Morrison Supermarkets under pressure after 1H results

Wm Morrison Supermarkets, a chain of supermarkets, reported 1H operating profit before exceptionals down 20.2% to £201m (2019/20: £252m), with margin down 55 basis points (bps) to 2.3%. Group LFL excluding fuel was up 8.7%, comprising a retail contribution of 7.9% and wholesale contribution of 0.8%. Total revenue was £8.73bn, down 1.1% year on year. Total revenue growth excluding fuel was up 8.8%. The interim ordinary dividend is up 5.7% to 2.04p (2019/20 1.93p).

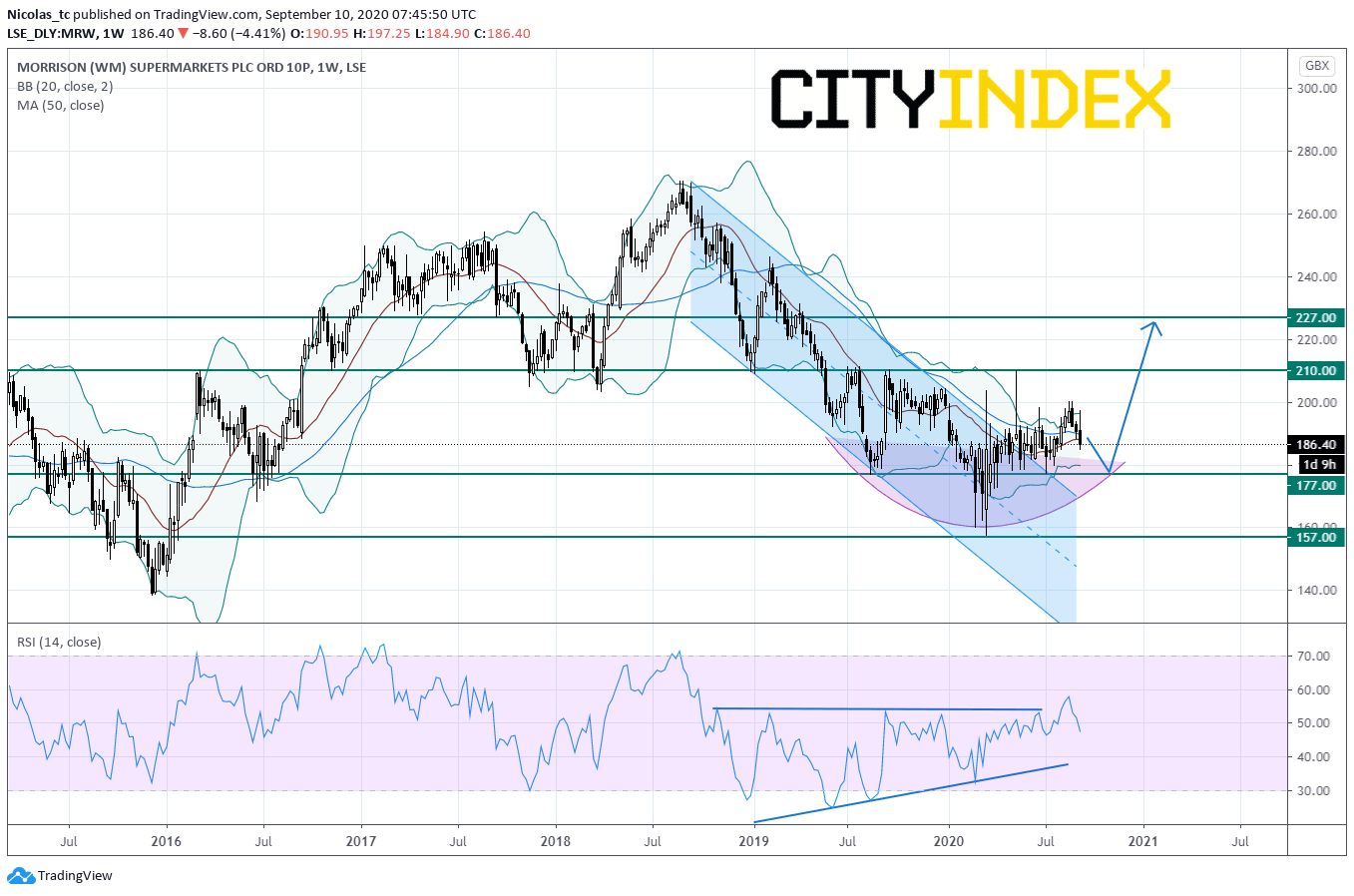

From a chartist point of view, the stock price escaped from a bearish channel in place since August 2018 and is nearing the 20WMA (ST pullback). A key support base has formed at 157p. In addition, a rounding bottom pattern is taking shape. A continuation of the short term consolidation move cannot be ruled out towards 177p. As long as 157p is support, a rebound is likely. A break above 210p would open a path to see 227 (Fibonacci projection). Alternatively, a break below 157p would call for a reversal downtrend.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM