NFP Prep Colossal jobs report may tip the scales for the Fed

The August Non-Farm Payroll report will be released tomorrow at 8:30 ET (12:30 GMT, 1:30pm BST), with expectations centered on a headline print of 217k […]

The August Non-Farm Payroll report will be released tomorrow at 8:30 ET (12:30 GMT, 1:30pm BST), with expectations centered on a headline print of 217k […]

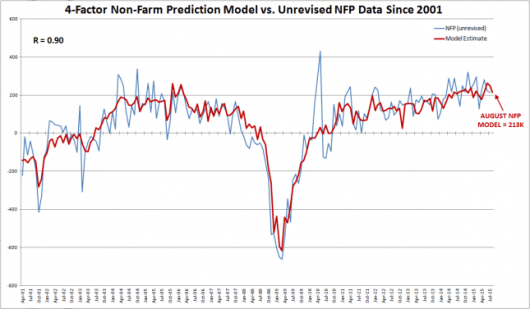

The August Non-Farm Payroll report will be released tomorrow at 8:30 ET (12:30 GMT, 1:30pm BST), with expectations centered on a headline print of 217k after last month’s as-expected 215k reading. My model suggests that the report could meet these expectations,with leading indicators suggesting an August headline NFP reading of 213K.

The model has been historically reliable, showing a correlation coefficient of 0.90 with the unrevised NFP headline figure dating back to 2001 (1.0 would show a perfect 100% correlation). As always, readers should note that past results are not necessarily indicative of future results.

Source: Bureau of Labor Statistics, City Index

Source: Bureau of Labor Statistics, City Index

Relative to last month, most leading indicators for the non-farm payrolls report have deteriorated slightly. The lone bright (or maybe “modestly glowing”) spot this month was the ADP employment report, which edged up from an initial estimate of 185k last month to 190k this month. Meanwhile, both the Manufacturing and Non-Manufacturing PMI employment readings edged lower, to 51.2 and 56.0, respectively, though they both continue to show growth. Finally, initial jobless claims in the survey week came in at 277k, above last month’s historically low 255k reading, but still at a very low level, indicating relatively few new unemployed Americans.

Trading Implications

Unless you’re far-sighted, things generally become clearer as you get closer to them, but the Federal Reserve’s decision at this month’s highly-anticipated meeting has never been more murky: the central bank seems determined to raise interest rates, at least once, this year, but the latest round of market turmoil and ho-hum economic data has many traders betting on a more cautious Fed.

Therefore, an upside surprise in tomorrow’s jobs report could go a long way toward tipping the scales toward a rate hike ahead of the Fed’s colossal meeting in two weeks, whereas a disappointing report (especially accompanied by weak wage growth) would favor waiting until December or later. Three possible scenarios for this month’s NFP report, along with the likely market reaction, are shown below:

| NFP Jobs Created | Likely USD Reaction | Likely Equity Reaction |

| <> | Bearish | Slightly Bullish |

| 180k-250k | Slightly Bullish | Neutral |

| > 250k | Bullish | Bearish |

As always, traders should monitor both the overall quantity of jobs created as well as the quality of those jobs. To that end, the change in average hourly earnings could be just as critical as the headline jobs figure. A monthly increase of 0.1% or 0.2% in wages would likely leave many questions ahead of the Fed’s meeting, but a reading beyond that range may be the deciding factor for the central bank. Historically, USD/JPY has one of the most reliable reactions to payrolls data, so traders with a strong bias on the outcome of the report may want to consider trading that pair.

Though this type of model can provide an objective, data-driven forecast for the NFP report, experienced traders know that the U.S. labor market is notoriously difficult to predict and that all forecasts should be taken with a grain of salt. As always, tomorrow’s report may come in far above or below my model’s projection, so it’s absolutely essential to use stop losses and proper risk management in case we see an unexpected move. Finally, readers should note that stop loss orders may not necessarily limit losses in fast-moving markets.