Multi Bullish Signals Found in China Evergrande

China Evergrande (3333), a major Chinese real estate group, announced that contracted sales climbed 11.6% on year to 65.21 billion yuan in April. Besides, the company reported that it repurchased 3.712 million shares on March 5, involving 51.51 million Hong Kong dollars.

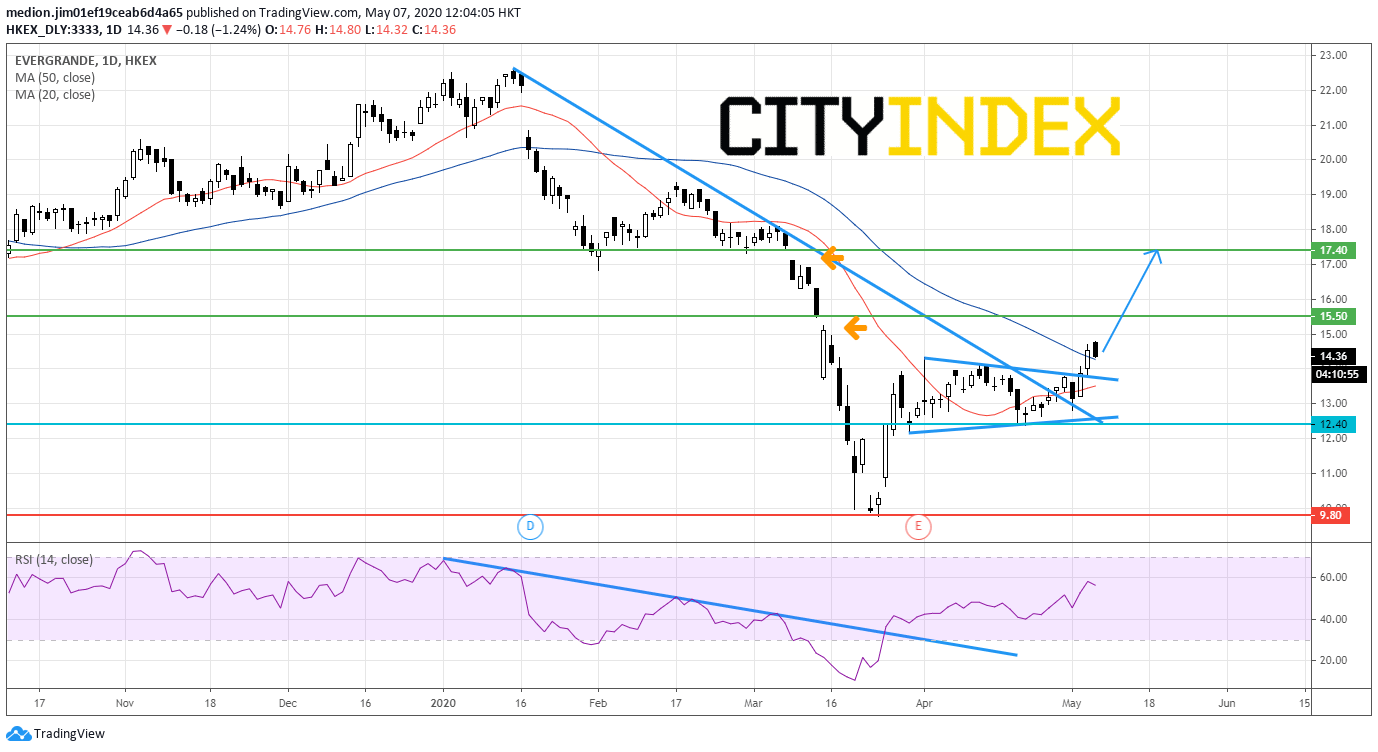

From a technical point of view, the stock broke above the declining trend line drawn from January top and the Pennant pattern on the daily chart. Those patterns suggest a bullish outlook on the chart.

The RSI has broken above the declining trend line drawn from January and is still heading upward, suggesting the upward momentum for the stock prices.

Bullish readers should consider to set the support level around the previous low at $12.40. The resistance level is located at $15.50 (a gap occurred on March 16) and $17.40 (a gap occurred on March 9).

Source: GAIN Capital, TradingView

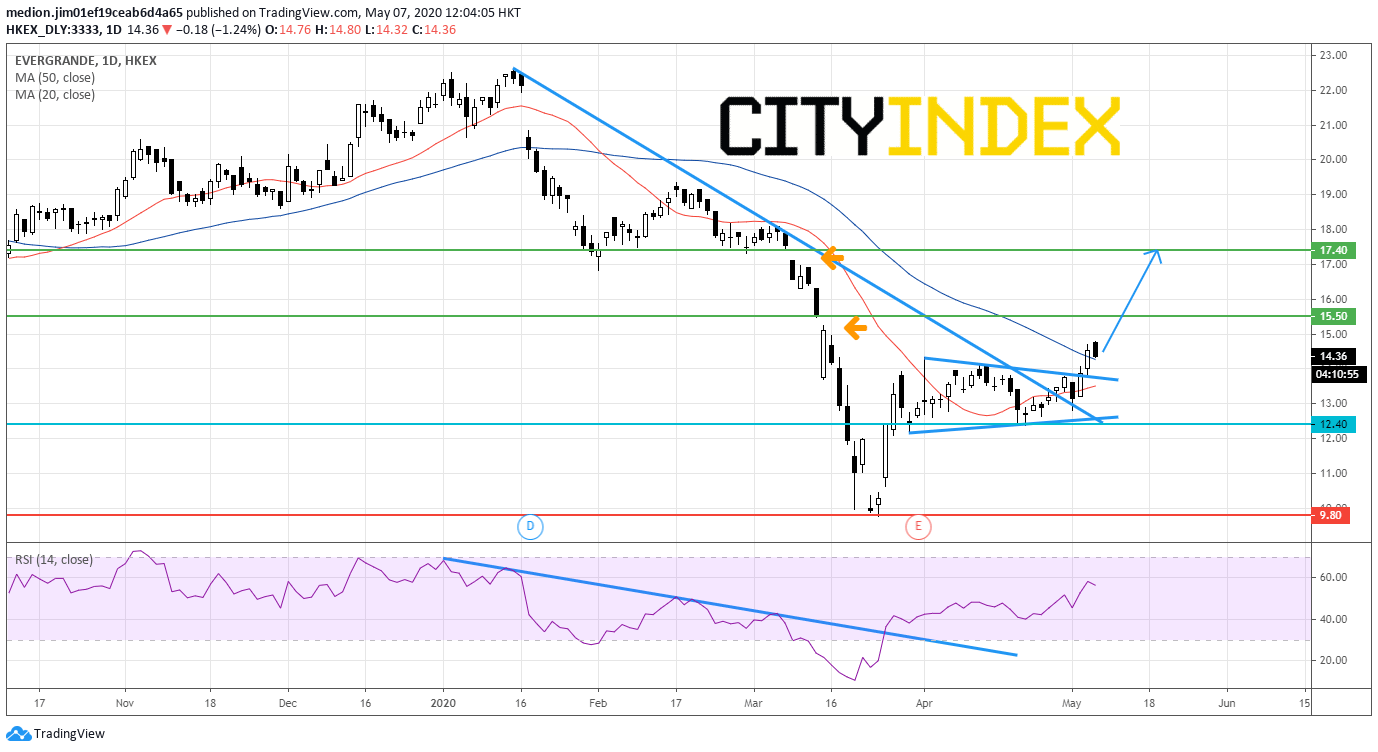

From a technical point of view, the stock broke above the declining trend line drawn from January top and the Pennant pattern on the daily chart. Those patterns suggest a bullish outlook on the chart.

The RSI has broken above the declining trend line drawn from January and is still heading upward, suggesting the upward momentum for the stock prices.

Bullish readers should consider to set the support level around the previous low at $12.40. The resistance level is located at $15.50 (a gap occurred on March 16) and $17.40 (a gap occurred on March 9).

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM