Yen again

- Without a doubt the most remarkable development to occur overnight in an increasingly holiday-distracted market (judging by thinner volumes) was the sharp rebound in the yen. It has surged as much as 1.66 yen to the dollar stopping just short of the high 103s, apparently reviving after last Friday posting its first two-week fall since early June.

- The likeliest trigger for the move is the emergence this morning of further details about a long-trailed fiscal package from Japan’s Ministry of Finance. Nikkei news reported the government planned a direct fiscal stimulus of around 6 trillion yen ($56 billion) over the next few years. That is well short of two earlier figures that have filtered into the market over the last month or so. Initially a package worth around ¥10 trillion ($100bn) was reported. This subsequently doubled to ¥20 trillion in newswire reports out just days ago. The much smaller scope of the potential scheme detailed by the ‘benchmark’ Japanese financial news provider magnifies existing doubts about the potential for any additional measures—fiscal or monetary—anytime soon.

- For the Bank of Japan, which meets this week and announces policy on Friday, market expectations of action were already falling, though that pessimism was partly predicated on the possibility that the MoF would do some of the near-term heavy lifting to lift inflation back towards a BoJ target of 2% supported by PM Shinzo Abe’s newly strengthened government.

- Still, with time ticking, voting among BoJ rate setters is almost bound to be tight and the likelihood of a decision is getting closer to call. A poll conducted by Reuters and released late last week had most economists expecting BoJ easing on Friday via a combination of further interest rate cuts and asset buying. That would entail a cut of the bank’s current -0.1% rate on certain bank deposits to -0.2% and require an expansion of the BoJ’s existing moderate purchasing of equity ETFs, rather than boosting already substantive bond buying. The main sticking point to these projections is that economists are also wary that the BoJ and the MoF have a soft target for the yen of below 95 yen per dollar, and its only around such levels that many economists expect hard foreign exchange intervention to be executed. (By default, such a model also implies diminished incentive for monetary or fiscal authorities to boost stimulus unless the yen rallies to such levels too.)

- Another complication is that the Bank is expected to include the impact of government measures in its new inflation forecasts on Friday. Logically if the BoJ makes upwards adjustments to forecasts, that also reduces the impetus for monetary action.

- Like clockwork, Nikkei fell 1.4% overnight as the pressure on Japan Inc. ramped back up again after a fortnight’s pause. Sterling once again led the charge against the yen, rising a full 2% at last check to 1.36 yen, whilst the euro also grabbed its chance and ran some 170 sen to 114.60 yen.

- These Western currencies weren’t sitting so pretty against the dollar though, with the pound slipping back again against the dollar to 1.3080, which is now looking like important daily support before the 1.29s are revisited. I don’t see anything apart from trading dynamics like squeezes and technically orientated buying behind this latest relapse of sterling. That’s partly corroborated by the euro catching a bid against the dollar and recapturing $1.10 to trade last at $1.1009. Just watch the 101s. The euro was kicked off the level of one dollar and one point one zero one last Friday and failed to get back above it earlier this morning.

- Again, the euro’s bid against the pound suggests position taking, rather than fundamental drivers. The single currency was last up 50 pips to 8417. It’s been constructive since a low of 8247 in mid-July. It has consolidated impressively in a mini channel within a larger, longer-term channel, whose top is around 8440, before this year’s highs above 86p.

Heavy BP drags FTSE after light profits

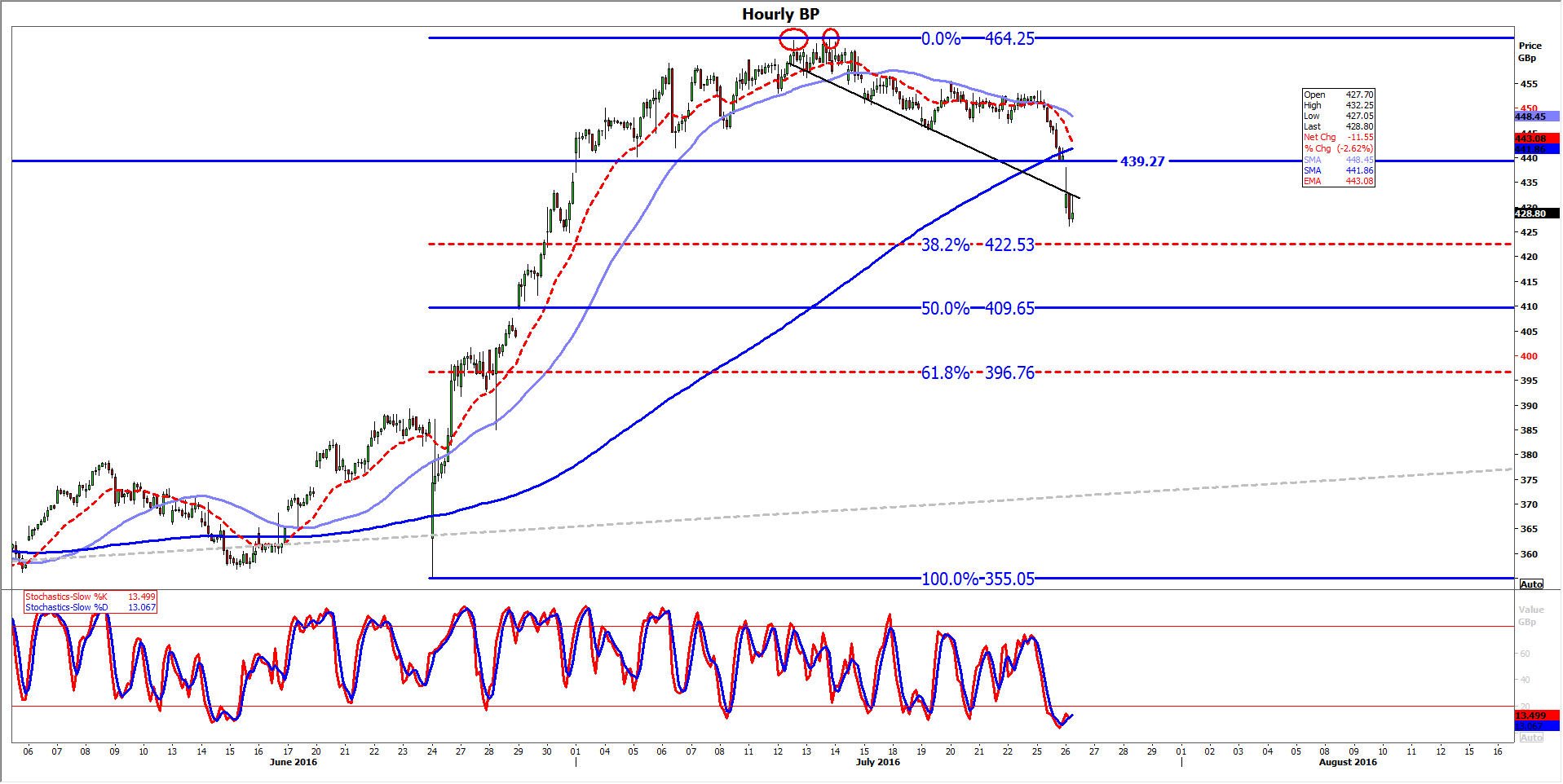

- FTSE 100 continues in its tight range, trading just 0.1% higher though still extending post-23rd June gains. It’s now almost 17% higher than 24th June lows. Heavyweight BP is a drag. It’s trading 3% lower after missing quarterly profit expectations by $120m, at $720m, some $1.3bn below Q2 2015 underlying replacement cost profit (the industry’s most watched income measure). There wasn’t a great deal to be positive about from the British No.1 oil major’s outlook either. “As we look forward, we expect the external environment to remain challenging,” said Chief Executive Bob Dudley.” The hourly chart below shows what traders are looking at from a technical basis. We see a recent double top at 464p, the end of an hourly trend which had kept the stock’s slide on a contained gradient; inversion of shorter-term momentum (lilac=50-interval moving average; perforated red=21-interval exponential MA) and a break below the 200-interval MA (blue). These points are suggestive of a deeper consolidation, in keeping with renewed concerns about a crude oil glut. Obviously the bears will be looking to get the price below looming 38.2% retracement of the rise from 355p to 464.3p late last month. If that push fails, and BP can get back into/above the gap between 432.55p and 439.3,p the wider-term uptrend would be intact.

Please click image to enlarge

- DAX is edging lower too, though it again, it has made solid progress, and is up 10% since lows for the year on 27th June. It’s not being helped by earnings from one of its big banks out this morning, Commerzbank, which said its core capital buffer unexpectedly shrank in the second quarter, although profits met expectations. The news is also pulling Deutsche Bank lower too.

- Major economic releases are thin on the ground on Tuesday, ahead of the start of the Fed’s two day meeting this afternoon. US New Home Sales will be eyed by some investors.