When:

Netflix is the first of the high growth tech stocks to report. Numbers ate expected to be released on Thursday 16th July after market close.

Netflix is the first of the high growth tech stocks to report. Numbers ate expected to be released on Thursday 16th July after market close.

Numbers:

The group has guided for

• EPS $1.81 vs $0.6 (Q1 2020)

• Revenue of $6.048 billion

• 7.5 million additional subscribers

The group has guided for

• EPS $1.81 vs $0.6 (Q1 2020)

• Revenue of $6.048 billion

• 7.5 million additional subscribers

What to Watch

1. Subscriber numbers

Historically investors are most concerned with subscriber numbers. We don’t expect that to be any different this quarter. Netflix set the bar high in Q1 after reporting an impressive 15.8 million new subscribers in the first three months of the year and guiding for an additional 7.5 million in Q2, well ahead of the 2.7 million new members added in the same quarter last year, as people sheltering at home in the coronavirus crisis turn to the streaming service.

The fact that many economies across the globe haven’t fully reopened means that actually subscriber number for this stay at home stock could be higher than forecast.

Historically investors are most concerned with subscriber numbers. We don’t expect that to be any different this quarter. Netflix set the bar high in Q1 after reporting an impressive 15.8 million new subscribers in the first three months of the year and guiding for an additional 7.5 million in Q2, well ahead of the 2.7 million new members added in the same quarter last year, as people sheltering at home in the coronavirus crisis turn to the streaming service.

The fact that many economies across the globe haven’t fully reopened means that actually subscriber number for this stay at home stock could be higher than forecast.

2. Second Half expectations

Q3 subscriber number guidance will be closely eyed, a figure over 6.8 million achieved in Q3 2019 could please the market. However, fears are also growing that Netflix could soon be nearing its peak. The marketplace is becoming overcrowded with the likes of Disney, Amazon. There is also the concern that the lockdown driven subscriber growth will act as a pull forward of signs ups it would have seen later. New commentary surrounding the second half will be closely eyed.

Q3 subscriber number guidance will be closely eyed, a figure over 6.8 million achieved in Q3 2019 could please the market. However, fears are also growing that Netflix could soon be nearing its peak. The marketplace is becoming overcrowded with the likes of Disney, Amazon. There is also the concern that the lockdown driven subscriber growth will act as a pull forward of signs ups it would have seen later. New commentary surrounding the second half will be closely eyed.

3. Content news

Netflix line up continues to grab attention and hasn’t so far been affected to the coronavirus crisis. Whilst filming for many productions elsewhere has been halted owing to the coronavirus crisis, Netflix said in the Q1 earnings call in March that 2020 films and series had already been shot and headway had been made into 2021 slate. Any update on 2021 filming and looking further out will be closely eyed.

Netflix line up continues to grab attention and hasn’t so far been affected to the coronavirus crisis. Whilst filming for many productions elsewhere has been halted owing to the coronavirus crisis, Netflix said in the Q1 earnings call in March that 2020 films and series had already been shot and headway had been made into 2021 slate. Any update on 2021 filming and looking further out will be closely eyed.

Analysts Rating

From 13th July of the 43 analysts which cover Netflix the Thomson Reuters poll showed:

• 15 rate strong buy

• 12 rate buy

• 11 rate hold

• 2 sell

• 3 strong sell

From 13th July of the 43 analysts which cover Netflix the Thomson Reuters poll showed:

• 15 rate strong buy

• 12 rate buy

• 11 rate hold

• 2 sell

• 3 strong sell

Chart thoughts

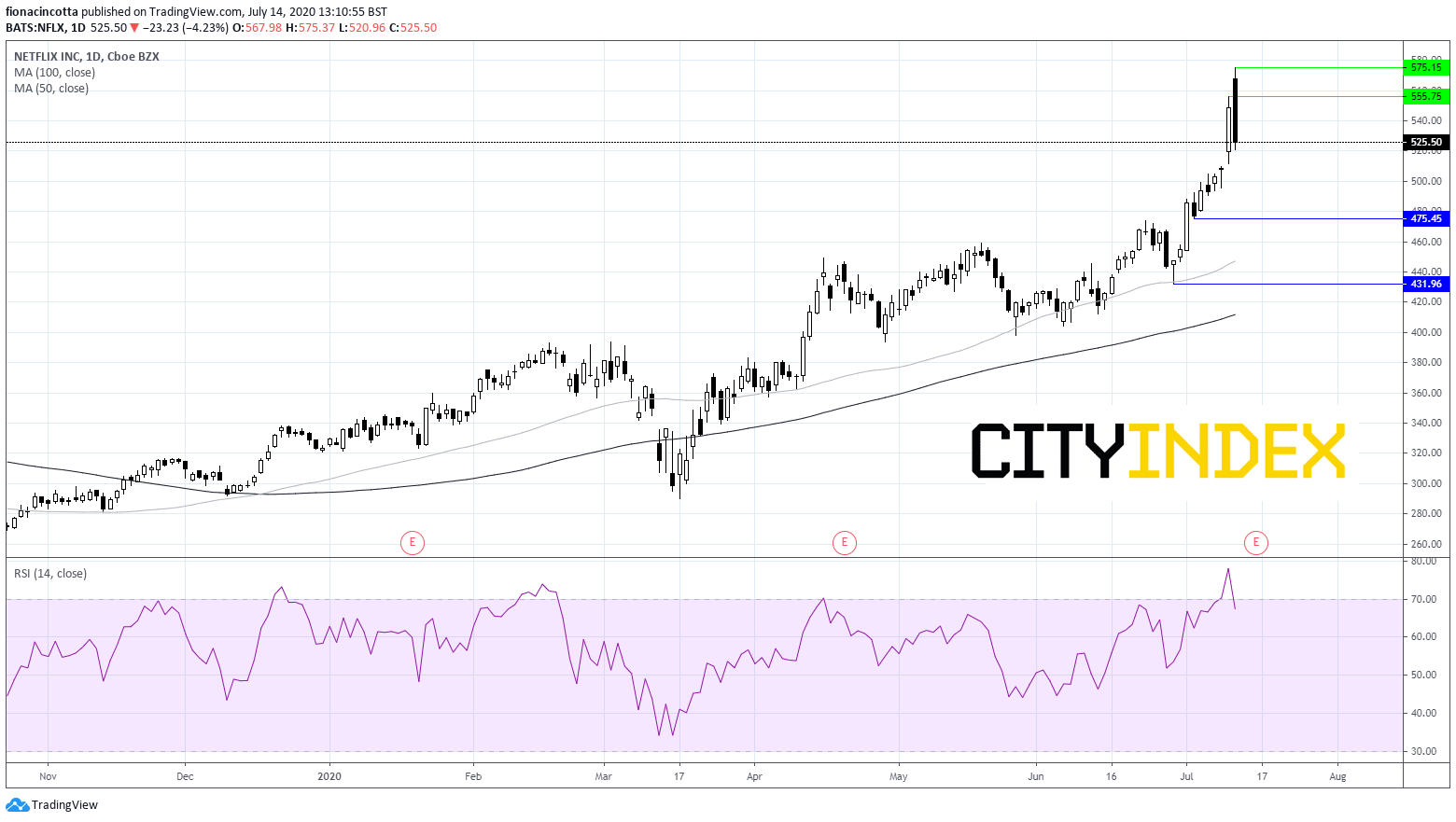

Expectations are high, with strong growth priced in meaning that it could be a tough market to please. Shares are up 40% YTD around $525, significantly outperforming the broader market.

The share price has accelerated its rally moving towards the earnings date, sending the stock to an all-time high of $575. A 4% sell off at the end of the session on Wednesday has brought the stock out of over bought territory.

Solid numbers could see the stock set a new all time high. Weaker than expected numbers or guidance could see the stock drop back towards support at $475 and the 50 SMA at $447.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM