- Two and a half days later, it’s still all about last Friday’s non-farm payrolls, when a blow-out 255,000 addition to the US employment market fuelled a global stock market rally and blew pure oxygen on gasping bond yields.

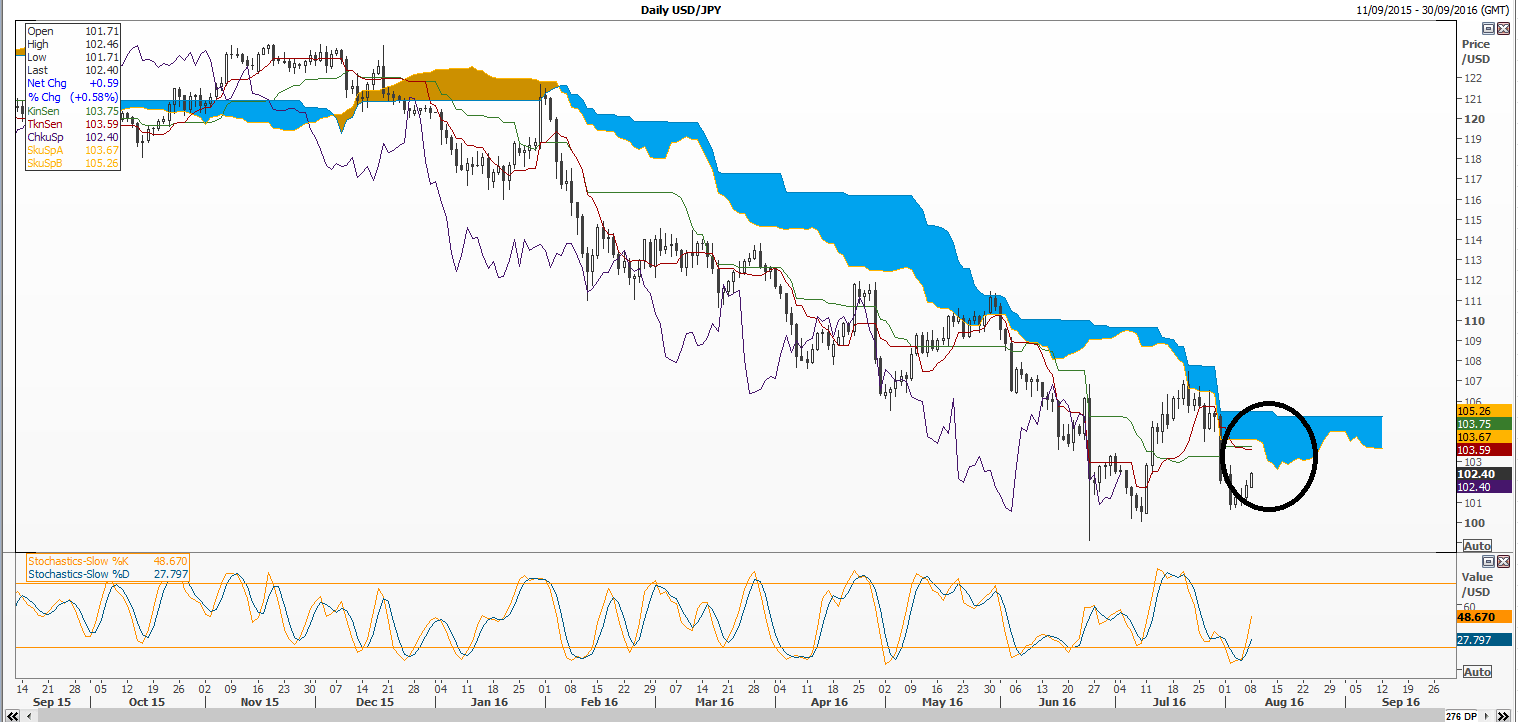

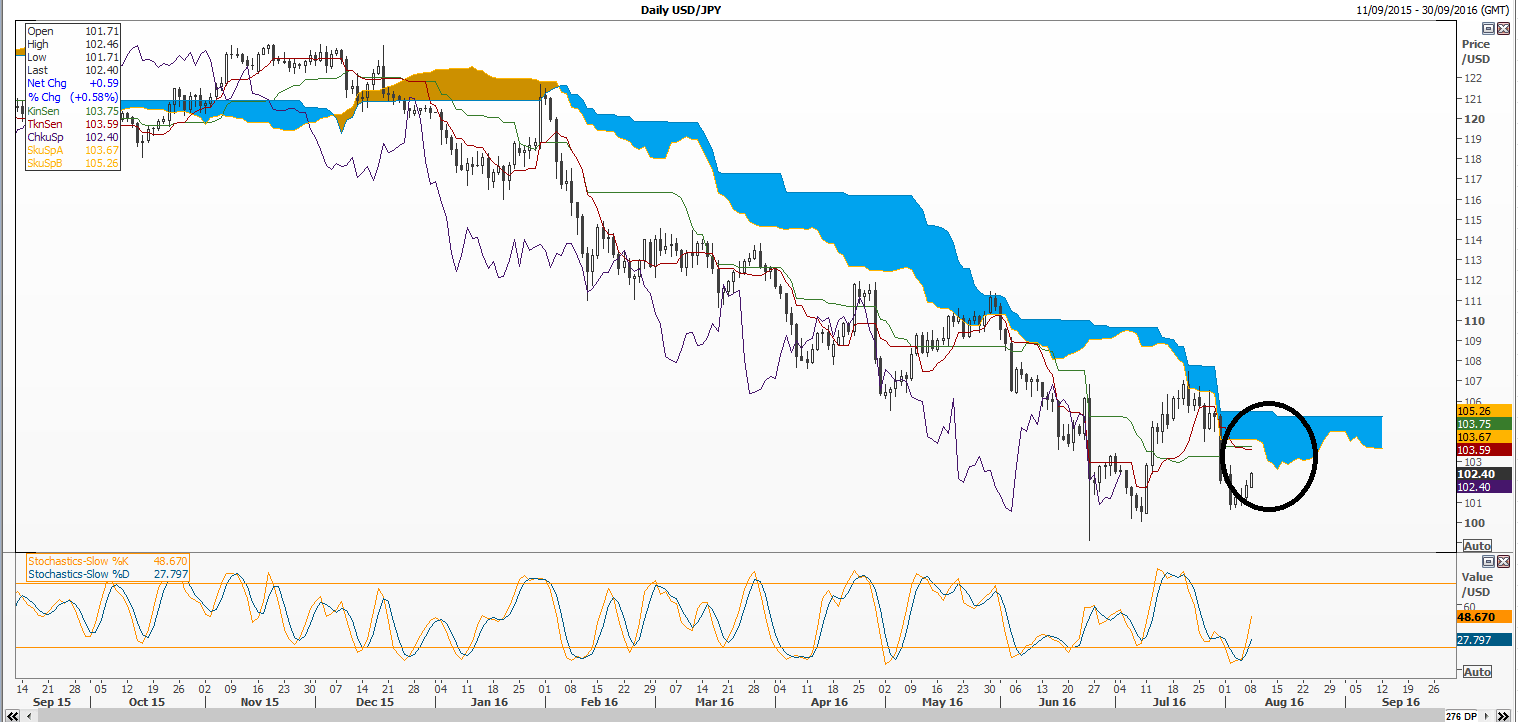

- The rally is still going, taking Asian stocks to a new high for the year, if you agree MSCI’s Asia-Pacific Index (excluding Japan) is the appropriate benchmark. It rose 0.7% and hit its highest level since August last year, having risen 12% over six weeks. Japan participated this time too, in quite a big way, with the Nikkei rising more than 2%, enabling Tokyo shares to retake almost all of the ground lost over the last five weeks. Japanese stocks are therefore showing increased resilience to the yen, which to be sure seems nowhere near close to ending its all-year-long rally, though is 0.6 of a yen weaker against the dollar on Monday. Even so we still expect the daily Ichimoku Kinko Hyo cloud to begin to apply pressure again should the rate reach 102.95 yen per dollar in the near term (say about a week).

DAILY CHART: USD/JPY

Please click image to enlarge

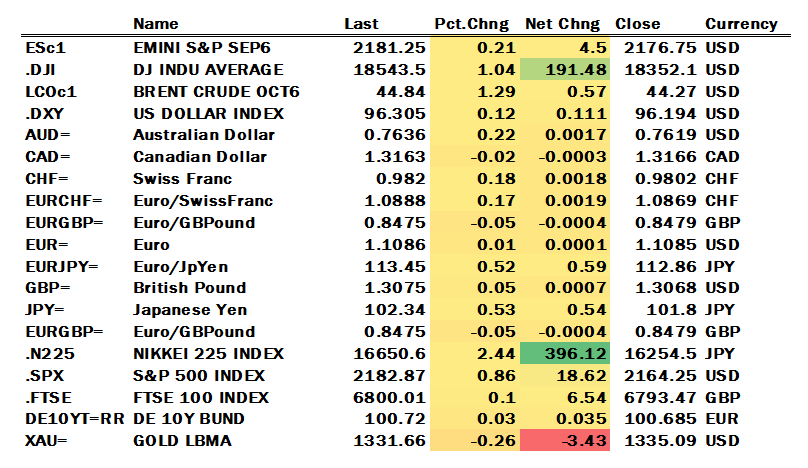

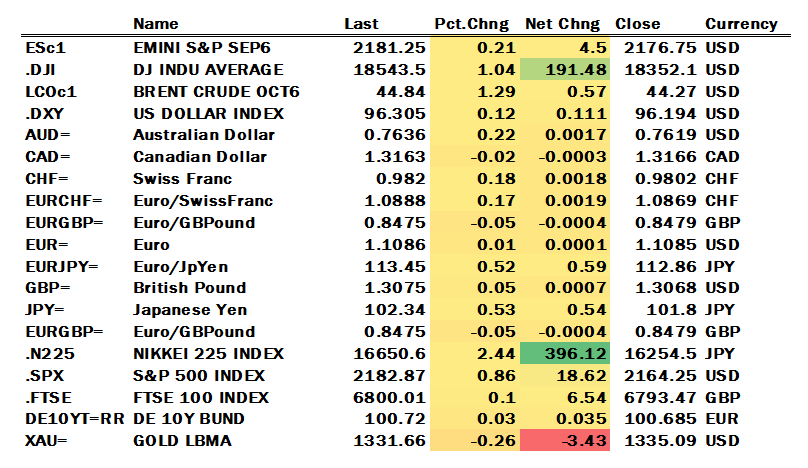

And the other global markets at online time looked like this:

Note: ‘Canadian dollar’, ‘Swiss franc’ and ‘Japanese yen’ are traded as dollar pairs, hence for those currencies, a negative percentage/net change denotes a rise per dollar and a positive change denotes a fall per dollar.

- As you can see from the euro traded against the dollar, the pound, the franc and the yen, and also by the DAX’s rally, there seems to be a bit of European-specific impetus going on as well. Indeed there is. A better than expected result by industrial production in the engine of the trading bloc, Germany, is reinforcing the floor under German stocks and bringing cheer to the rest of the broad region’s riskier markets too. Whilst production rose 0.8% against 0.7% forecast month-to-month in June, attention has also fallen on the revision of the May reading to a fall of 0.9% instead of a 1.3% fall, though that’s still in the context of a 1% decline in the second quarter which will be impossible to revise away entirely.

- Still, the hope is that the robust factory data heralds subsequent strength in the single-currency area’s wider economy, an update of which will be available on Friday.

- Britain’s currency and economy are of course the outliers of late, as neither can be said to be going great guns. Good news for the US job market is still good news for all global stock markets, including the FTSE 100 on Monday, to a modest degree. But the strengthening dollar is also clamping down further on gold and, not to mention sterling. The latter has now definitively breached closely watched support between $1.3070 and $1.3100, and, absent a near-term recovery, it could even be that the pound is again vulnerable enough to face another test of levels as far as or at least close to 30-year lows, slightly under $1.28.

- That said the rest of the week’s most important scheduled economic focus points are bereft of inputs that are likely to be sensitive enough to significantly weaken sterling further, on their own.

- Tuesday 9th August - China CPI (July)

- Tuesday August 9th - UK Manufacturing Output (June)

- Wednesday 10th August - Japan Machine Orders (July)

- Thursday 11th August - Japan Machine Orders (July)

- Friday 12th August - Eurozone GDP (Q2)