Nestle to Buy Aimmune Therapeutics

The proposed price implies a 170% premium to Friday's closing price of $12.60. The transaction will be financed with "available cash".

The acquisition will contribute to the organic growth in 2021, and to earnings by 2022-2023.

Nestle mainly wants to acquire Palforzia, a product recently approved in the United States, which is presented as the only product to help reduce the frequency and severity of peanut allergic reactions in children.

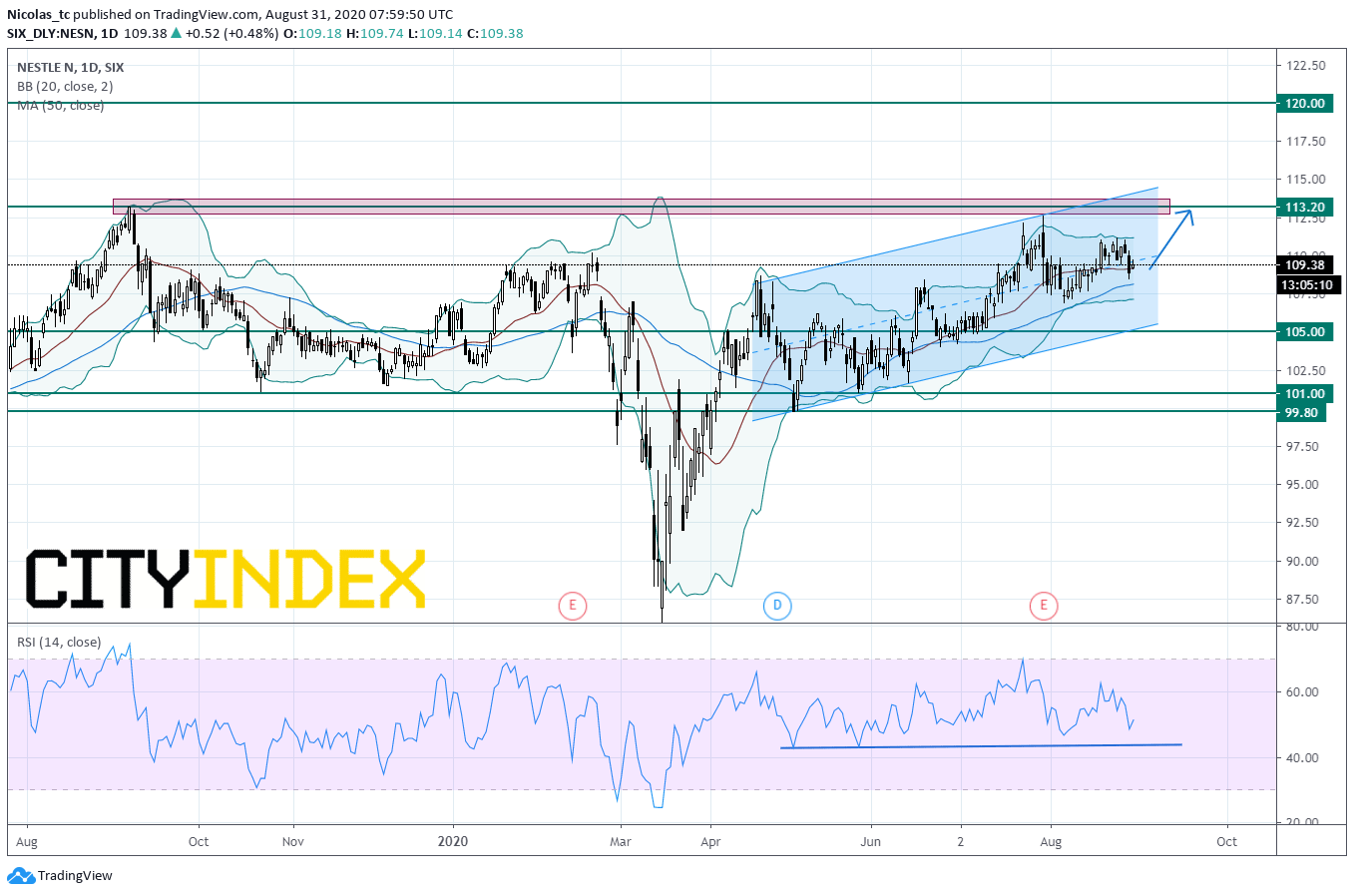

From a chartist’s point of view, the stock price is trading within a short term upward-sloping channel since April 2020 and remains supported by its rising 50DMA currently at 108.14CHF. Prices are nearing the former resistance at 113.2CHF. A short term consolidation move cannot be ruled out. As long as 105CHF is support, the bias remains bullish. A push above 113.2CHF would call for a new up leg towards 120CHF. Alternatively, a break below the channel support at 105CHF would call for a reversal down trend with 99.8CHF as target.

Source: GAIN Capital, TradingView