Perhaps the key takeaway so far as that Trump has performed much better than the polls expected, whilst Joe Bidden has not quite made the progress that the polls guided for. It certainly wouldn’t be the first time that polls have underestimated Trump.

Congress is also going down to the wire with the Democrats not flipping as many seats as the polls had indicated in the Senate. This is key, because even if Joe Bidden wins but fails to flip the Senate then more fiscal stimulus deadlock could be expected which is unfavourable for both risk sentiment and stocks.

Services PMI data in focus

The markets will remain fixed on the results of each state as they come in, however attention will also be turning towards the service sector PMI data. The service sector across the board has been more deeply impacted by the pandemic, with a more fragile recovery. In the UK that recovery has been showing signs of losing momentum as covid cases started rising again. The UK service sector PMI is expected to confirm October’s flash reading of 52.3.

The Eurozone, which saw the second wave of covid start earlier particularly in tourist destinations such as France and Spain, is expected to report a deeper contraction in the sector that in September, with the PMI expected to fall to 46.2. The level 50 separates expansion from contraction.

With the UK, France and Germany heading back into lockdown, these figures are going to significantly deteriorate next month.

US ADP & ISM non manufacturing data

Looking ahead US ADP employment numbers will be in focus ahead of Friday’s non-farm payroll. Expectations are for 650K private sector jobs to have been created in October, down slightly from last months 750k. US ISM non-manufacturing will also provide some clues into the health of the US economy.

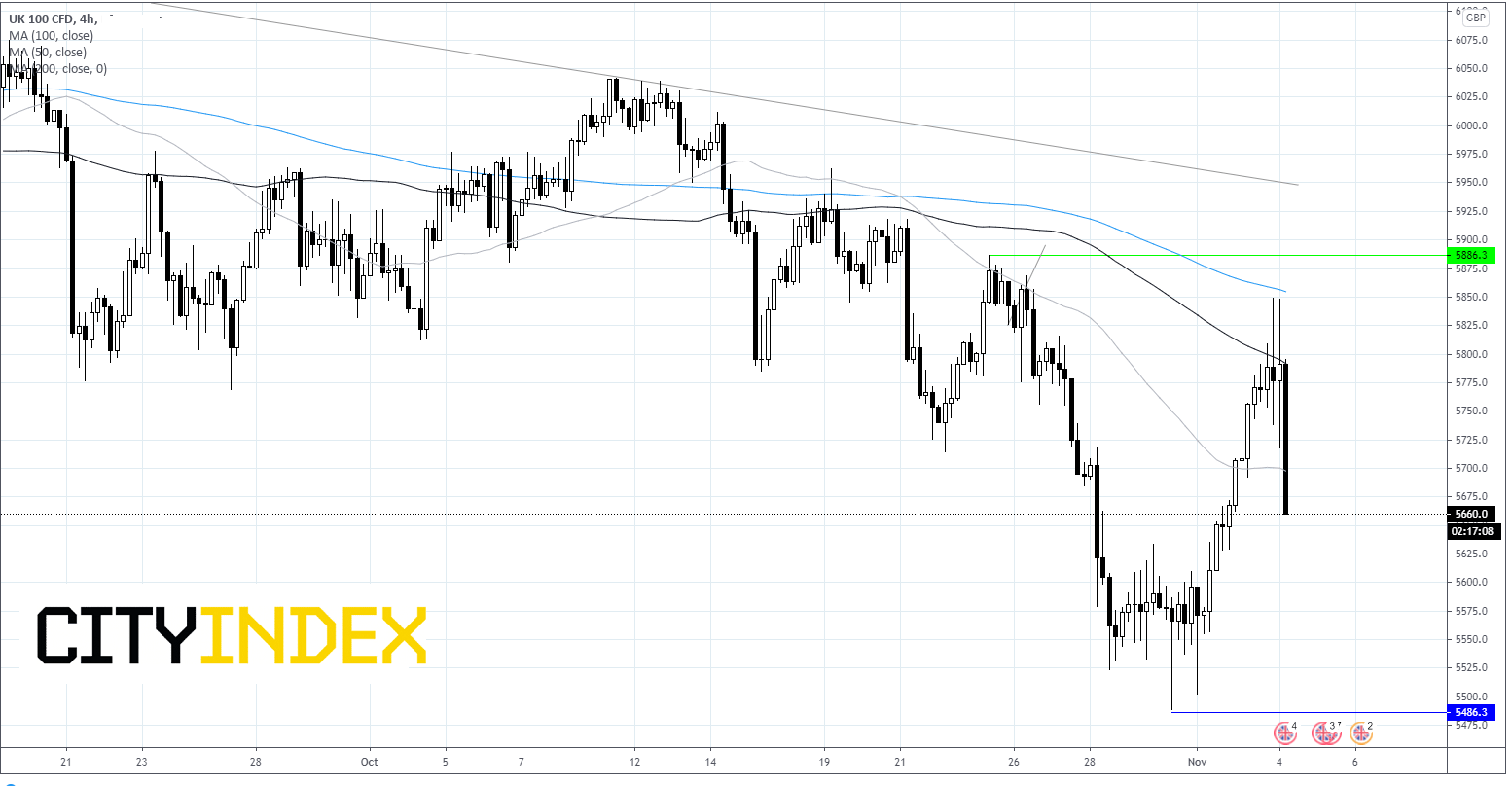

FTSE Chart