Stock market snapshot as of [26/6/2019 5:30 PM]

- Nasdaq indices can thank semiconductor bellwether Micron for an assured swing higher that negates much of Tuesday’s jittery decline. The bounce also puts an improved gloss on broader sentiment heading into the G20 summit

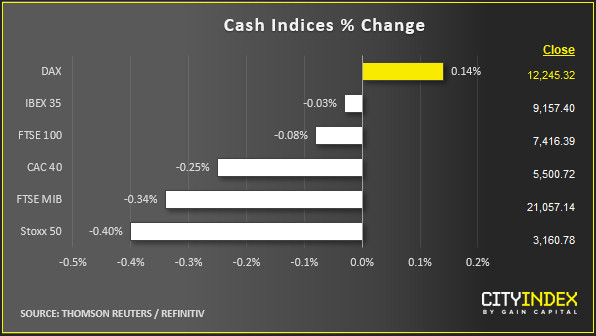

- European markets continued to fare less well. New uncertainties on potential Fed rate cuts combine with wide-open questions about talks between Presidents Trump and Xi at the meeting this weekend

- Washington’s signal that it is likely to hold off from imposing further tariffs on Chinese goods essentially confirms what markets had already tentatively priced in. The news doesn’t remove longer-term uncertainties with possible tariffs hanging over Europe’s automobile sector

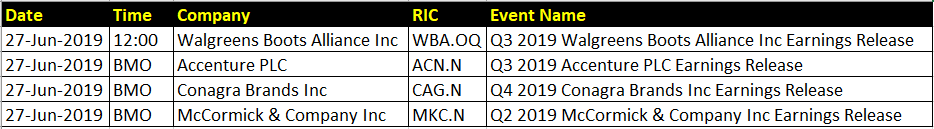

Corporate News

- Resumed oil supply concerns push all 13 components of the S&P 500 Oil & Gas Exploration and Production index into the black. Conoco Phillips and Hess gain most with 5% jumps

- Micron leads large caps though. A 12%-14% surge defies the $41bn group’s unequivocal exposure to the U.S.-China trade dispute. Yet results were widely judged as “better-than-feared” and guidance barely addresses forthcoming bans of firms on the Commerce Department’s Entity list, including key customer Huawei, nor the risk of more U.S. tariffs

- General Mills stands out on the losing side of the market, sliding 5%. The Old El Paso brand owner’s worse-than-expected North America results bring a cooler take on the Consumer Staples outlook, leaving the sector as the session’s worst performer with a 1% fall

Upcoming corporate highlights

BMO: before market open

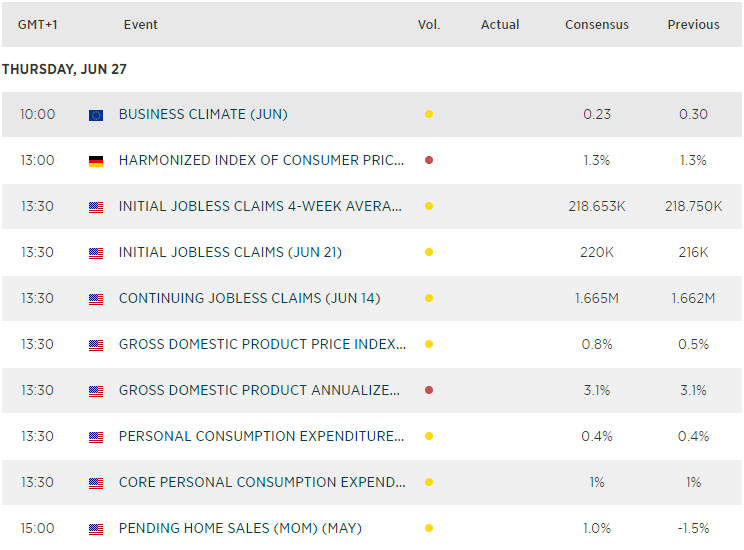

Upcoming economic highlights

Latest market news

Yesterday 08:33 AM