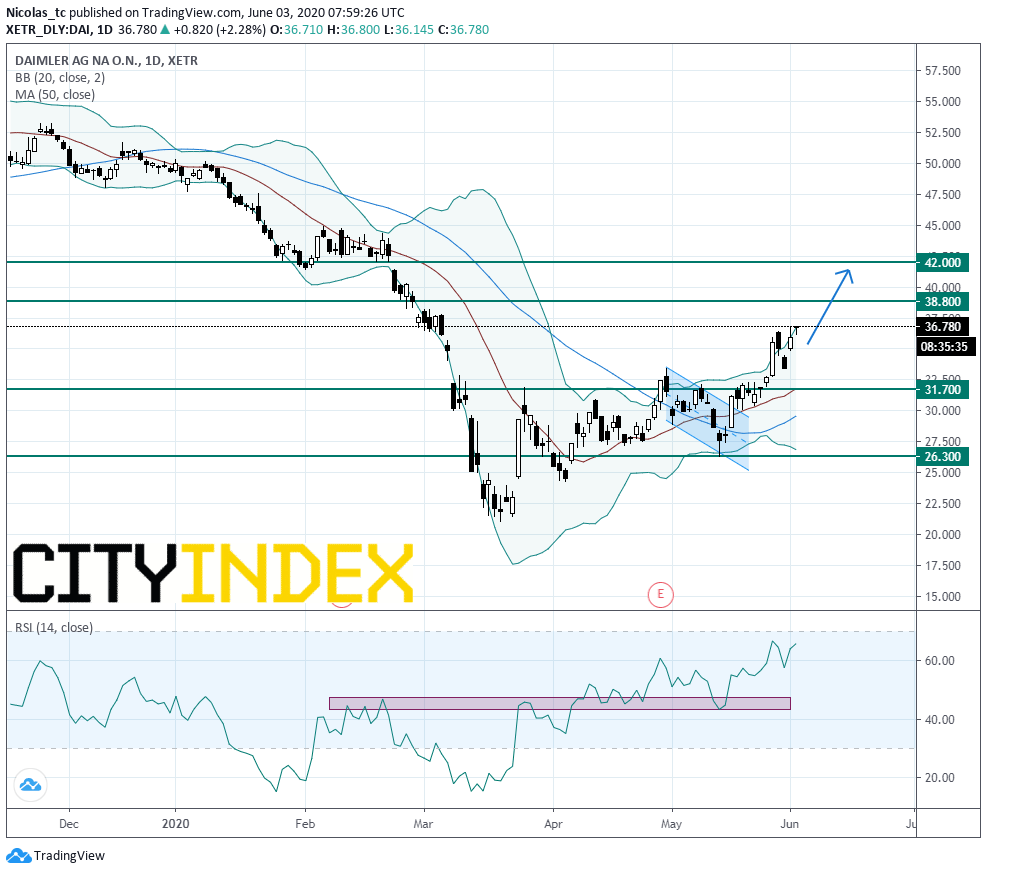

Moody’s downgrades Daimler – the bias remains bullish above 31.7E

Daimler's, the vehicle manufacturer, "A3" credit rating outlook was revised to "Negative" from "Ratings Under Review" at Moody's.

From a technical perspective, 33.45E was the trigger point for acceleration towards 37.6E.

The rating agency stated: "The negative outlook reflects the potentially severe impact that the coronavirus could have on Daimler's operating performance and credit metrics over the next twelve to eighteen months while implementing its restructuring plan and attempting to restore its competitive position in the face of the coronavirus pandemic."

From a technical perspective, 33.45E was the trigger point for acceleration towards 37.6E.

To follow up on our previous article, bulls could consider raising stop losses to 31.7E. The trend remains bullish, as prices rebounded from the new support at 33.45E (polarity principle). Next resistance thresholds are set at 38.8E and 42E. Alternatively, a break below 31.7E would call for a decline towards 26.3E.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM