Merck trades lower after 1Q results – The trend remains bullish

Merck KGaA, the chemicals and pharmaceuticals group, posted 1Q net income surged to 458 million euros from 190 million euros in the prior-year period and adjusted EBITDA rose 27.2% on year to 1.18 billion euros on revenue of 4.37 billion euros, up 16.7%. Regarding full-year outlook, the company said: "Group EBITDA pre is expected to be in a range of between E4.35 billion and E4.85 billion. Owing to strong restrictions of economic life and declining income in the context of the Covid-19 pandemic with correspondingly adverse effects on the businesses, Merck forecasts a merely stable organic development."

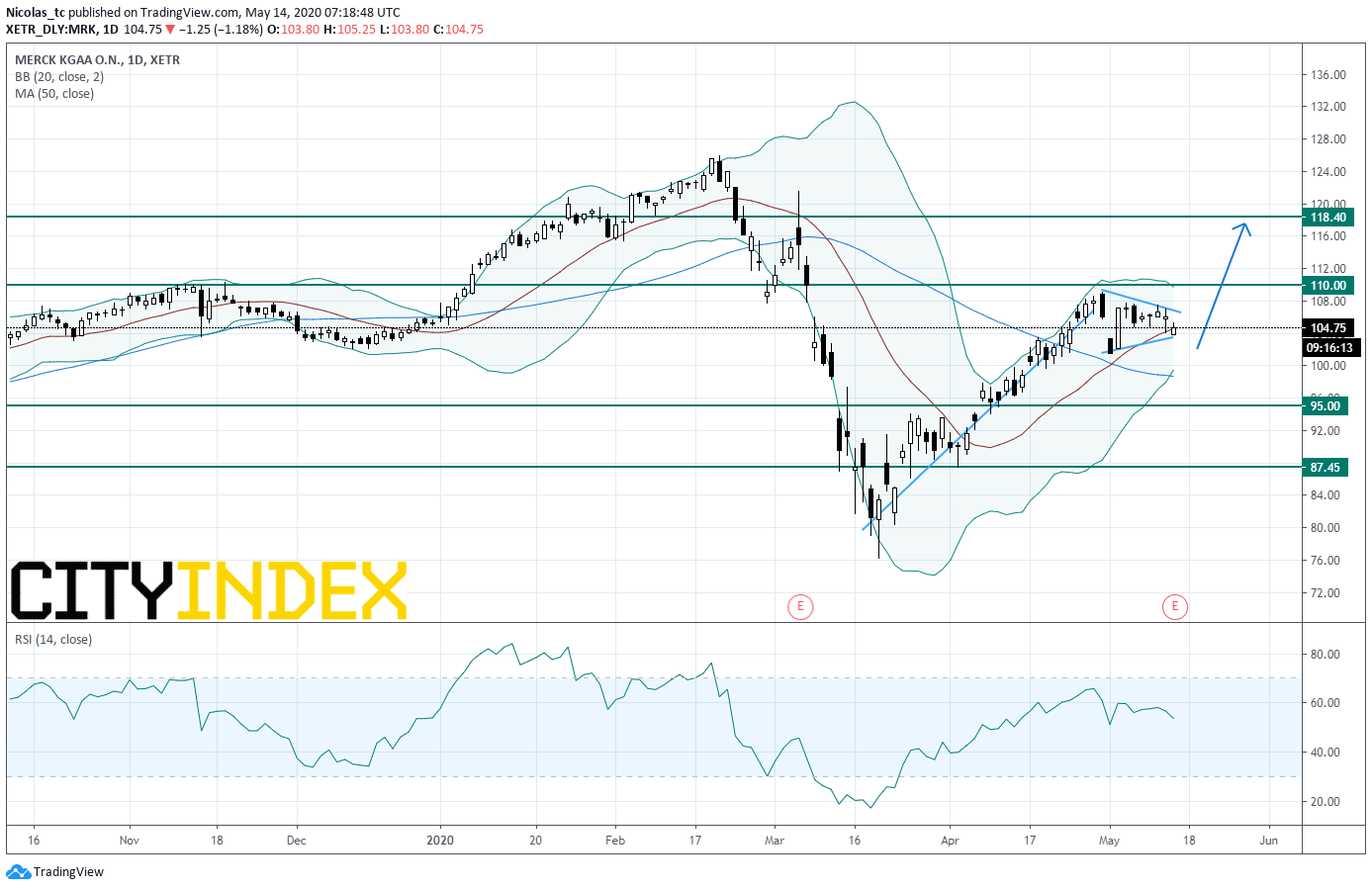

From a technical perspective, the bearish gap opened this morning calls for a short term consolidation move. However, the trend remains bullish. A pennant pattern is taking shape. (Continuation trend pattern). The daily Relative Strength Index (RSI, 14) is above 50% and is not overbought (<70%).

As long as 95E is support, the bias is bullish. The validation of the pennant pattern would call for a new rise towards 110E and 118.4E.

Alternatively, a break below 95E would negate the bullish view and would call for a reversal down trend with 87.45E as first target.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM

Yesterday 11:30 AM