Momo (MOMO): Further Technical Rebound

Social networking platform operator Momo (MOMO) will report second quarter results on September 3. According to Bloomberg, its adjusted EPS is expected to drop 46.8% on year to $2.98 and revenue is estimated to be down 7.6% to $3.84 billion. Investors will also focus on its monthly active users, which declined 5.6% to 108 million in the first quarter.

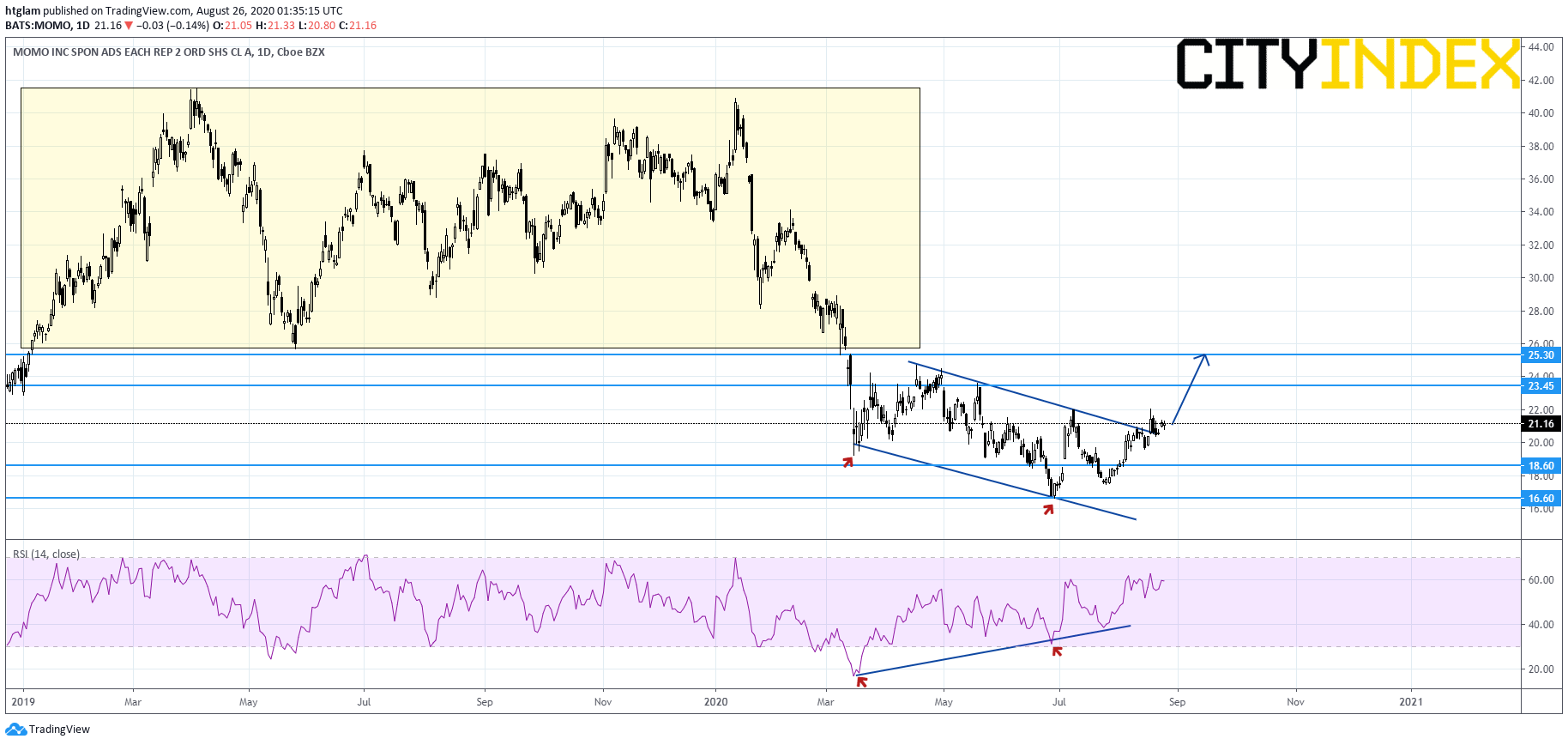

From a technical point of view, in mid-July, we spotted a bullish RSI divergence on Momo’s (MOMO) daily chart, but it was not enough to conclude an upturn.

After price swings, Momo (MOMO) has now broken above a bearish channel, potentially suggesting a stronger technical rebound. The level at $18.60 might be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $23.45 and $25.30. Alternatively, a break below $18.60 may suggest that the rebound has failed and the next support at $16.60 would be challenged again.