The main theme in FX markets overnight has been continued buying of the U.S. dollar, particularly against the EUR, JPY and CHF, following the release of Fridays upbeat U.S. jobs report.

The jobs report, coming after a truce was declared in the U.S. - China trade war at the G20 Summit, has diminished hopes that the Federal Reserve will cut rates by 50bp at its upcoming meeting, July 31st. There is now just 25 bp of cuts priced for July, and another 40bp of cuts priced after that, into yearend.

Current market pricing is unlikely to change significantly before Fed Chairman Powell’s testimony to Congress later this week, which represents an opportunity for the Fed chairman to correct current market pricing if he feels the need to do so.

For example, if Powell wanted to lean further on the markets dovish pricing, last Friday’s jobs report gives him an excuse to do so. Offsetting this is the run of soft manufacturing economic data of late, a 3mth/10year U.S. Treasury yield curve which has entered its sixth week of inversion (usually a reliable indicator of upcoming recession), persistently low inflation and of course ongoing political pressures highlighted by this tweet from President Donald Trump, shortly after Friday's jobs report.

“Strong jobs report, low inflation, and other countries around the world doing anything possible to take advantage of the United States, knowing that our Federal Reserve doesn’t have a clue!”

The most likely outcome at the July 31st FOMC meeting is for a 25bp cut delivered in conjunction with dovish guidance. Powell’s testimony this week should reflect this. Presuming this is the case, there is scope for USDJPY to build upon its recent rally.

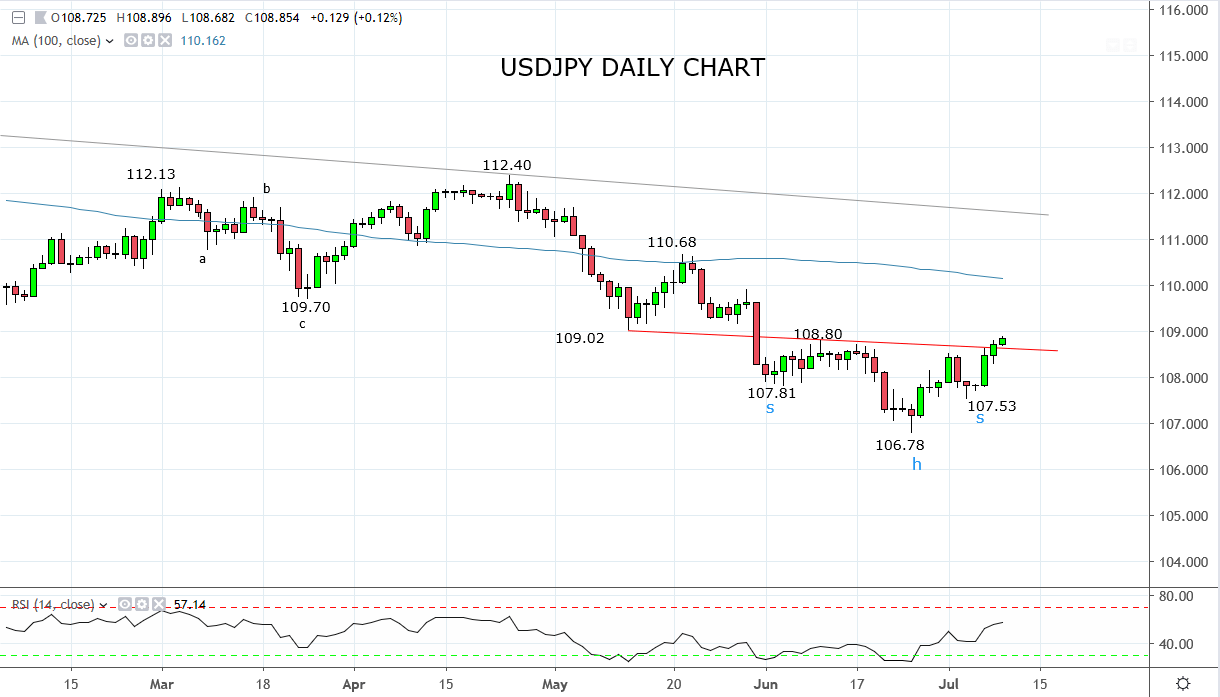

The chart of USDJPY below, shows a potential bottoming pattern, an inverted head and shoulders. The break above the neckline (108.70) is a positive development which sets the ground for USDJPY to rally towards near term resistance 109.30/50. Beyond that, there is scope for the move to extend towards the 200-day moving average at 110.20 after the Fed Chairman’s Testimony to Congress.

Source Tradingview. The figures stated are as of the 9th of July 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.