Where else to begin but the pound, after the Bank of England on Thursday reduced the Bank rate to the lowest in its 322-year history.

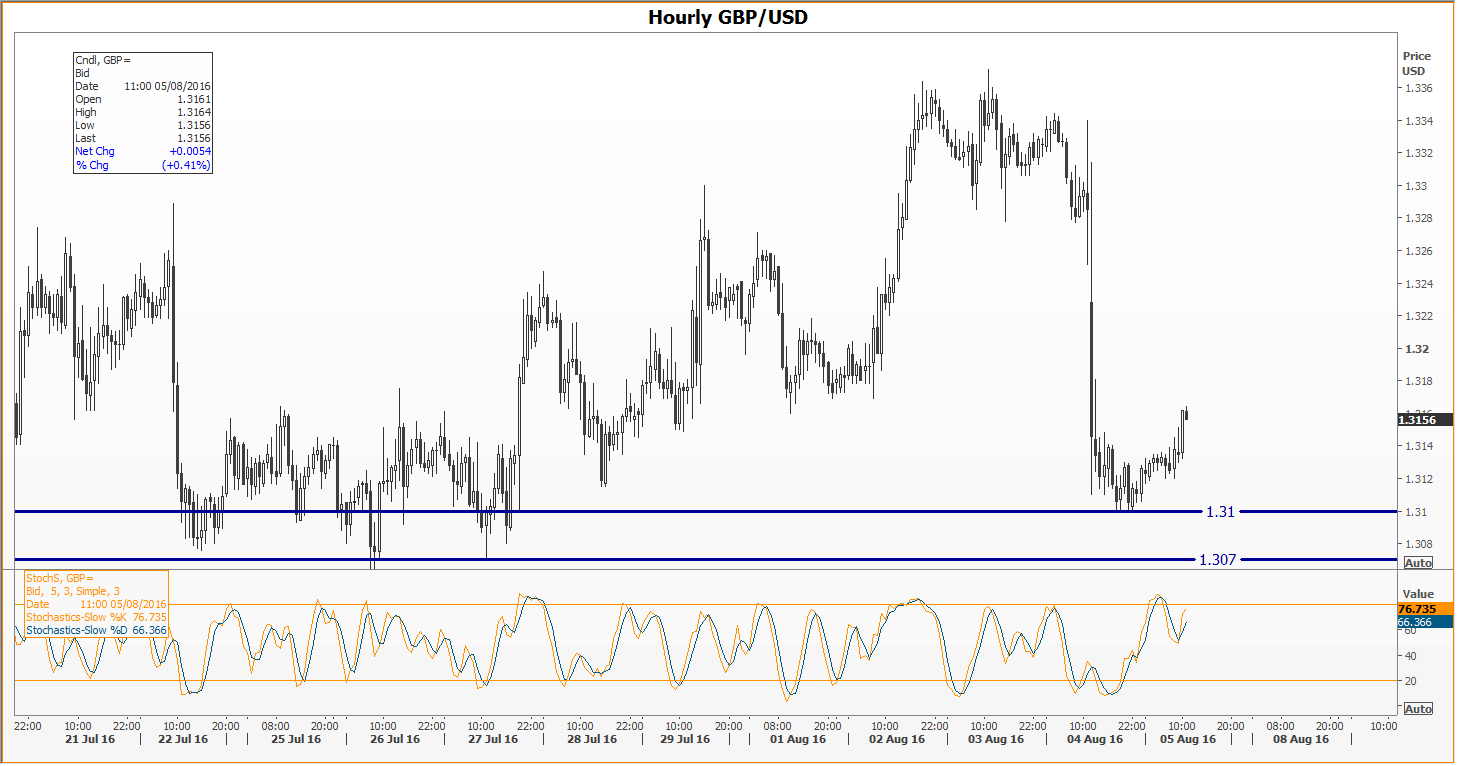

- Sterling is rallying strongly. To be sure, it slipped the hardest in about a fortnight in reaction to the cut and £170bn worth of stimulus: £60bn in government bond buying, £10bn in high-grade corporate bond buying, and the Term Funding Scheme—offering banks the cheapest loans to ensure they keep lending. However for the pound to be rallying against the dollar a day later is a testament to the ongoing recovery and resilience of sterling, although that is likely to be severely tested in the months ahead if BoE Governor Mark Carney’s assessment of the damage done to UK economic prospects is correct. Also if the Bank follows through with its pledge to expand all the above measures if warranted. For now, cable is rallying above the crucial $1.30-$1.31 support band traders have been watching since late July. Real progress would be heralded by an hourly close above Thursday’s $1.3181 high, but that’s unlikely to be seen on Friday.

Please click image to enlarge

- As for the global market reaction, US stocks closed essentially flat—the Dow Jones lost about 3 points, the S&P gained half a point. In Asia, they were a bit less laconic: the broad MSCI Asia-Pacific index which excludes Japan was up 1.1%, heading into a narrow gain for the week with Shanghai’s main gauge ticking up by 0.1%. The world is of course also pre-occupied by the monthly Non-Farm Payrolls Show, coming up at 1.30 BST and in China a heavily weighted raft of pivotal economic data will be floated in the coming week. The Nikkei was the weakest performer in the region, surrendering earlier gains and closing flat under the weight of the seemingly unstoppable yen. Lingering disappointment about the size of Prime Minister Abe’s stimulus package, is now metastasizing into rumour, and certainly more credible speculation that the monetary policy review that the Bank of Japan announced at its last meeting might result in it essentially throwing in the towel at its next policy update. Back in the UK, one standout stock is Royal Bank of Scotland after reporting its upteenth loss, this one wider year-on-year in the first half at £2.05bn, with a £450m provision for PPI misselling. It has scrapped plans to sell-off Williams’ & Glyn as a separate bank and really, has not made a great deal of progress to speak of since the last time it reported dire results, earlier this year. Santander has expressed interest in buying off some of the assets in the unit formerly named W&G, which RBS is obliged to sell as a condition for receiving state aid, a long, long time ago.

- Yields on government debt, both in Japan and around the globe followed the lead of that country’s stocks in the wake of the BoE’s curve weakening actions. US Treasury 10-year yields dropped 25 basis points overnight, and 10-year gilt yields saw a record low of 0.639%. In the Eurozone, bund yields also tumbled on Thursday as bond prices rose after the BoE news.

Global markets at online time:

| Name |

Last |

Pct.Chng |

Net Chng |

Close |

| S&P FUTURE |

2164.5 |

0.24 |

5.25 |

2159.25 |

| DJ INDU AVG (THU CLOSE) |

18352.05 |

-0.02 |

-2.95 |

18355 |

| BRENT CRUDE OCT6 |

43.85 |

-0.99 |

-0.44 |

44.29 |

| US DOLLAR INDEX |

95.631 |

-0.13 |

-0.127 |

95.758 |

| Australian Dollar |

0.7655 |

0.37 |

0.0028 |

0.7627 |

| Canadian Dollar |

1.3013 |

-0.02 |

-0.0002 |

1.3015 |

| Swiss Franc |

0.9736 |

0 |

0 |

0.9736 |

| Euro/SwissFranc |

1.0854 |

0.14 |

0.0015 |

1.0839 |

| Euro |

1.1142 |

0.13 |

0.0014 |

1.1128 |

| Euro/JpYen |

112.49 |

-0.08 |

-0.09 |

112.58 |

| British Pound |

1.3155 |

0.4 |

0.0052 |

1.3103 |

| Japanese Yen |

100.95 |

-0.25 |

-0.25 |

101.2 |

| Euro/GBPound |

0.8469 |

-0.22 |

-0.0019 |

0.8488 |

| NIKKEI 225 INDEX |

16254.45 |

0 |

-0.44 |

16254.89 |

| S&P 500 INDEX (THU CLOSE) |

2164.25 |

0.02 |

0.46 |

2163.79 |

| FTSE 100 INDEX |

6760.47 |

0.3 |

20.31 |

6740.16 |

| 10Y BUND (PRICE) |

100.893 |

-0.09 |

-0.087 |

100.98 |

| GOLD (SPOT) |

1361.81 |

0.07 |

1.01 |

1360.8 |

- Traders, the rest of your day is going to be all about the ‘non-farms’, but most of you know that already. Please read the as always second-to-none preview by our Chief Technical Strategist James Chen here. James’s view of the probable reaction to the main possible outcomes:

NFP Jobs Created Potential USD Reaction

> 190,000 Moderately Bullish

180,000-190,000 Neutral to Slightly Bullish

170,000-179,000 Moderately Bearish

< 170,000="" ="" strongly="">

- The traditional pair traders opt for into the US monthly employment reports is USD/JPY. Bear in mind that yen implied volatility remains elevated after some tenors rallied to all-time highs over the last few months. 3-month at the money vol. (i.e. options volatility in the simplest and most common trade) is up 45% this year even after falling 30% since 24th June. In other words be ready to move fast or be chopped if you’re trading that pair, or indeed any involving Japan’s currency.