Miners benefit as copper rallies

Copper is often referred to as the bellwether for the global economy. It’s ability to signal an economic recovery has earned it the name Dr. Copper.

Copper prices broke briefly through $10,000 a decade high, for the second time this week as optimism surrounding the global economic recovery post covid has sent demand expectations through the roof.

Reopening rally

Demand is primarily from the US and China, the world’s two largest economies. China is firmly on the path to the strong growth it was experiencing pre-covid, requiring huge amounts of copper for infrastructure and also wiring homes.

In the US growth is picking up firmly after the pandemic. Optimism surrounding President Biden’s infrastructure programme has boosted metal markets, with copper a clear beneficiary. This near-term upside from stimulus is already working through the market.

Green revolution

However, there is another dimension, here. The longer-term driver of copper - the green aspect. Many green, clean energy alternatives involve the use of copper. Solar panels are just one example. Electric vehicles are another. As the green revolution and electrification of automobiles gather pace copper consumption is rising quickly.

As Biden looks to re-establish the US at the forefront of all things green demand for copper is expected to keep on rising potentially accelerating.

Where next for copper?

The copper price topped a decade high of $10,000 for the second this week, nearing the all time high of $10,190 in February 2011. The price of copper has more than doubled from covid lows and momentum remains on its side.

Copper futures today struggled at resistance of $4.5725 per pound for a second time this week before easing lower. Even so the uptrend remains intact whilst the price holds above $4.49 per pound.

Learn more about trading copper prices

Copper miners

In addition to the commodity itself copper miners are also worth keeping an eye on. Antofagasta, Anglo American and Glencore have all surged around 25% so far this year compared to the FTSE’s 9% rise and have rallied around 120% over the past 12 months.

Where next for Anglo American share price?

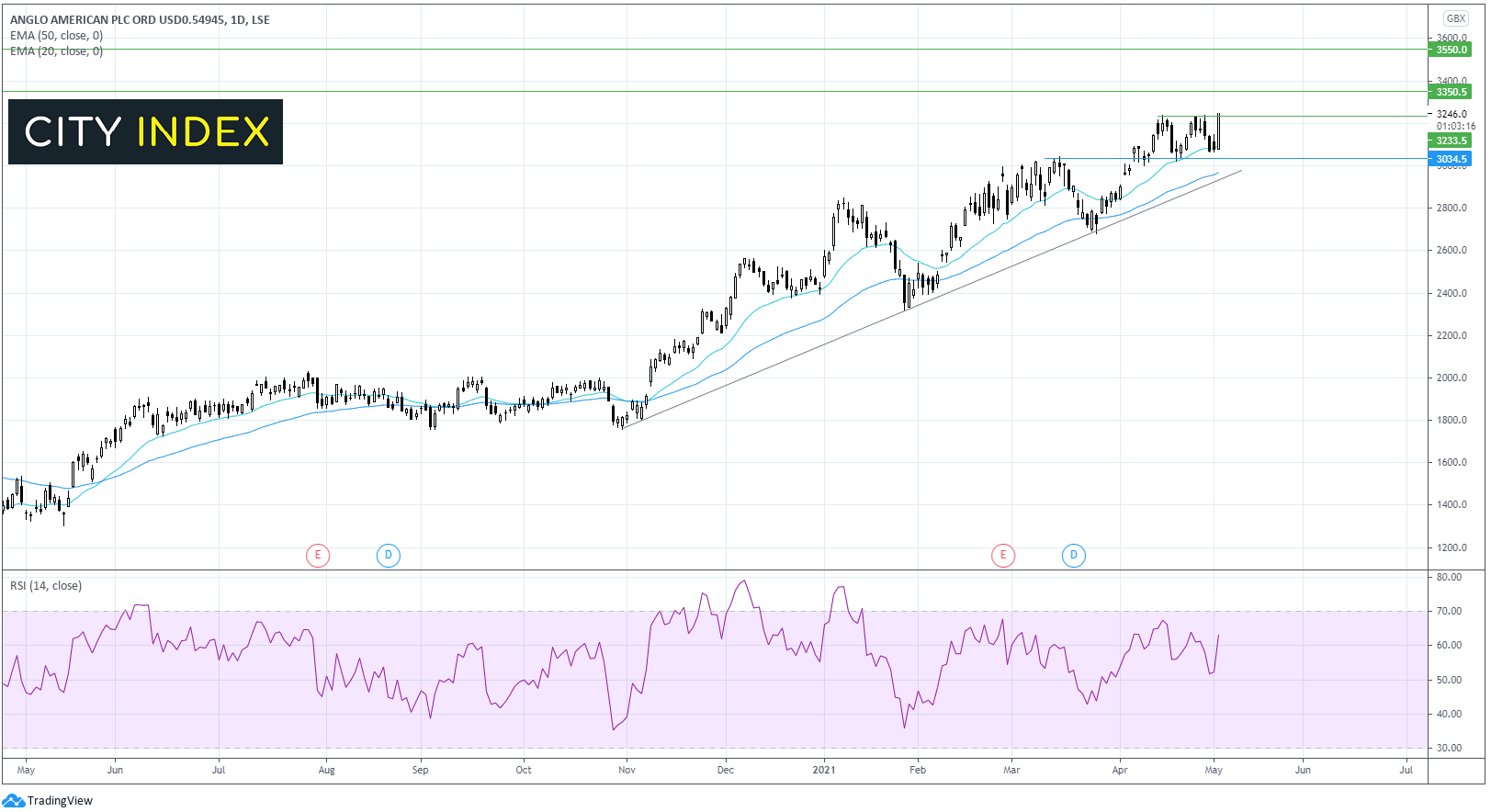

The Anglo American share price trades above its multi month ascending trendline and its 20 & 50 EMA on the daily chart in a bullish trend. The RSI is supportive of further upsides.

However, the recent rally has run into resistance at 3245p its highest level in a decade. A move above this resistance is required to head towards 3350 the 2011 high and on towards 3550 the 2008 and all-time high.

Failure to take 3245p could see Anglo American continue to consolidate between 3030 and 3245p. It would take a move below 3030p to negate the current near term bullish trend.