Sales surge was entirely online

Next's £2m profit forecast upgrade as it winds up a surprisingly resilient 2019 financial year keeps positive momentum going. However, the group’s fourth quarter trading update fails to allay concerns that could trim last year’s near-80% stock price improvement.

To be sure, as noted in Thursday's preview article, Britain’s biggest clothing retailer needed to maintain the view that full-price sales—its most closely watched sales—will grow at least 3.6%. After better-than-expected Christmas trading, Next is able to do just that. Sales have enjoyed an extra lift as Britain’s winter weather has so far co-operated with clothing retailers’ seasonal plans, for a change. That helped Next’s comparable sales growth in the quarter to 28th December to jump 5.2%, “1.1% ahead of our internal forecast”. In turn, the bumper season allowed the group to add £2m to its full-year pre-tax profit expectation. It now sees £727m after tweaking its view of those all-important full-price sales to rise to 3.9%, compared with 3.6% previously forecast.

The U.S. airstrike in Iraq that has brought global New Year market cheer to an abrupt halt partly explains why Next shares haven’t sustained an initial rise on Friday. However, with the stock topping out at a modest 1.4% gain, the broader reversal isn’t entirely to blame. Indeed, though Next touted improved inventory availability during the season, in-store full-price sales still fell hard—ironically sliding 3.9%; as much as they’re expected to rise for the year. To be clear, that fall was still an improvement on the 6.3% in-store full-price fall of the quarter before, and -4.2% in Q2. But with 2019/20 profit growth still expected to be modest, rising 0.6% compared to the 0.3% uptick expected before, stores remain a considerable weight on Next’s outlook. It is notable that despite Christmas cheer, Next hasn’t been so confident on the year ahead to forecast a sales acceleration. 3% growth foreseen in the 2021 financial year is pretty much the run rate for the last six months or so. Under that scenario, pre-tax profit would see a similar modest advance to £734m in 2020/21 as in the current year.

Given lingering headwinds then, Next’s continued appearance of boxing clever on digital is an increasingly essential offset. Online full-price sales boomed 15.2% higher over Christmas, besting +9.7% in Q3, even after a strong (hence tough to beat) comparable season in the year before.

Overall, Next’s medium-term strategy of gradual store closures and pushing for lower rent remains very much needed to safeguard the outlook. However prospects that such measures will continue to do so are only moderately assured. Investment growth must also continue, though probably at a less demanding pace than rivals like Marks & Spencer must achieve. As well, Next’s cash-return plans should not be significantly impacted, so long as sales performance continues on the current track. The group is sticking with the formula of an 8% total return per annum. Calculations suggest management will need a special dividend to achieve that, though this wasn’t mentioned on Friday. Stakes are thereby raised for full-year results due out in mid-March.

Chart points

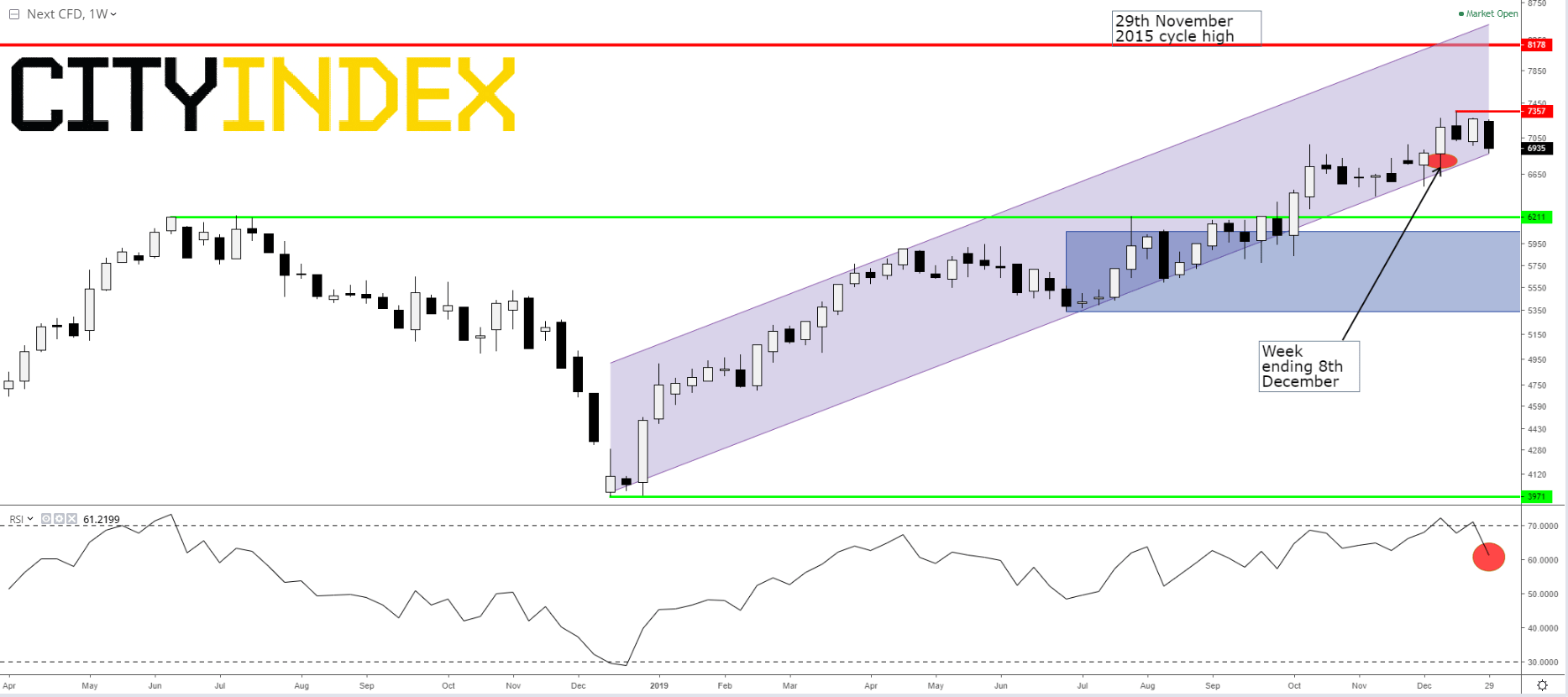

- Consolidation of 2019 uptrend confirmed by decreased probability that 7357p four-year high in December will be taken out any time soon. Note that declining weekly RSI corroborates continued near-term downside

- Rising channel since December 2018 remains intact and may continue to provide support. However, definitive sustained breach of the lower rising line would tend to invalidate support. Long-term support at 6211p looks more pivotal. Any deterioration would increase the extent of the correction

- In the unlikely event that the stock steadies around current levels and preferably holds above the low on Friday 8th December, chances that Next can extend its uptrend, would improve

Next Plc. CFD – Weekly [03/01/2020 13:19:48]

Source: City Index