After the closing bell on Tuesday 26th January

What to expect?

EPS of $1.64 representing a 8.6% year on year growth. Revenue is expected to come in at $40.23 billion up from $36.91 billion reported in the same quarter last year.

Microsoft has benefitted from strong demand in its cloud, personal computer and gaming business amid the covid restrictions and lockdown. Expectations on Wall Street are running high that Microsoft could beat Q2 forecasts.

Microsoft X-box series X

Q2 results come hot on the heels of 2 new Xbox gaming console releases which are expected to see strong demand.

Azure

However, more importantly, Azure is benefitting from being one of the leaders in cloud services. Azure, the cloud platform, remains the most important driver of overall earnings & revenue growth, which is expected to remain strong, supported by remote working & WFH dynamics.

Given the importance of the cloud business, any sign of weakness could exert strong downward pressure on the stock. Whilst momentum has tapered off slightly, a more permanent shift to WFH could well buoy demand over the coming year.

Investors will be keen to see whether growth in Azure has been strong enough to offset slower growth in Microsoft’s other key areas and on-premise server business? The broad expectation is that it has.

Of the 33 analysts that follow Microsoft 31 have buy ratings and 2 have hold ratings. The average target price is $248.19 according to FactSet data.

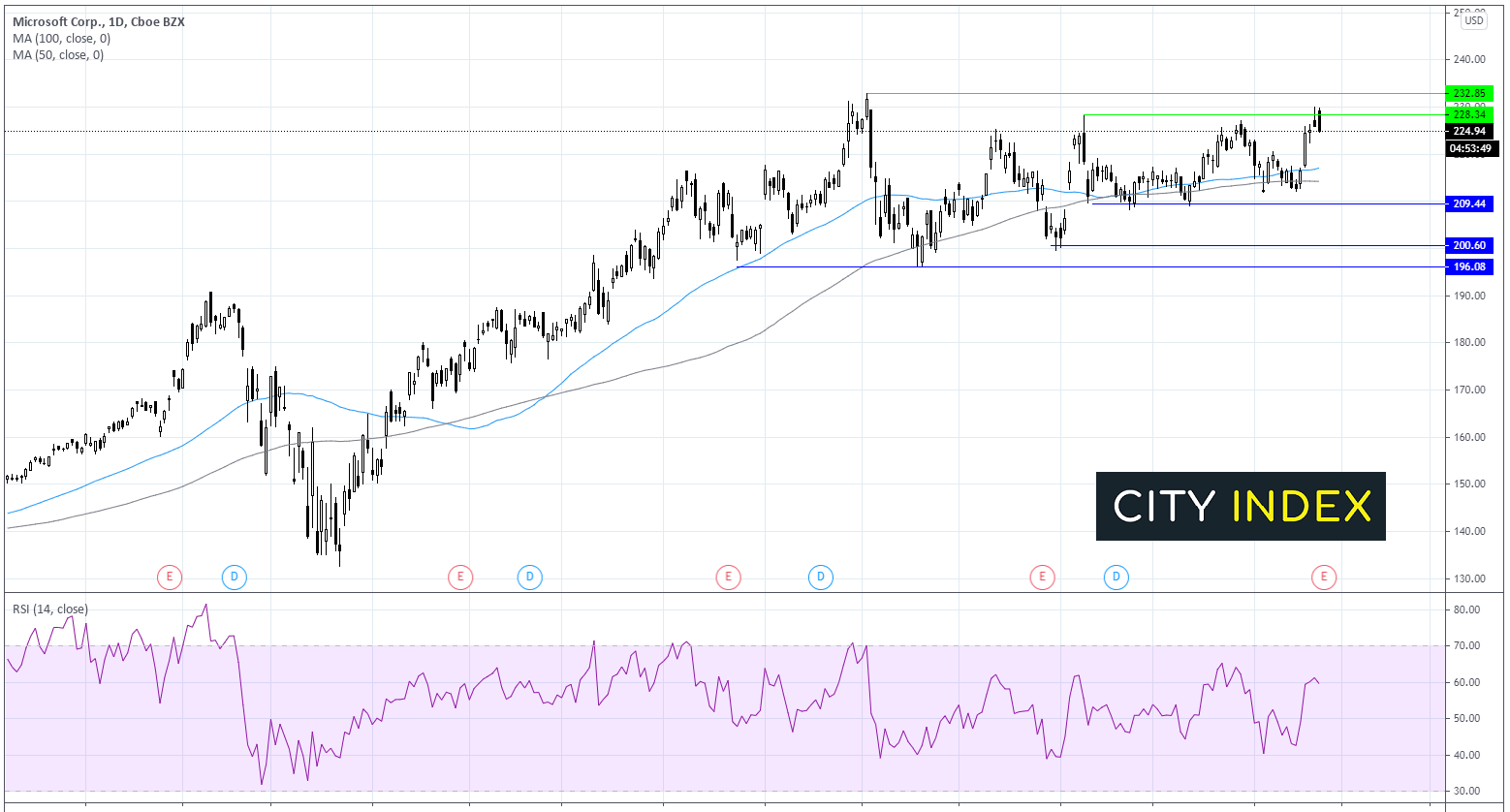

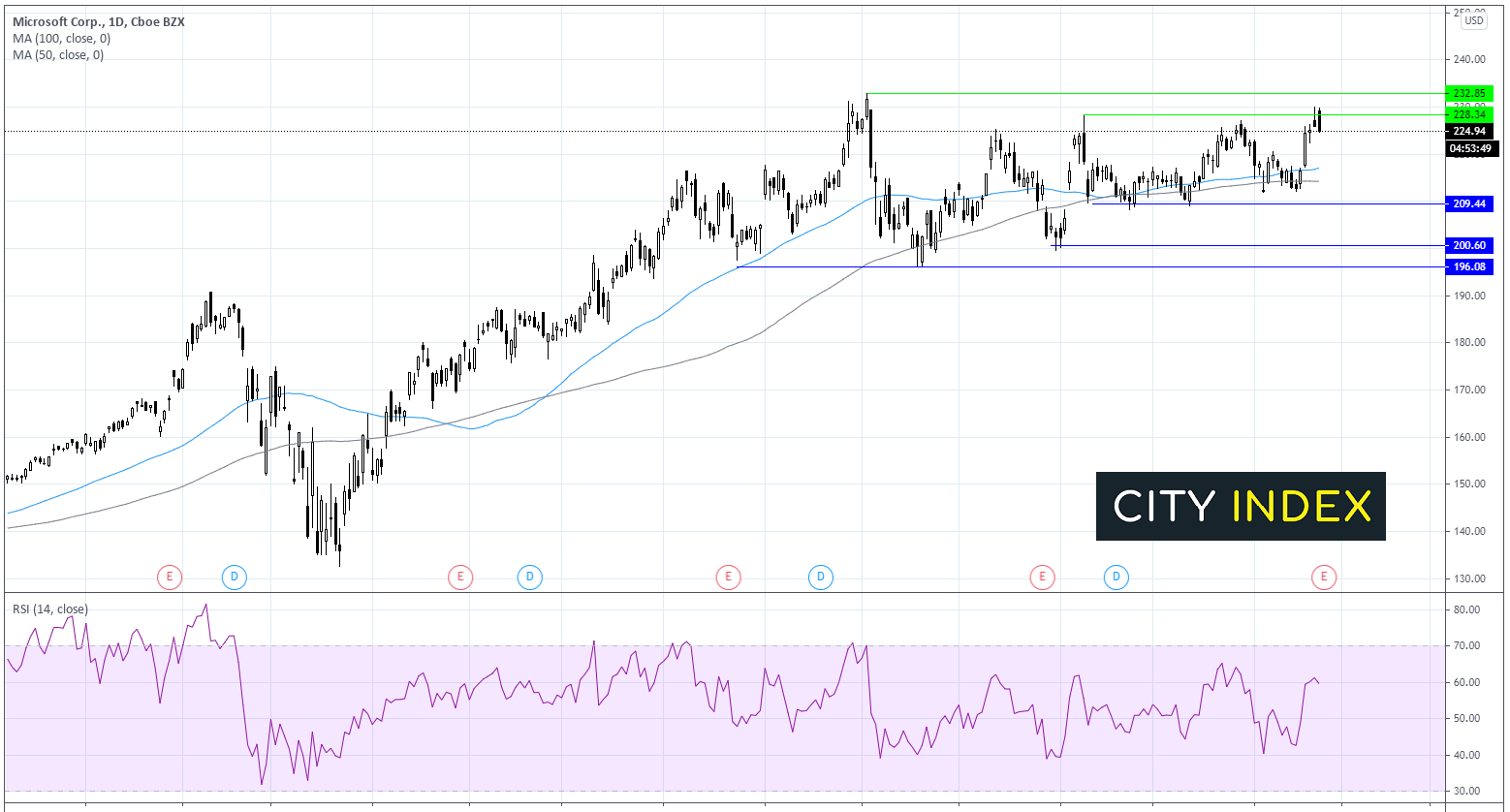

Microsoft share price technical analysis

After surging 42% in 2020, Microsoft trades +2.4% so far this year.

After a steep recovery from its mid-March low momentum has noticeably run out of steam over recent months. The share price has traded within a tight range and horizontal channel since early early November, capped by 210 on the lower band and 228 on the upper band.

The 50 & 100 sma were flat and the price hovered over them suggesting a neutral position.

Just over the last few sessions Microsoft share price has jumped higher pushing over the 50& 100 sma and it is attempting to break out of the upper band.

The RSI is supportive of more upside to come.

Strong Q2 earning could see the price break out above 228 upper band and push beyond 232 to a fresh all-time high.

Any weakness could see the bears push the share price below the lower band at $210 back towards $200 psychological level and $196. A move below this level could see the start of a bearish trend.

Learn more about trading equities