Wages lower than expected

With unemployment remaining at 3.6%, we might be tempted to think that headline job creation is weaker due to full employment, however wage growth doesn’t support this story. In the case the full employment we would expect wages to move higher as well. As this isn’t happening the cause for lower job creation appears to be something else, something a little more sinister. Wages disappointed, increasing 0.2%, lower than the 0.3% expected.

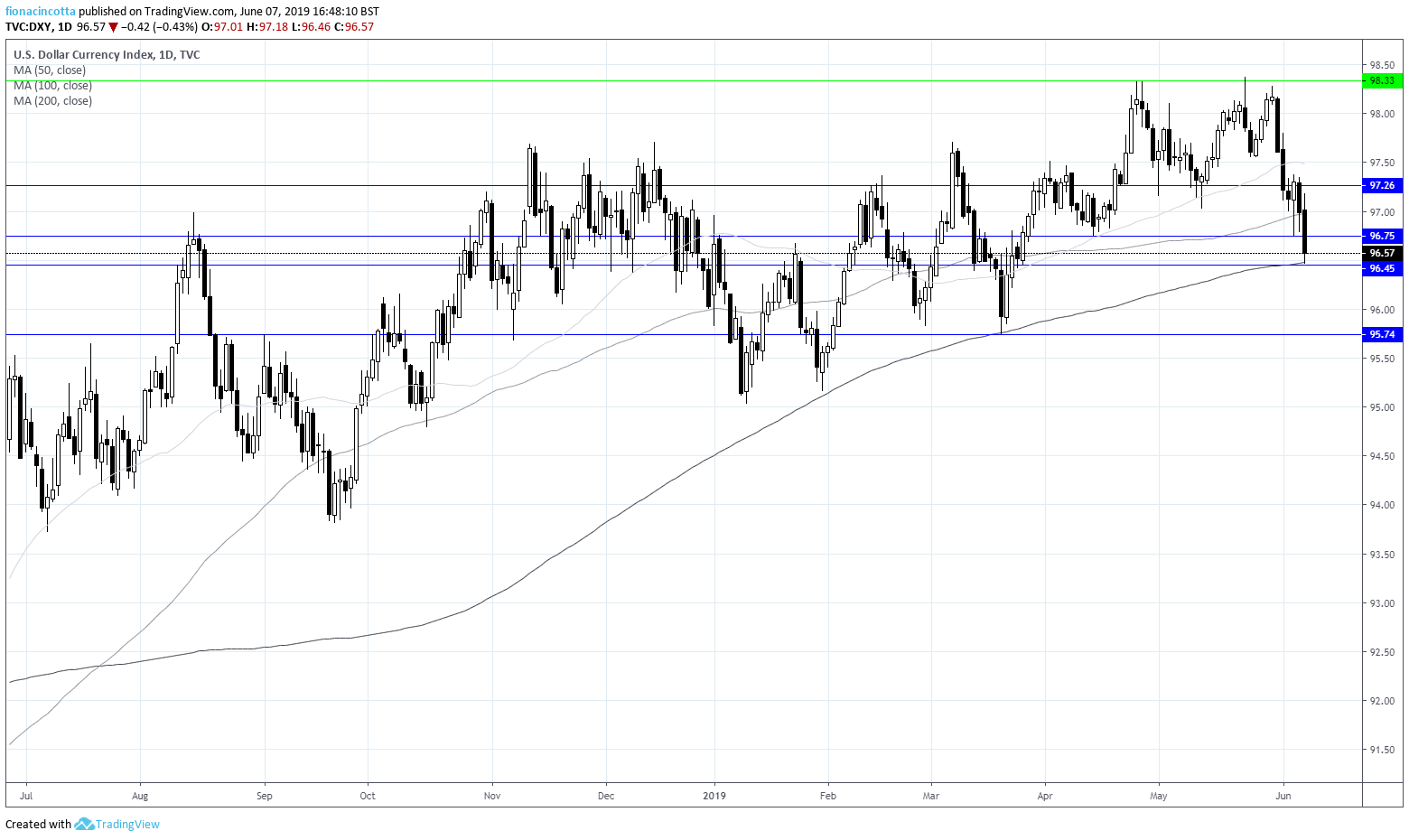

Dollar dives 2.5 month low

The market’s reaction is that of a market which is expecting a rate cut imminently. The CME Fed Fund shows the market is now pricing in a 79% probability of a rate hike by July and a 97% probability of a rate rise by September. The dollar dropped to 96.5 versus a basket of currencies, its lowest level in 2 ½ months.

Whilst the start of next week is relatively quiet as far as US economic data is concerned, it picks up in the second half with inflation, retail sales, industrial production and consumer confidence. Any sign of weakness could see the dollar drop toward support at 95.75.