Natural Gas Futures Remains Under Pressure

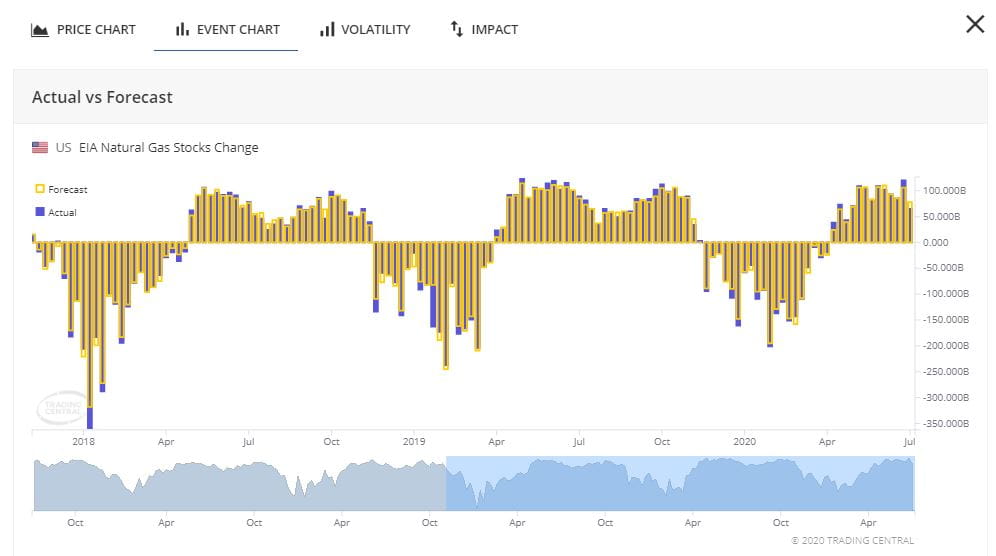

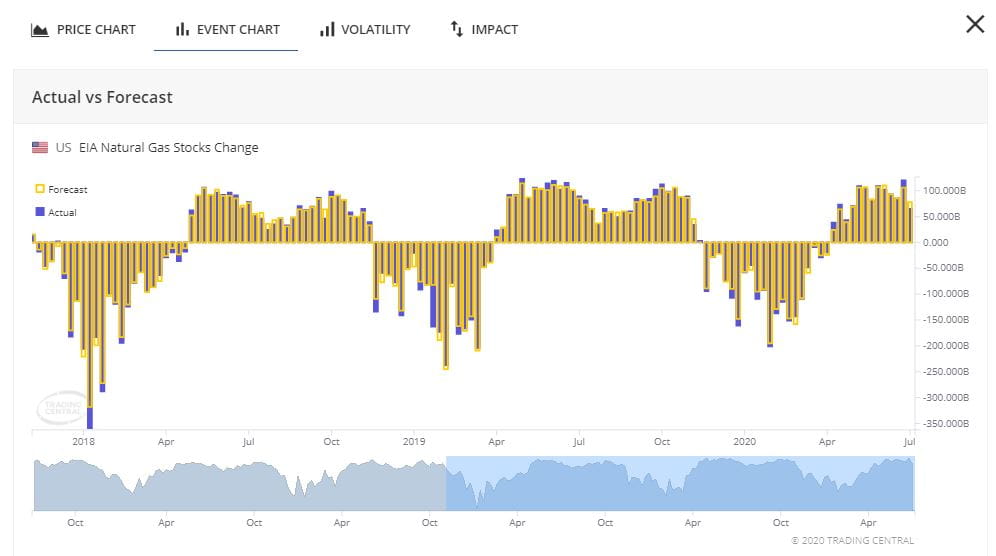

The U.S. Energy Information Administration (EIA) said the storage of natural gas increased by 65 billion cubic feet to 3,077 billion cubic feet for the week ended June 26. The total working gas storage increased by 30.1% from last year.

Source: Trading Economic

In the above chart, the natural gas storage storage is increasing after April. In fact, there would be a seasonal cycle to build the stockpile during April to November. Therefore, it would expect the continuation of increasing the natural gas storage.

The International Energy Agency estimated that the global consumption of natural gas would drop by 4% this year, or twice amount lost after the 2008 global financial crisis.

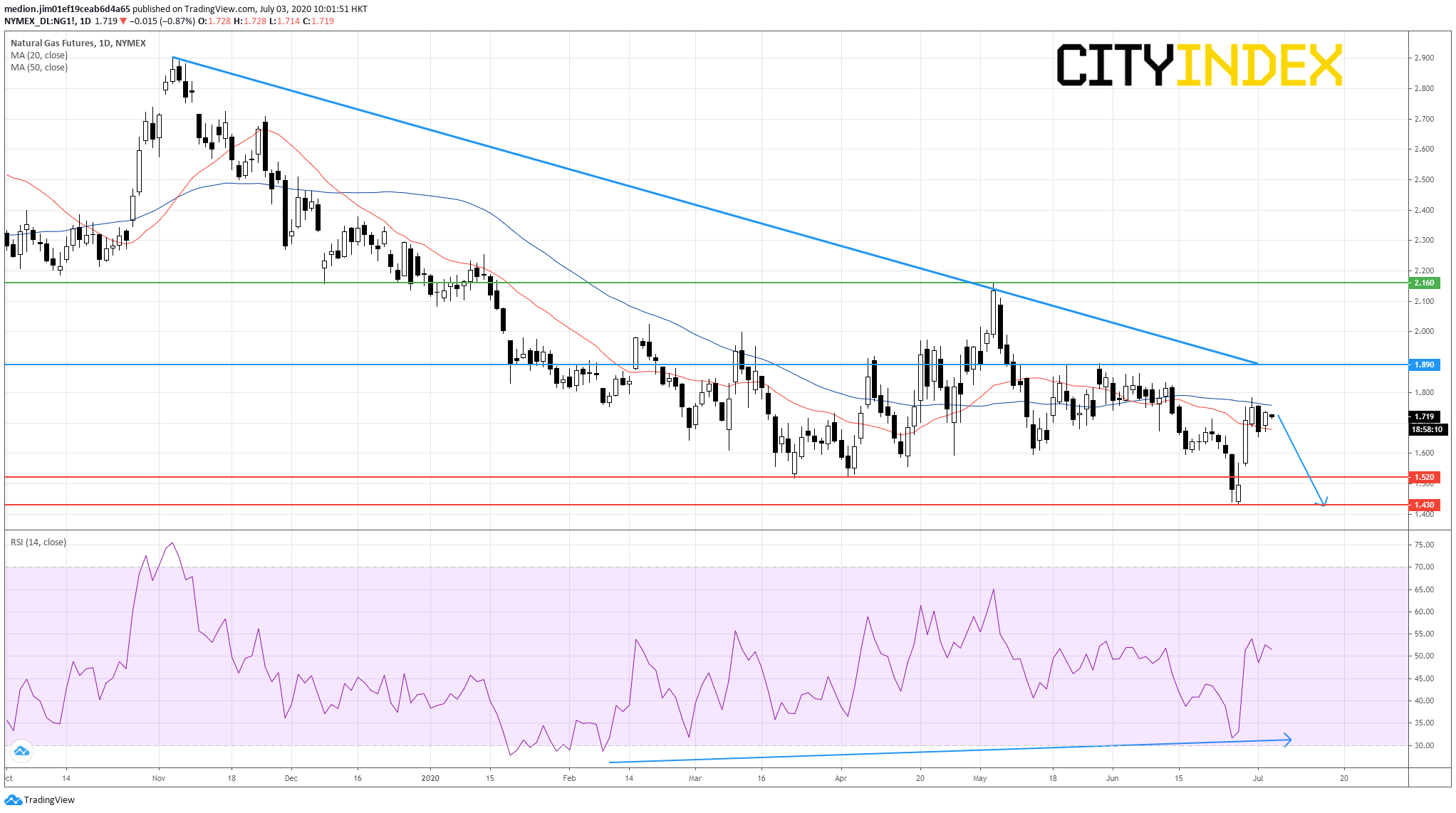

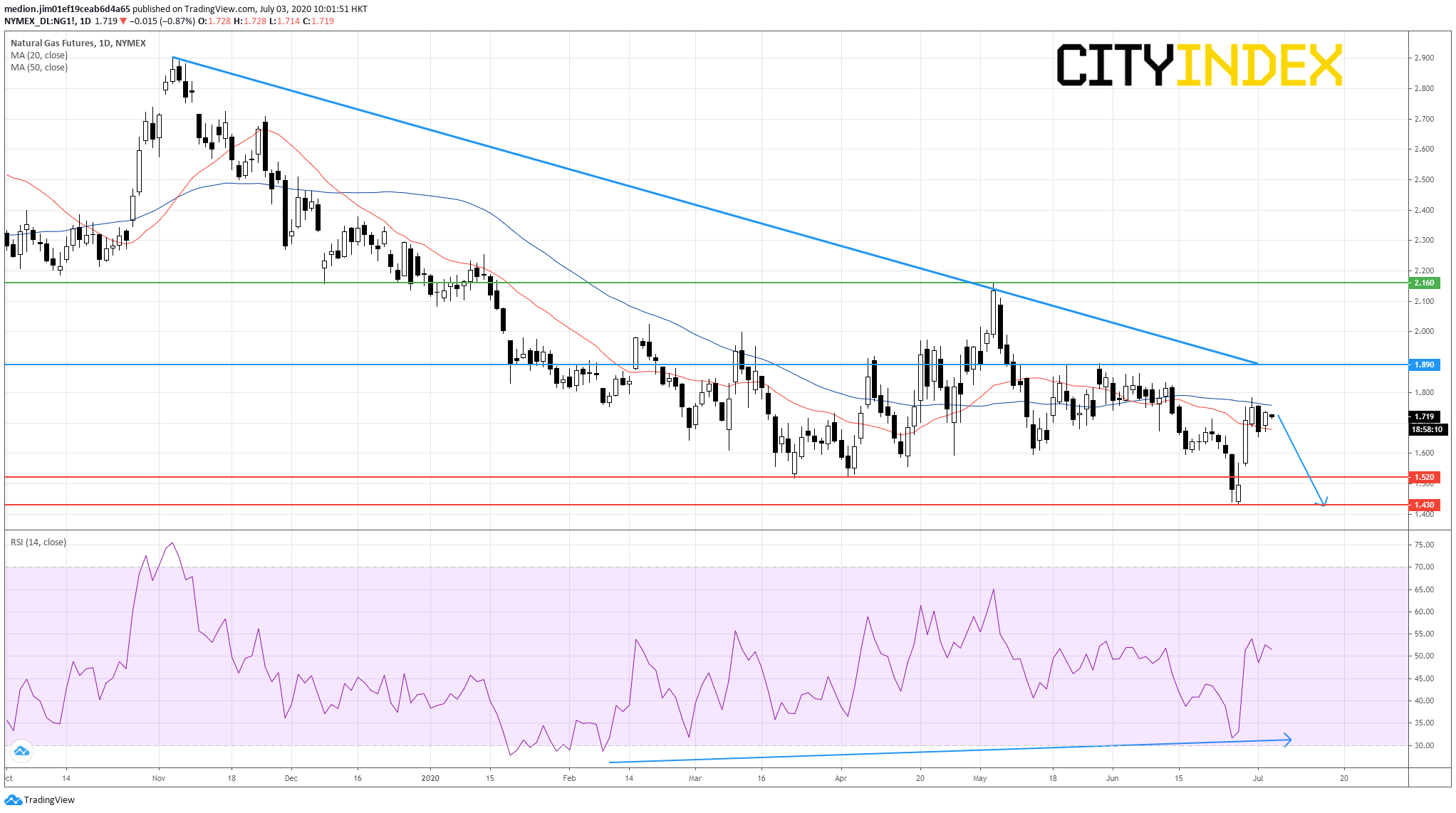

From a technical point of view, natural gas futures broke below the March low at $1.52 before posting a strong rebound from $1.43 on a daily chart.

Currently, the prices remain capped by a declining trend line drawn from December 2019 and falling 50-day moving average. Both technical configuration would favour the bearish outlook.

In an alternative scenario, a break above $1.89 would signal a bullish breakout of the declining trend and would call for a rebound to $2.16 (the high of May).

Source: GAIN Capital, TradingView

Source: Trading Economic

In the above chart, the natural gas storage storage is increasing after April. In fact, there would be a seasonal cycle to build the stockpile during April to November. Therefore, it would expect the continuation of increasing the natural gas storage.

The International Energy Agency estimated that the global consumption of natural gas would drop by 4% this year, or twice amount lost after the 2008 global financial crisis.

From a technical point of view, natural gas futures broke below the March low at $1.52 before posting a strong rebound from $1.43 on a daily chart.

Currently, the prices remain capped by a declining trend line drawn from December 2019 and falling 50-day moving average. Both technical configuration would favour the bearish outlook.

However, investors should alert that the bullish divergence signal from RSI is forming. It would indicate the loss of downward momentum for the prices.

Therefore, as long as the previous high at $1.89 is not surpassed, natural gas could consider a limited downside to $1.52 (the low of March) and $1.43 (the low of June).

In an alternative scenario, a break above $1.89 would signal a bullish breakout of the declining trend and would call for a rebound to $2.16 (the high of May).

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM