Metals and Oil Dragging Commodity Currencies Higher

Gold, Silver, and Oil all moved higher today and as a result brought many of the commodity currencies with them.

The Australian Dollar and the New Zealand Dollar are putting in highs vs the US Dollar not seen since late July as both Gold and Silver are breaking above key levels trendlines and catapulting higher. Take a look at the price action below to see how the commodities and currencies are moving together.

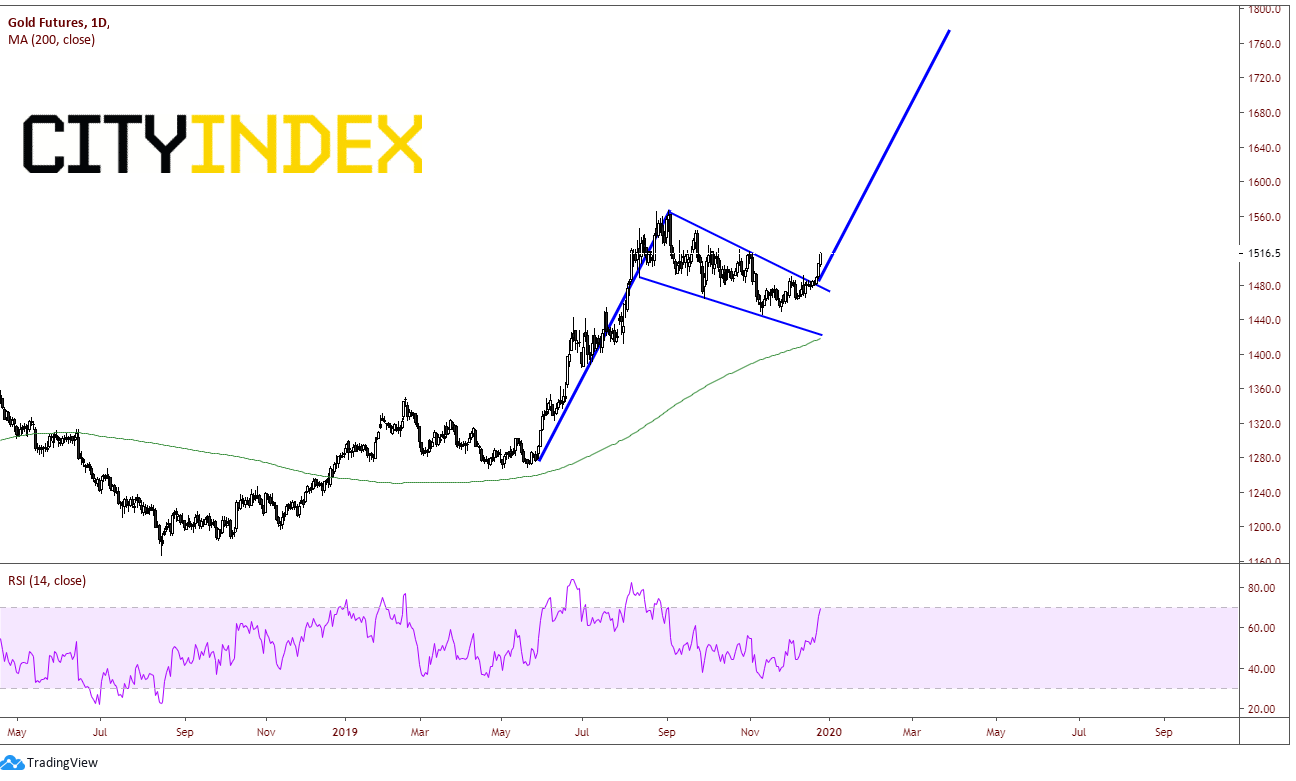

Gold:

Source: Tradingview, COMEX, City Index

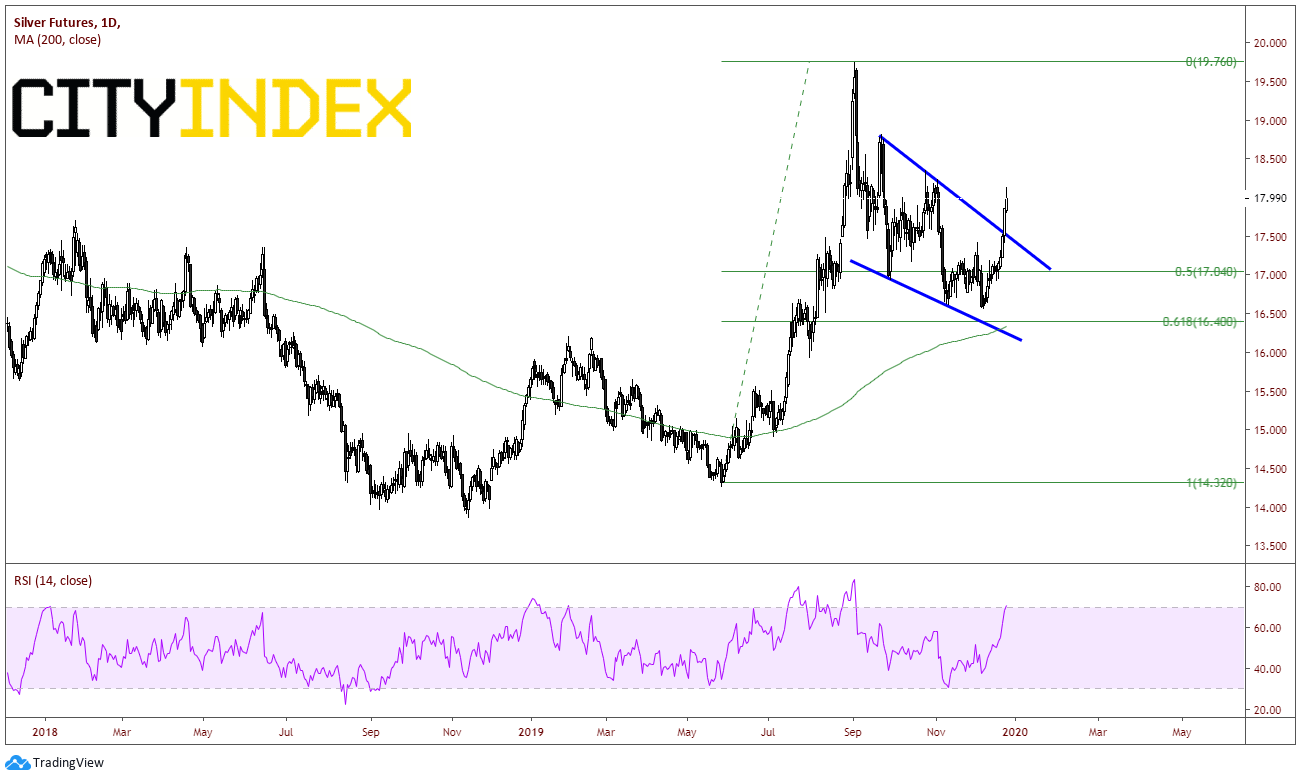

Silver:

Source: Tradingview, COMEX, City Index

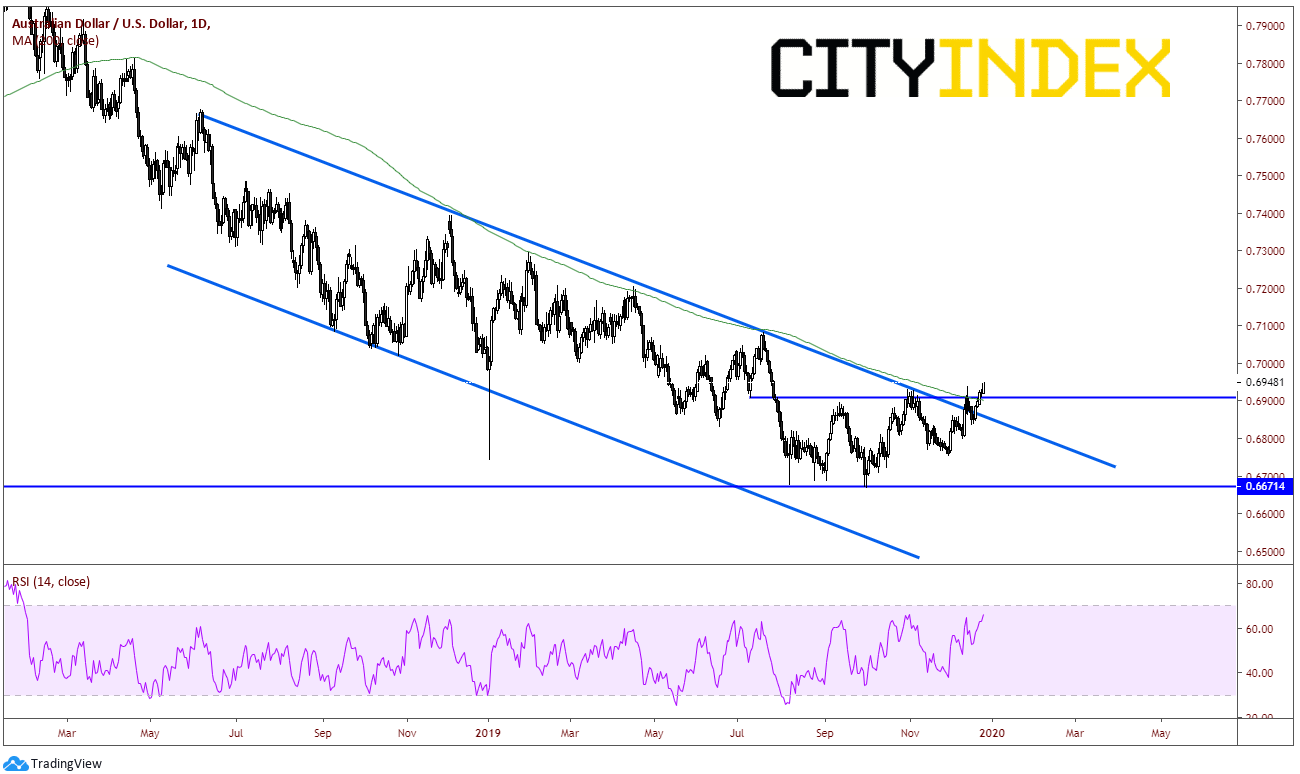

AUD/USD:

Source: Tradingview, City Index

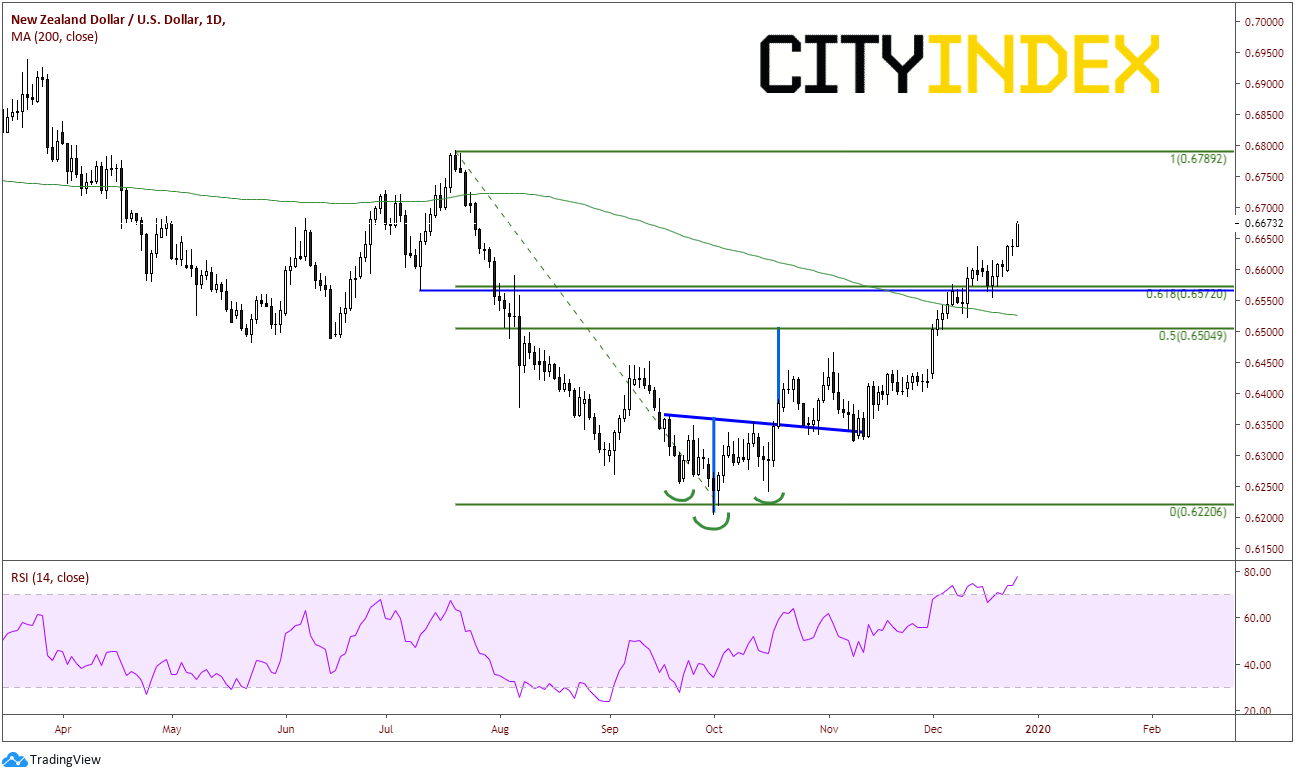

NZD/USD:

Source: Tradingview, City Index

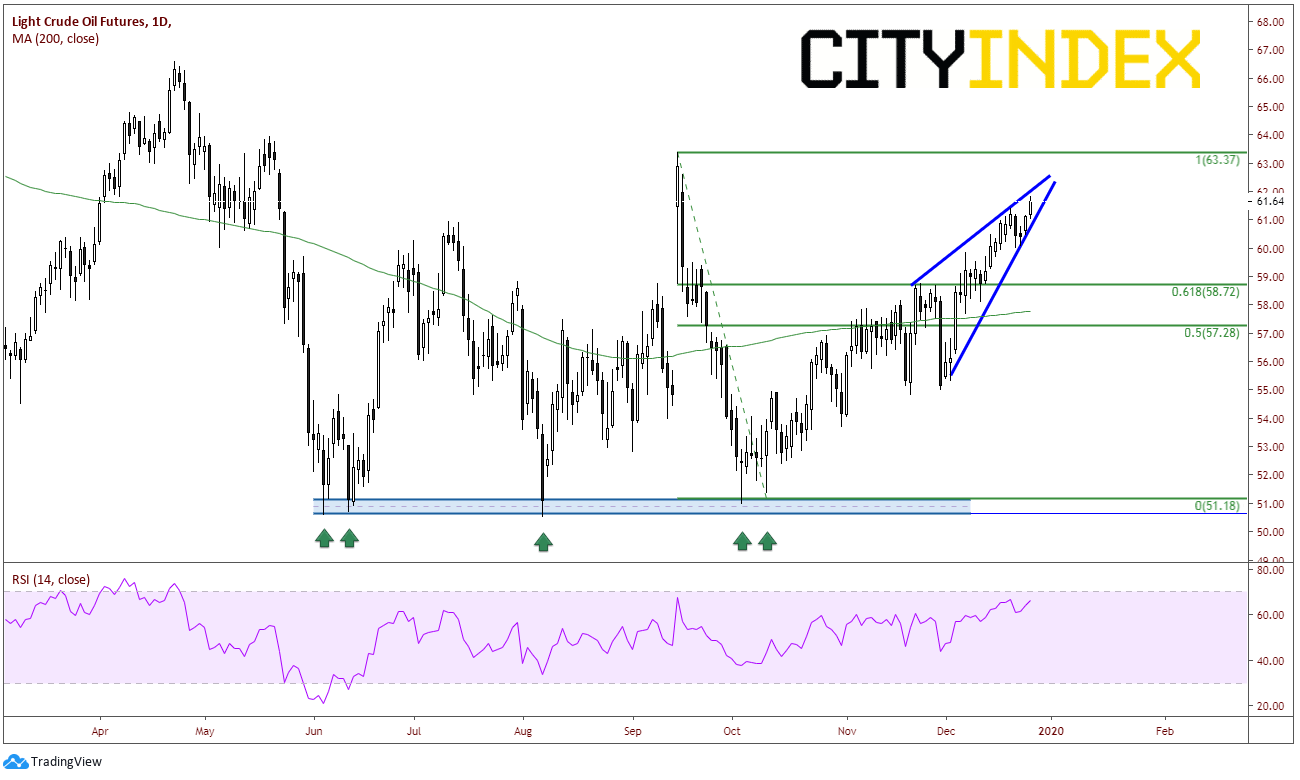

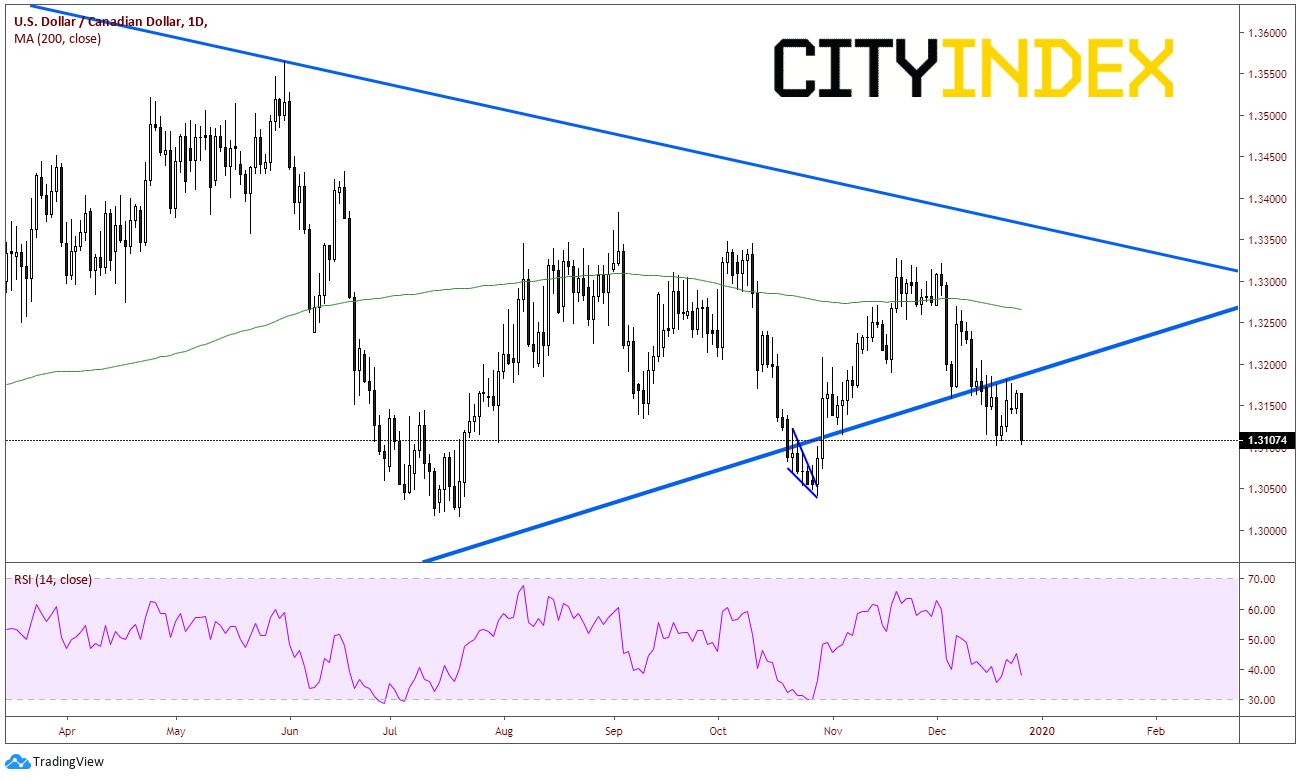

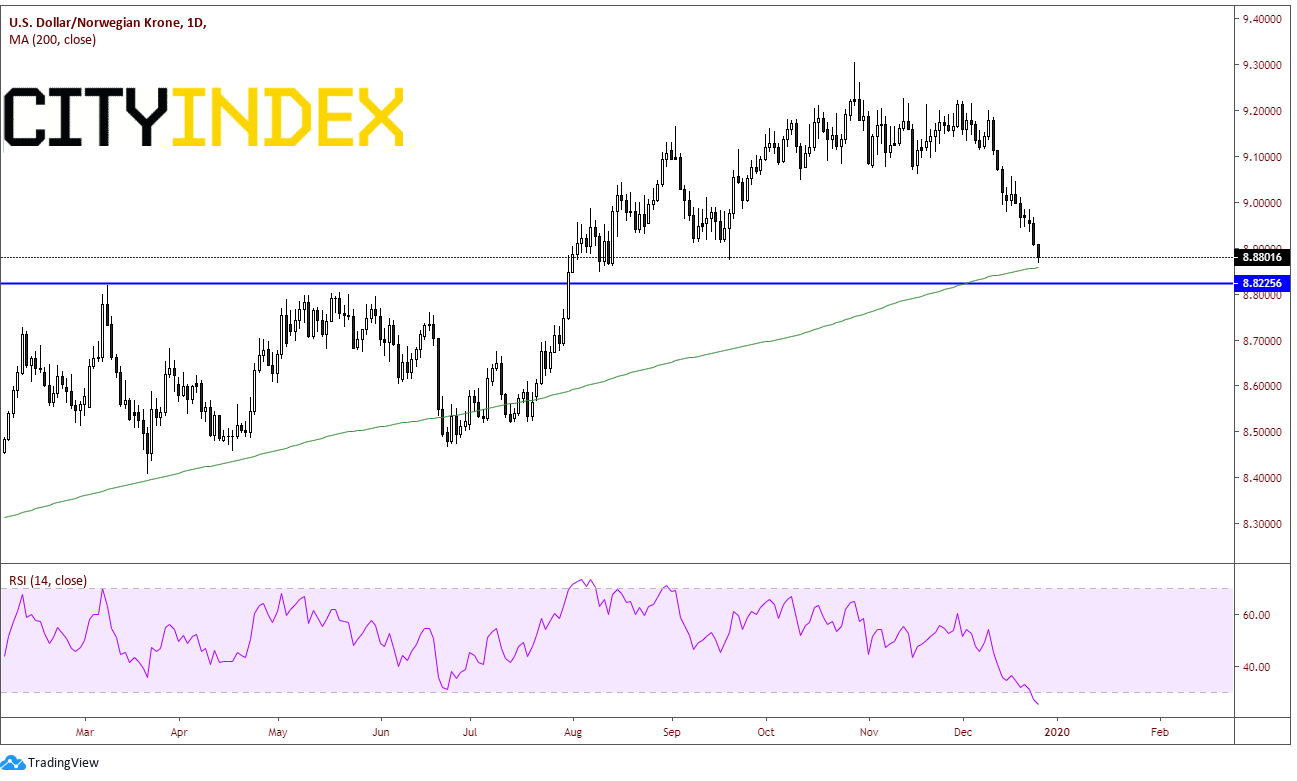

Similarly, with West Texas Intermediate Crude Intermediate Futures moving higher, it is also carrying the Canadian Dollar and the Norwegian Krone higher (USD/CAD and USD/NOK lower). Both Canada and Norway are oil export led economies. As a result, the movement of crude oil effects the currencies of both those countries.

Crude Oil:

Source: Tradingview, NYMEX, City Index

USD/CAD:

Source: Tradingview, City Index

USD/NOK:

Source: Tradingview, City Index

As they say, a picture is worth a thousand words. When looking to trade commodity currencies, always make sure to check the underlying commodity to see if it could be ready for a big move. If so (and all else equal), associated currencies may move with it!