When: 21st January after the closing bell in US.

Expectations: EPS $0.52 on revenue $5.45 billion

Paid subscriber additions: 7.6 million (+623,000 in Q4 vs 517,000 in Q3)

What to watch for:

1. Subscriber numbers

The Q4 results come in a newly competitive era for the streaming giant meaning there is more pressure than ever to increase subscriber numbers both in US and internationally and to not lose market share to the likes of Disney+ and Apple TV+ Time Warner, to name a few.

Goldman Sachs raised the price target on Netflix to $450 per share from $400, in anticipation of so a strong set of quarterly figures. Owning to highly anticipated films and series in Q4 Goldman Sachs expects a significantly higher 9.7 million paid subscriber additions.

2. Return on Content Development

Netflix has been on a spending spree for content over the past year. Investors will be keen to see how successful the company has been turning this spending into revenue and profit.

Chart thoughts:

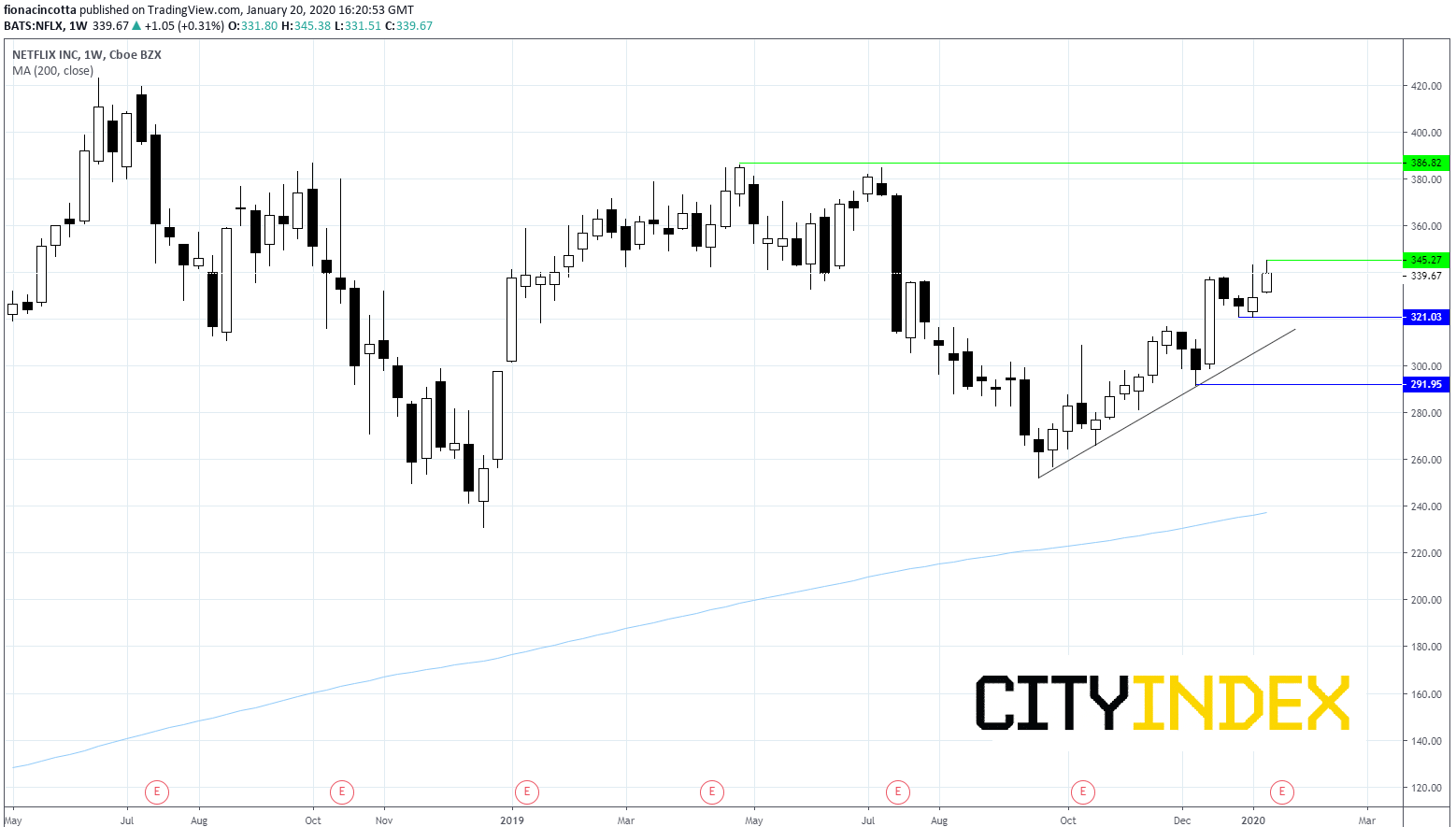

The share value has surged 20% following Q3 results, outpacing S&P500 index in the same period by two-fold. The stock has continued its bullish run into 2020 trading up 5% year to date.

After rebounding off 250 (23rd Sept low) Netflix has bounded higher in a series of higher highs and higher lows, striking a 6-month high of 246 at the end of last week just ahead of earnings.

The stock is trading firmly above its 200 sma and has recently pushed over 100 & 50 sma’s, on a bullish chart.

Immediate resistance can be seen at 345 (high Jan 14th) prior to 386 (high April 29th).

On the downside support can be seen at 321 (low Jan 6th) before opening the door to 292 (low Dec 9th).