The growth story takes an unexpected twist, though it’s a recoverable one

A shock fall of U.S. subscribers in the second quarter appears to have taken investors totally off guard, with the shares pinned 11% lower well into Thursday trade. After all, the subscriber flop is the group’s first customer reversal since the fourth quarter of 2011, when paying U.S. streamers fell to 20.15 million from 20.51 million. But management sees last quarter’s decline as an outlier. Nor does Netflix shy away from admitting that the 126,000 U.S. net subscriber drop—compared to a rise of about 300,000 expected—was linked to its decision to hike prices in January. International additions also missed, though still rose 2.83 million against 4.75 million seen. Still, after a three month stretch that is typically Netflix’s slowest, 60.1 million total paid viewers was almost identical to the 60.2 million tally of the quarter before. Financials results were largely as forecast.

- Revenue missed by a whisker at $4.92bn, versus an average estimate of $4.93bn

- EPS of 60c beat the estimate of 56c

Headline financial guidance also paced market views

- Netflix sees Q3 revenue at $5.25bn against investors’ $5.23bn estimate

- 3Q EPS guidance is $1.04, vs. an estimated $1.03

Furthermore, before Tuesday night’s subscriber drama, investor focus was largely on forthcoming quarters, when an unusually large slate of new series and films is expected to reap at least one blockbuster quarter in the second half. Netflix expects net streaming additions in the current quarter to be 7 million. That’s above Wall Street’s 6.38 million forecast, with upside possible to Netflix’s round number. If so, the shortfall between 800,000 Q3 guidance on U.S. net additions and Wall Street’s 832,600 call would be neutral.

Yet there’s no doubting the reaction to Tuesday’s flop is all the more caustic due to unfortunate timing. Netflix’s show of weakness comes right ahead of ramped up competition from HBO, NBC, Disney+, Hulu and others. With $15bn in cash costs this year, rising to $18bn in 2020, on top of $19bn in streaming-related obligations this year, a possible spending rise to fend off new, aggressive rivals is another investor bugbear. Thursday’s share price punishment warns of the kind of sell-off Netflix faces if expenditure runs off the rails. For now though, debt markets aren’t signalling much concern. Netflix junk bonds have slid in step with the disappointing news, but a default-risk model based on 5-year CDS prices ticked up to just 0.028% on Thursday.

The balance of probabilities suggests Netflix’s maintained forecast of a 13% operating margin this year, a first step on the road to profitability, still holds water. It looks like a bumpier road now, with more obstacles. But the same applies to new entrants in the streaming market, which face a seemingly insurmountable challenge to catch the incumbent.

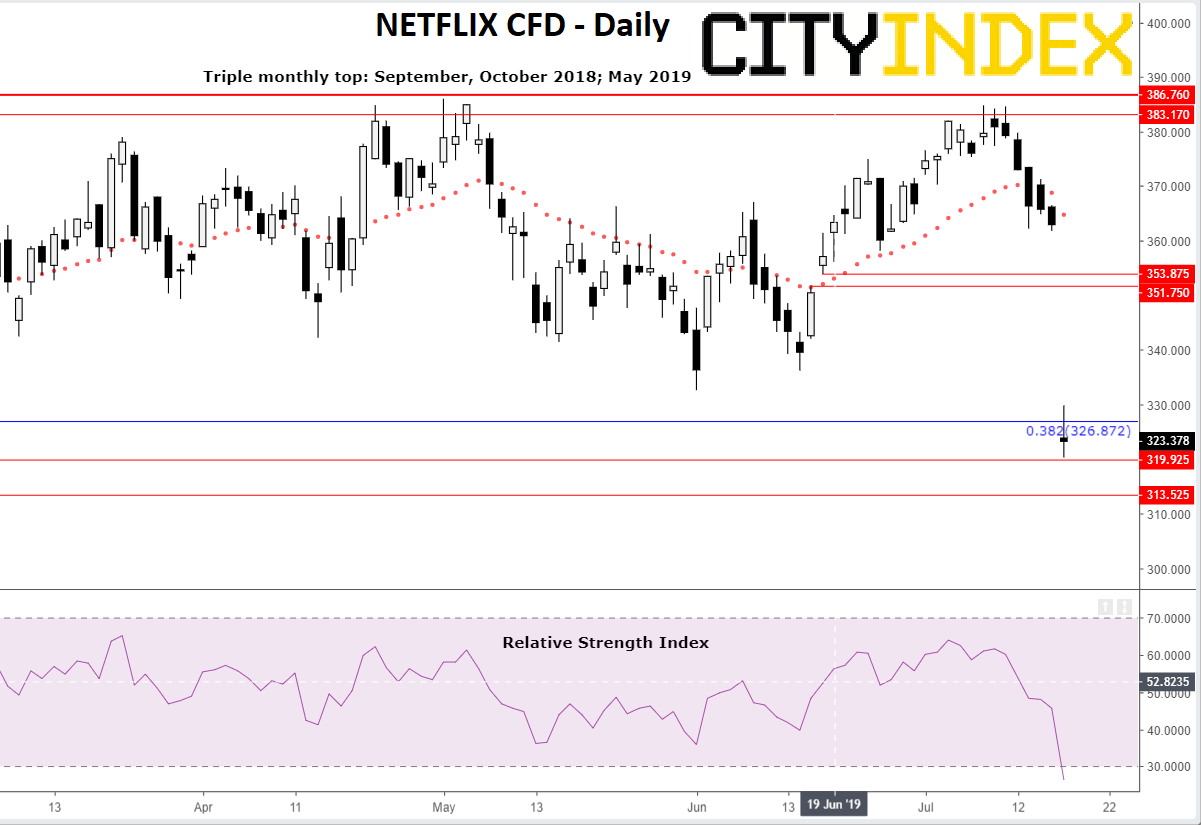

Chart thoughts

The stock has duly corroborated the bearish set-up we outlined a day ago and then some. It has broken below the previously supportive 200-day moving average (not shown on the chart below) and was last under the closely watched 38.2% Fibonacci interval of its advance from December lows to the year’s peak in May. Bullish and consolidative lows from January argue for support at the current price and down to $313.50. But NFLX ideally needs a close above the 38.2% notch, preferably this week, to avoid being dragged down to the 61.8% level. That will begin to look magnetic if the stock fails to hold current ground.

Netflix CFD – daily [18/07/2019 18:15:33]

Source: City Index