADP and the NFP when the ADP has beaten estimates by more than 50k, as it has done for March. Thus, we are fairly confident with our model’s reading for this month’s NFP report.

Why payrolls could reinvigorate the stock market rally

If we are correct, and payrolls beat expectations to the tune of 50k or more, then we could see a large bounce in the dollar, and signs that the labour market is doing well could also boost US stock indices. Wage data is also worth looking at since this could determine the timing of the next Fed rate hike. The market is expecting a slight slowdown in wage growth for March to 2.7% annually, from 2.8% in February, which could ease expectations of a near-term rate hike from the Fed, which may further boost US stock markets in particular, and keep any uptick in Treasury yields contained.

We will be live tweeting the payrolls report on Friday, so follow us @CityIndex to find out if our model is correct.