Nasty NFP Numbers

The headline Nonfarm Payrolls number was -20,500,000 vs an expected -21,000,000 and a revised -870,000 for March. At any other point in time a 500,000 difference between the estimated and actual would have been a huge difference. However, these days, the actual number was considered roughly in line with expectations. The Unemployment Rate skyrocketed from 4.4% in March to 14.7% in April. Perhaps the most disturbing data point though is the increase in average hourly earnings, which rose from 0.5% in March to 4.7% in April vs an expectation of 0.4%. This substantial rise is largely due to job losses of lower paid workers and increases in pay for those that were kept. The Average Hourly Earnings figure is an important data point for the Fed when gauging inflation. It will be extremely important moving forward to determine if this turns out to be inflationary or just a “one off” event.

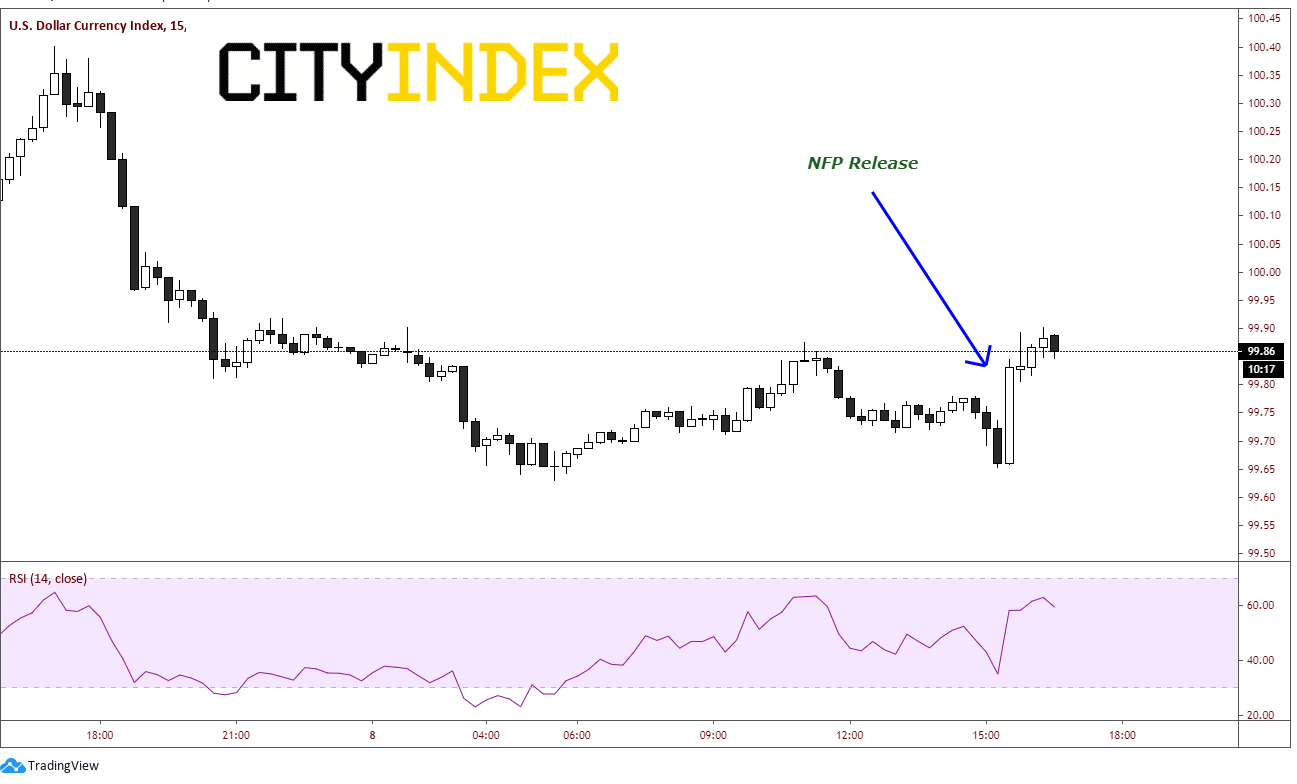

With the headline NFP number close to expectations, yields and the US Dollar went bid on the data release as fears of possible inflation may have been the initial reaction. 10 Year Yields moved from 0.62% to 0.66%.

Source: Tradingview, City Index

The DXY went bid as well, moving higher from 99.66 to 99.85.

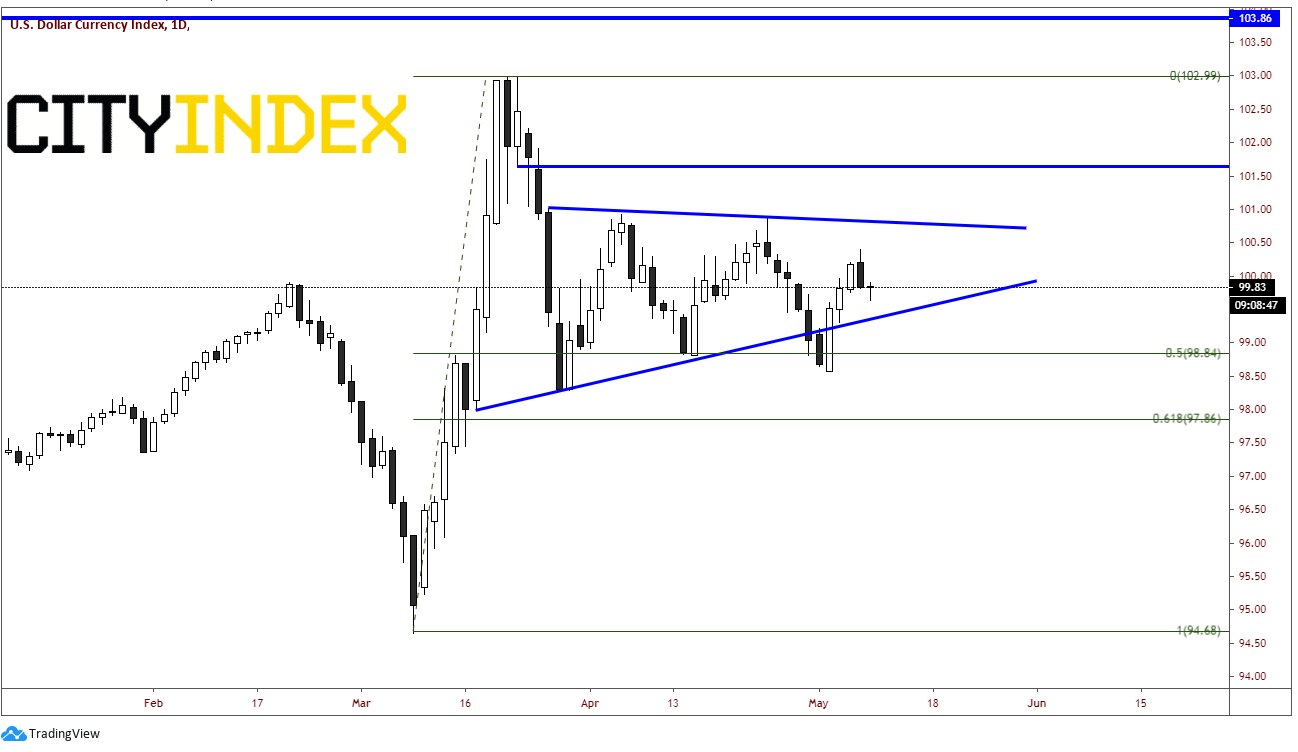

Source: Tradingview, City Index

The US Dollar Index is currently in a symmetrical triangle pattern on a daily timeframe, recovering from a false breakdown on May 1st. Support is at the lower trendline of the triangle near 99.38, then Monday’s lows at 98.57. The 61.8% Fibonacci retracement level from the March 9th lows to the March 23rd highs comes across below there at 97.86. If the DXY continues to move higher, first resistance is yesterday’s high at 100.40. Above there is the high from April 24th and the upper trendline from the triangle at 100.83. Horizontal resistance then comes in at 101.65.

Source: Tradingview, City Index

Today’s close with will be key for the DXY. If the index can close above 100.32, it will create a bullish engulfing candle which would signal further upside for the US Dollar.

The most important thing to take away from today’s NFP data is that it was only 1 month of data points. The data was very bad. If the job numbers continue to come in poorly and the average hourly earnings continue to increase over the next few months, then the Fed will have its work cut out for them!