NFP could be the Last Horse in the Trifecta

What a week it has been so far! Worse than expected ISM Manufacturing and worse than expected ADP Employment data has tanked stocks and the US Dollar. Tomorrow we get Nonfarm Payroll (NFP) data for September, which could be the third horse in the trifecta if the data comes in worse than expected. The headline consensus number is 140K, however as written in our NFP Preview, the NFP data could determine whether or not the Fed cuts rates 25bps later this month (the market is already pricing in a 90% chance of a cut).

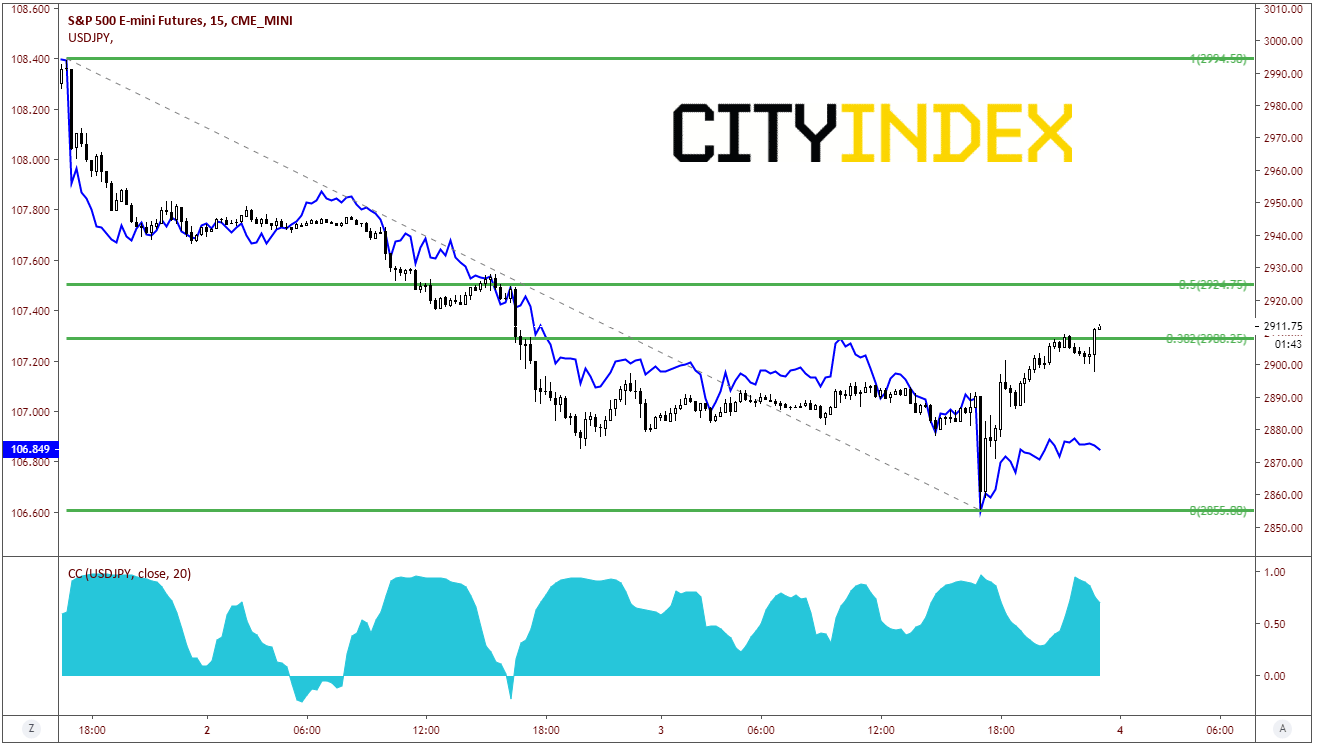

Two barometers of market sentiment are SP500 and USD/JPY. When the markets feel good about the direction of the economy, they tend to rise together. When the markets fear the direction of the economy, they tend to move down together. Consider the chart below:

Source: Tradingview, City Index, CME

The chart is a 15-minute candlestick price chart of S&P 500 E-mini Futures vs the price of USD/JPY (blue line). Since the poor ISM Manufacturing data was released on Tuesday, the 2 assets have been positively correlated almost the entire time. Any reading above a 0.00 means that the 2 instruments move together. The closer the number is to 1.00, the closer the degree of the move together. Currently, the correlation is +.70. However, look at the dip in the correlation (or separation of the prices) earlier today. Both assets sold off after the ISM Non-Manufacturing data was released, however the correlation fell to +.28. The S&P500 then bounced from 2855 to a high of 2909.5, 54.5 handles, to the 38.2% retracement from the pre-ISM Manufacturing data to todays lows. USD/JPY only bounced from roughly 106.50 to 106.90, 30 pips. An equivalent move in USD/JPY to the S&P 500 would have been a bounce up to 107.30.

What does this mean? It means that there are a lot more people who want to cover short positions in S&Ps than people who want to cover short USD/JPY positions ahead of tomorrow’s NFP data. However, it could also mean that traders are more reluctant to cover US Dollar shorts than S&P shorts. Do US Dollar traders know (or think they know) something S&P traders don’t?

With China out and little data out in Europe, it may be quiet ahead of the NFP data. But upon release of the data, make sure to watch USD/JPY to give the first indication as to whether the data is bullish or bearish.