NetEase develops and operates online PC and mobile games, advertising services, email services and e-commerce platforms in China. According to App Annie, NetEase is ranking second in China gaming market in 2019, just behind the technology giant Tencent.

Recently, the Company announced that 1Q net income was up 30.0% on year to 3.6 billion yuan on revenue of 17.1 billion yuan, up 18.3%.

Besides, the Hang Seng Company allowed secondary-listed company from Hong Kong, mainland China, Macau and Taiwan will be eligible to be included in the Hang Seng Index and Hang Seng China Enterprises Index, with a weighting cap of 5 percent. Under this situation, NetEase would be possibly to enter the index after listing a certain of time, as the market capacity is around 53 billion dollars, which is larger than some Hang Seng Index's components stocks.

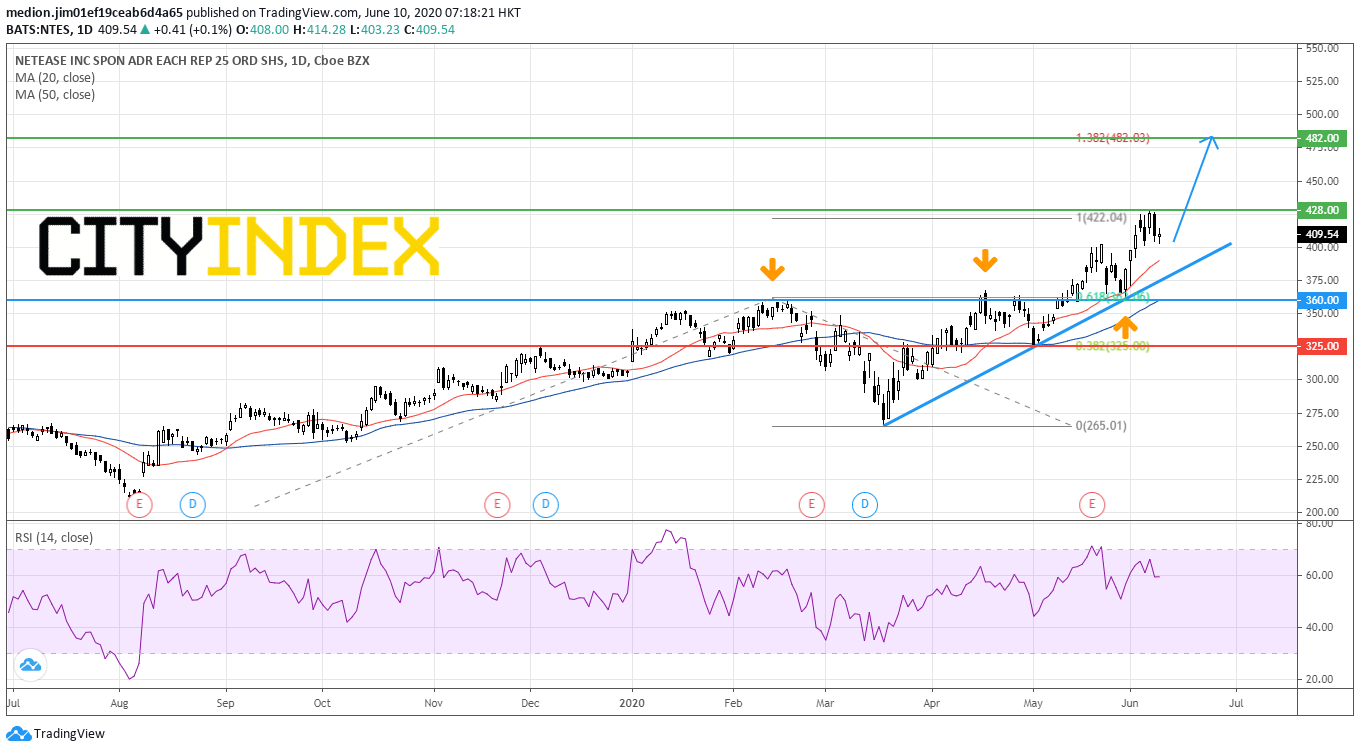

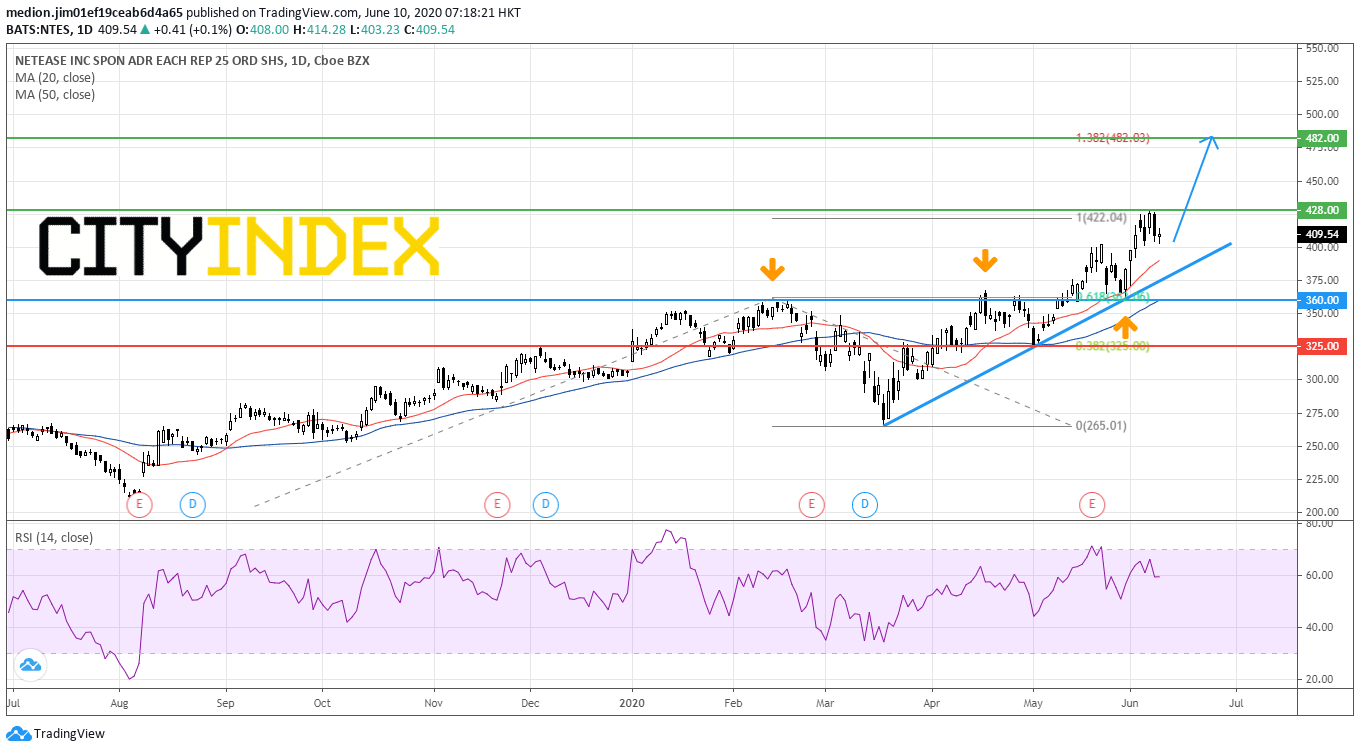

On a daily chart, the stock in the U.S. market is supported by a rising trend line drawn from March low, indicating a bullish outlook.

Source: GAIN Capital, Trading View

Currently, the prices are trading above both rising 20-day and 50-day moving averages.

NetEase Recorded 359 Times Oversubscription

NetEase, a leading Chinese gaming Company, is going to launch its secondary listing in Hong Kong Exchange on June 11. The Company confirmed the priced offering at HK$123 to raise HK$21 billion. NetEase's ADS closed at $409.54 in the U.S. as of June 9, converting to around HK$127.4 each share.

The IPO of Netease in Hong Kong oversubscribed 359 times. It indicates many investors are confident on this gaming company.NetEase develops and operates online PC and mobile games, advertising services, email services and e-commerce platforms in China. According to App Annie, NetEase is ranking second in China gaming market in 2019, just behind the technology giant Tencent.

Recently, the Company announced that 1Q net income was up 30.0% on year to 3.6 billion yuan on revenue of 17.1 billion yuan, up 18.3%.

Besides, the Hang Seng Company allowed secondary-listed company from Hong Kong, mainland China, Macau and Taiwan will be eligible to be included in the Hang Seng Index and Hang Seng China Enterprises Index, with a weighting cap of 5 percent. Under this situation, NetEase would be possibly to enter the index after listing a certain of time, as the market capacity is around 53 billion dollars, which is larger than some Hang Seng Index's components stocks.

On a daily chart, the stock in the U.S. market is supported by a rising trend line drawn from March low, indicating a bullish outlook.

Source: GAIN Capital, Trading View

Currently, the prices are trading above both rising 20-day and 50-day moving averages.

In this case, bullish readers could set the support level at $360 (the overlapping support level), while the resistance levels would be located at $428 (recent high) and $482 (138.2% fibonanci projection).

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM