Meituan (3690), the top food delivery platform in China, reported that 3Q adjusted net profit rose 5.8% on year to 2.05 billion yuan on revenue of 35.4 billion yuan, up 28.8%. The company said: "As China’s economic recovery accelerated during the third quarter of 2020 as a result of effective COVID-19 containment, our businesses continued to recover steadily and achieved positive growth across all segments." After reporting the 3Q result, the stock opened slightly higher.

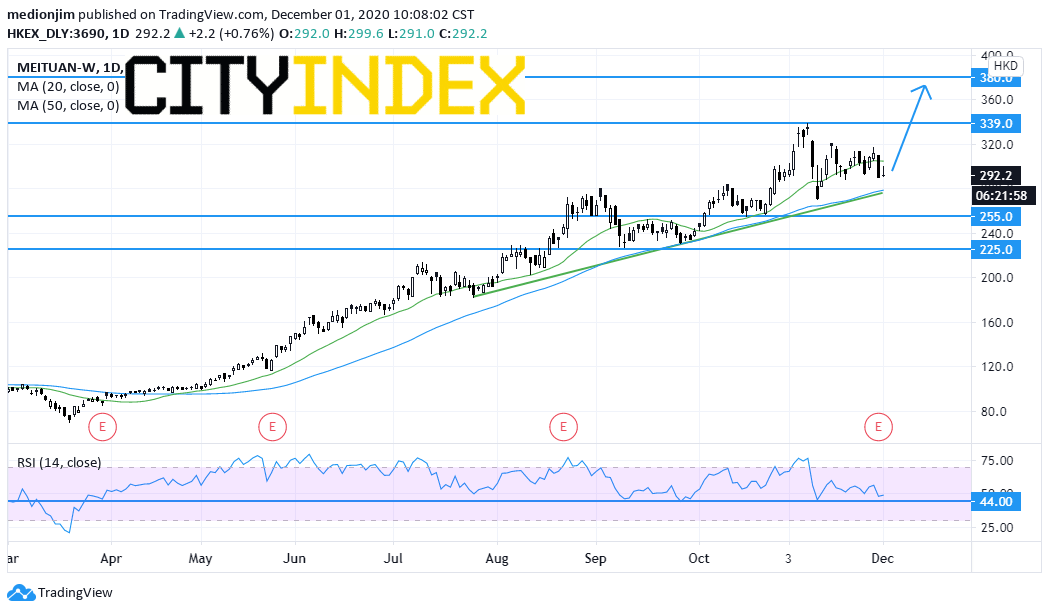

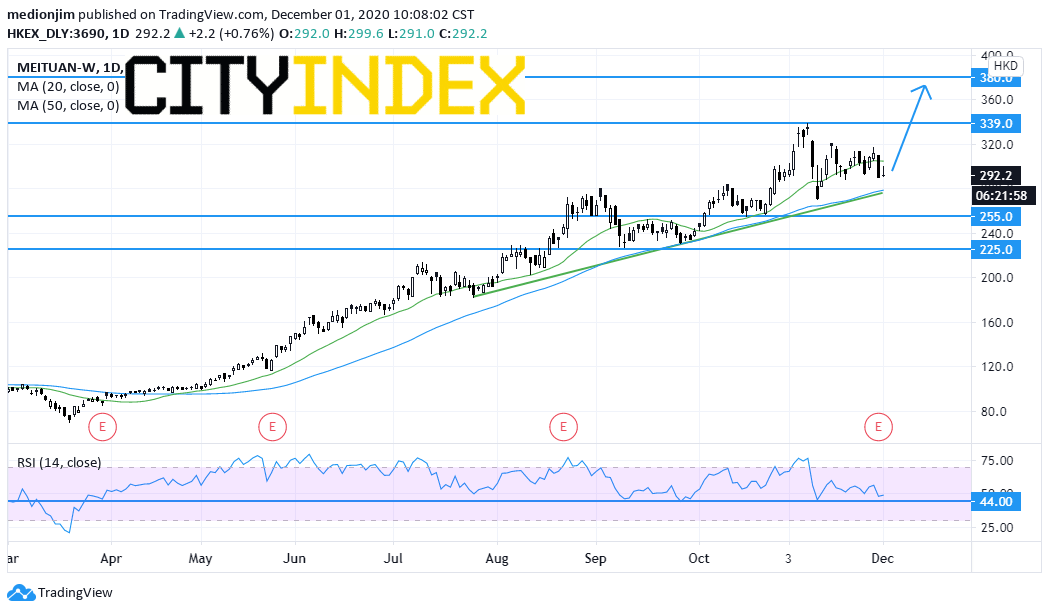

On a daily chart, the stock remains supported by a bullish trend line and rising 50-day moving average. The relative strength index also stays above the key level at 44.00. Unless the support level at HK$255 is violated, the stock could consider a rise to the resistance levels at HK$339 and HK$380.

Source: GAIN Capital, TradingView

On a daily chart, the stock remains supported by a bullish trend line and rising 50-day moving average. The relative strength index also stays above the key level at 44.00. Unless the support level at HK$255 is violated, the stock could consider a rise to the resistance levels at HK$339 and HK$380.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM