- What was the market impact of the Bank of England‘s (slightly) uncovered repo operation on Tuesday, which marked the start of the renewed QE announced last Thursday? Apparently nothing on the day. The pound still careered sharply lower to price weakened market rates and flattening at the long end of the curve.

- But in the medium term, it’s reasonable to wonder if the BoE’s failure to find enough buyers to hit a targeted £1.17bn in long-dated gilts could signify not just further hurdles for The Bank in fulfilling its pledge to scoop up a further £58.83bn gilts on top of the £375bn accumulated during its original QE program, but also if these difficulties are symptomatic of similar and growing disruption of global QE campaigns. It’s clear that scepticism is already way ahead of these observations in Japan, where several authoritative voices have interpreted the BoJ’s latest hang fire as a de facto throwing in of the towel. The BoJ is doing it tacitly for now in order to avoid having to do it officially—with the attendant market impact—for as long as possible, according to the rest of that view.

- It’s literally early days for BoE’s QE restart. But the fact that the market has begun to examine the viability of this relatively contained addition to the Bank’s gilt portfolio so early, is already a crack in the authority the BoE requires to project confidence in its monetary imperatives. Also its capability to see the economy through to the other side. If that crack widens; not good.

- The Bank said in a statement on Wednesday morning that it would make up the shortfall of £52m in gilts with at least 15-year maturities in the second half of what’s been billed as a 6-month repurchase programme, with details now set to be announced on 3rd November.

- ‘Whatever’, says Mr Market, ‘you’re on notice, and so is your easing programme’. Another visible sign of this sentiment is a modest rebound by the pound against the dollar. Given that the rate is still correcting a near-350 pip rout from 4th August high to Tuesday’s lows, it probably would have happened anyway. If our ‘gilt rebel’ thesis is correct though, the pound could recoup further and faster than seemed possible last week.

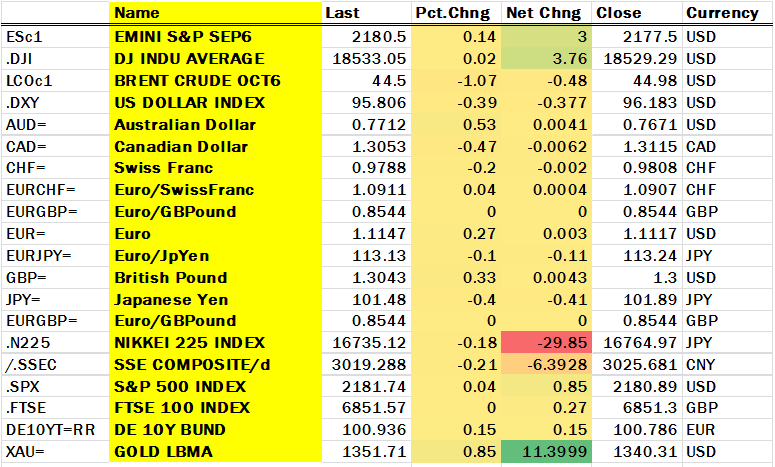

Global markets at online time:

Note: ‘Canadian dollar’, ‘Swiss franc’ and ‘Japanese yen’ are traded as dollar pairs, hence for those currencies, a negative percentage/net change denotes a rise per dollar and a positive change denotes a fall per dollar.

- The ten-year gilt yields and those of other long-dated British paper are plunging to near-record lows this morning and this is having a cross-market impact. The hit begins with a distortion of other sovereign bond markets—e.g. yields on benchmark 10-year Bunds are having trouble trading above minus 0.1% right now. The yield crush is also weighing on stocks a little too, whilst precious metals including gold, palladium and silver have been unleashed.

- That said the Asian stock market on aggregate was not quite ready to give up its run just yet. Stocks inched +0.2% on average to another one-year high overnight in MSCI’s Asia-Pacific index for shares in that region outside Japan. The region saw a modest tailwind after weaker US productivity data on Tuesday afternoon stopped the dollar in its tracks (though let’s face it, the Productivity and Costs index is usually ignored, unless the trading session is quiet…). The gauge came in negative when a quarterly rise of up to 1% was expected.

- Japan once again wasn’t invited to the party, because as predicted, the yen has found its feet, partly for reasons outlined above, though yen bulls may not have things entirely their own way for the next few sessions, according to data released during the Asian session. Japanese machinery orders rose more than expected in June in a sign that companies are gradually becoming more willing to increase capital expenditure.

- They gained 8.3% in June compared to 3.1% forecast. The implied uplift in capital spending should place a floor under forecasts of Japan’s GDP which will be updated next week. Even so, forecasts currently foresee only 0.7% annualised growth in the April-June quarter after 1.9% in Q1. Q2 month-to-month growth would be just 0.2% if the quarterly projection is correct.

- The data watch is still largely focused on the next batch from China, due on Thursday morning: Industrial Production and Retail Sales, though traders will also analyse the EIA oil inventories on Wednesday at 3.30pm BST and the RBNZ decision at 10.00pm.