The RBA made no changes to its Yield Curve Control and Quantitative Easing policies. Notably, it included a new sentence on low wages, despite a stronger than expected recovery.

"Despite the strong recovery in the economy and jobs, inflation and wage pressures are subdued. While a pick-up in inflation and wages growth is expected, it is likely to be only gradual and modest."

Attention now turns to the release tomorrow morning of Australia’s Q1 GDP which is expected to be much stronger than expected following the release of the final partials earlier today.

Specifically, net exports will provide a smaller than expected detraction and company inventories a stronger than expected contribution. The only disappointment, a -0.3% fall in company profits, likely a reflection of lower government subsidies from programs including JobKeeper.

As such, tomorrow's Q1 GDP will likely be almost twice as strong as previously expected at +2.0% q/q, taking GDP to +0.8% above its pre COVID19 level.

Why is a stronger GDP print important?

GDP is perhaps the most closely watched single measure of an economy's momentum and overall health. Stronger than expected GDP coupled with low inflation provides a tailwind for equity markets.

Where to now for the ASX200?

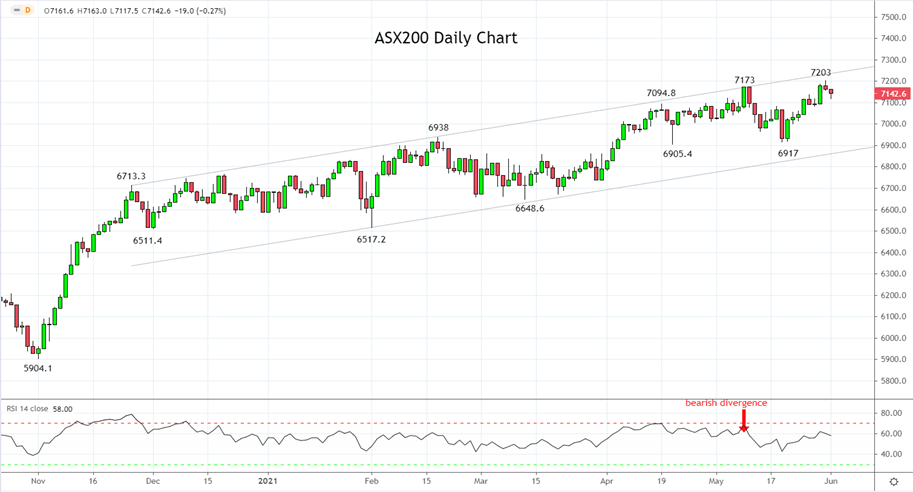

As regular as clockwork, the ASX200 completed a 3% pullback in May, before briefly trading to new all-time high yesterday. Locking in a +1.93% gain for May and an eighth straight month of gains.

Learn more about trading indices

As viewed on the chart below, the ASX200 has failed to break above the 7-month trend channel resistance on several previous occasions.

With this in mind, the preference is to buy pullbacks towards support at 6900, in anticipation of the ASX200 making fresh highs in the coming months.

Source Tradingview. The figures stated areas of the 1st of June 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation