- Asia keeps rising, and the pound keeps falling. It’s another manifestation of what is by now a near decade long and almost fabled ‘Search for Yield’. It’s taken MSCI’s Asia-Pacific index excluding Japan to another high for the year and its fourth consecutive rise. The region, much of which falls under the emerging markets classification, will be among the areas least impacted by post-Brexit economic and market volatility. At the same time the rebound of its shares from sharp falls last year plus its fast-growing EM nature have made it a major target for global investor.

- This was corroborated by analysts at Bank of America Merrill Lynch who noted the search for yield had led to the largest 5-week inflow on record to emerging market debt funds and the longest inflow streak to equity funds in two years.

- Japan’s stock market also rallied for the fourth straight session, though the yen was getting back on its feet against the dollar and the euro at the time of writing suggesting that Nikkei’s winning streak might be coming to an end.

- The broad APAC region saw another positive from China inflation data meeting expectations with a rise of 1.8% year-on-year, almost bang-on forecasts. That does represent tepid growth, but whilst it remains within the breadth of wide expectations it tends to back the thesis that additional stimulus will remain off the table for the medium term after the People’s Bank of China last conducted an absolute interest rate cut in October. The fact that recent economic growth figures were at or slightly better than government targets and signs of hot (perhaps overheating) credit also argue against near-term monetary action.

- The same cannot be said for the UK, whose economic and currency divergence is, if anything, becoming more pronounced, after the pound plumbed fresh lows for the month around $1.29 on Tuesday. UK real rates are of course being buffeted externally too—the march to the next Federal Reserve rate rise seems to be picking up pace regardless of the utterances of the Federal Open Market Committee, as traders notch the chances of a hike within the next month higher in the wake of a second consecutive month of blow-out unemployment data. Federal funds futures now imply a chance of around 54% of a Fed hike in December, higher after Friday’s data, though it’s notable that a fully priced in move isn’t projected until October next year.

- By contrast ‘short sterling’ futures (AKA 3-month Libor futures) currently price at least two Bank of England interest rate cuts plus some further easing on top. Rate expectations were further undermined on Tuesday by comments from a member of the BoE’s Monetary Policy Committee Ian McCafferty in the Times newspaper in which he pointed to the strong possibility or indeed need for further easing. His words carried more weight given that for many years until early 2016, he had been known as being on the more hawkish side of MPC thinking. UK Industrial Production data this morning were in line with forecasts and more to the point massively superseded, given that they covered the month of June.

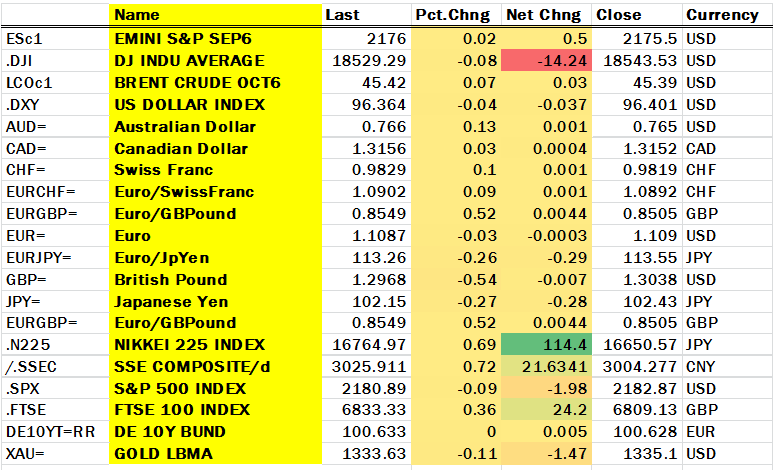

Global markets at online time:

Note: ‘Canadian dollar’, ‘Swiss franc’ and ‘Japanese yen’ are traded as dollar pairs, hence for those currencies, a negative percentage/net change denotes a rise per dollar and a positive change denotes a fall per dollar.

- To our minds the next set of economic data of wide interest to global markets are likely to be Japan’s machine orders on Wednesday morning given that the data are a leading indicator of the country’s GDP assessment which will be released next week. There’s a Reserve Bank of New Zealand rates announcement on Wednesday night London time ahead of China’s closely watched industrial production and retail sales update in the early hours of Thursday.