Wall Street is bracing itself for another strong quarter from the tech giant.

When:

Wednesday 29th January after market close

Expectations:

- Revenue $35.69 billion +9.9%

- EPS $1.32 +20%

Microsoft shares had an impressive 2019, rallying 56% across the year and outpacing the broader US market (S&P gained 22%). Microsoft is now one of the three US companies to be a member of the exclusive $1 trillion dollar club, alongside Apple and Alphabet.

Azure

Microsoft has benefited greatly from its cloud business Azure. In the most recent quarter, Microsoft reported a strong 59% yoy increase in revenue. Traders will be watching closely to Azure’s performance in Q2 of 2020 to see whether this growth can be maintained? Expectations are for a deceleration of growth in the segment in line with the broader trend:

Microsoft has benefited greatly from its cloud business Azure. In the most recent quarter, Microsoft reported a strong 59% yoy increase in revenue. Traders will be watching closely to Azure’s performance in Q2 of 2020 to see whether this growth can be maintained? Expectations are for a deceleration of growth in the segment in line with the broader trend:

Azure Revenue increase:

Q3 2019 75%

Q4 2019 68%

Q1 2020 59%

Q2 2020 53% exp.

Q3 2019 75%

Q4 2019 68%

Q1 2020 59%

Q2 2020 53% exp.

53% growth is still exceptional as Microsoft’s hybrid cloud is well positioned against peers Amazon and Apple. Recent surveys by Morgan Stanley and Credit Suisse showing that Azure was the preferred cloud enterprise option boding well for the outlook.

Analysts’ recommendations

According to FactSet data among 35 analysts covering Microsoft stock, 33 have a buy rating, 2 have hold and 0 have sell.

According to FactSet data among 35 analysts covering Microsoft stock, 33 have a buy rating, 2 have hold and 0 have sell.

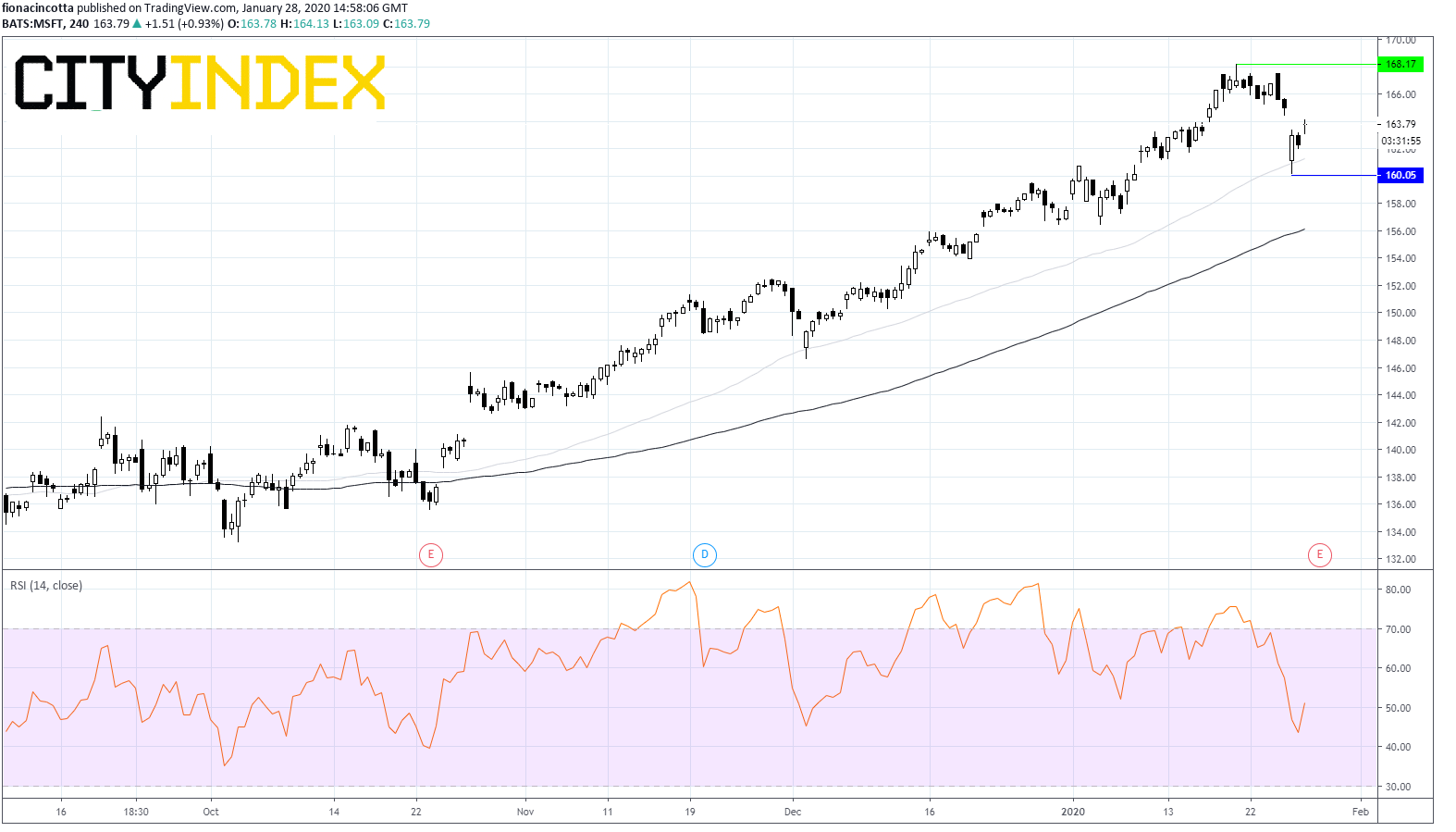

Chart thoughts

Microsoft trades above its 50, 100 & 200 sma in a bullish chart. Whilst it tested the 50 sma earlier this week, a rebound in the price means it is currently around 2% above the 50 sma.

Immediate support can be seen at yesterday’s low $160. Whilst resistance can be seen at the all-time high of $168.19.