The opposition National Party formerly led by ex-Prime Minister John Keys known for his role in financial markets as a Foreign Exchange dealer at banks such as Bankers Trust and Merrill Lynch, is likely to hold on to just 35 seats in the new parliament. Minority parties such as the Greens and former kingmaker Winston Peters New Zealand First party making up the balance.

Despite offering little in the way of new major policies, Arden’s successful pursuit of the elimination of the COVID-19 virus was the catalyst for her re-election, coming despite some of the harshest lockdown restrictions in the world, a point sure to have been noticed by politicians elsewhere.

However, in many ways, Arden’s election win was the easy part of her second term. As outlined in Friday's preview, significant challenges lie ahead for Arden, from how she elects to use her newly won mandate to manage the continued recovery of the economy to how soon she elects to re-open New Zealand's borders to tourists, immigration and students.

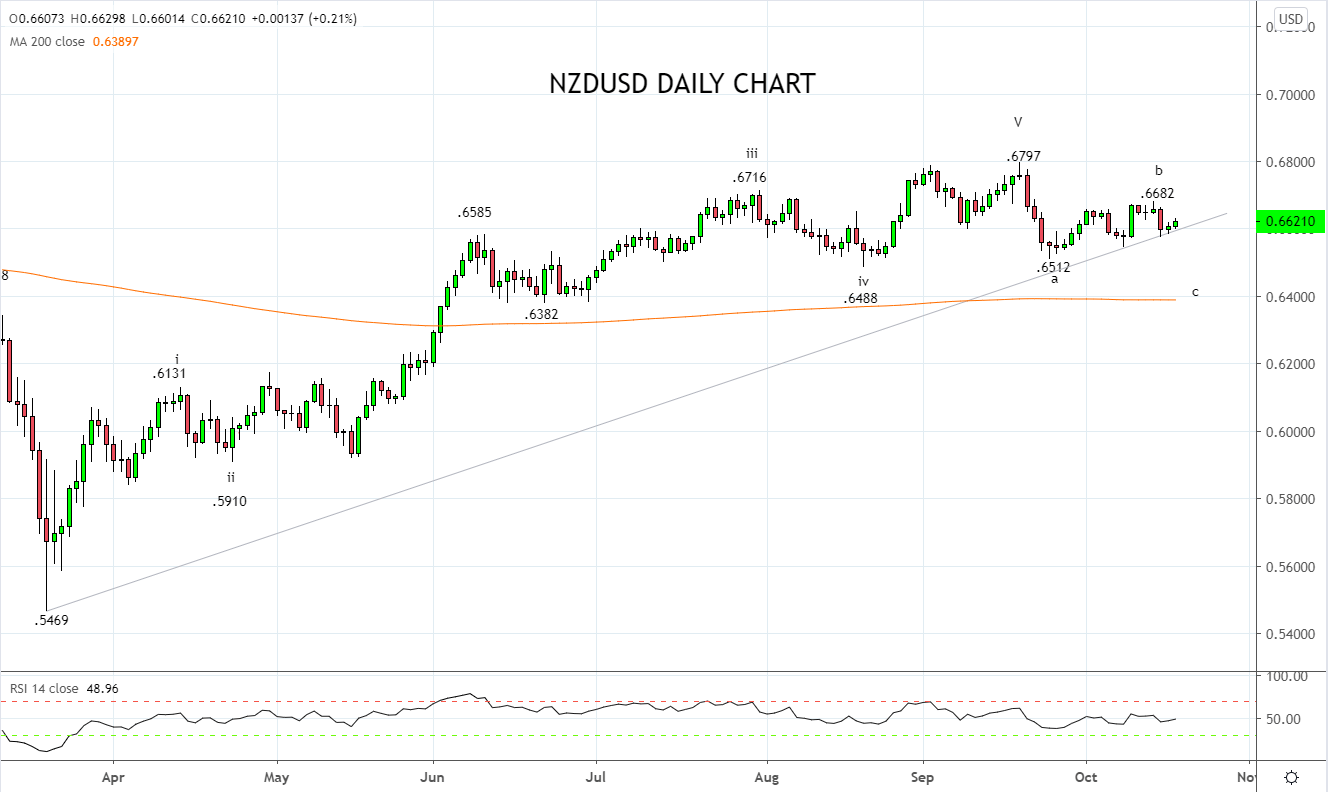

After closing last Friday at 0.6602 the NZDUSD has enjoyed a modest rally this morning, trading up to 0.6629. While further short-term gains are possible, in the medium term the domestic challenges outlined above along with global risk sentiment and the U.S. dollar trend will be the drivers of the currency.

For this reason, it is advisable to continue to monitor key support coming from the uptrend from the March .5469 low, currently at .6590 and last week’s .6576 low. Should the NZDUSD break and close below here (.6590/70) it would warn that a deeper correction has commenced, with the potential to retest the September .6512 low, before the 200 day moving average near .6400c.

Source Tradingview. The figures stated areas of the 19th of October 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation