When: Wednesday 26th May

Back in November Mark & Spencer reported its first loss in its 94 year history owing to the pandemic lockdowns, which forced its stores to close hitting retail operations. Marks & Spencer reported a £71.6 million loss after a 15.8% decline in sales in the first six months of the year. However, the food business helped to offset some of the weakness in the general merchandise arm thanks to the Ocado deal which saw a 47.9% rise in sales.

In Q3 things weren’t much better as with clothing and home sales down 24.1%, although this was actually an improvement on the 30% decline that had been penciled in. This was mainly thanks to an increase in online sales helping Q3 revenue hitting £2.77 billion.

A more modern online retailer....

With stores close for most of Q4 the numbers are likely to be affected. Although the numbers could also reflect progress towards turning the group into a more modern online retailer. The website has started to introduce other brands into its online fashion range

Furthermore, food sales could once again help offset any weakness in general merchandise after the Ocado deal put Marks and Spencer in a much better position as an online grocery champion.

Rumours of any turnaround or revival of Marks and Spencer have proved false in the past so market participants are understandably cautious.

Where next for Marks and Spencer share price?

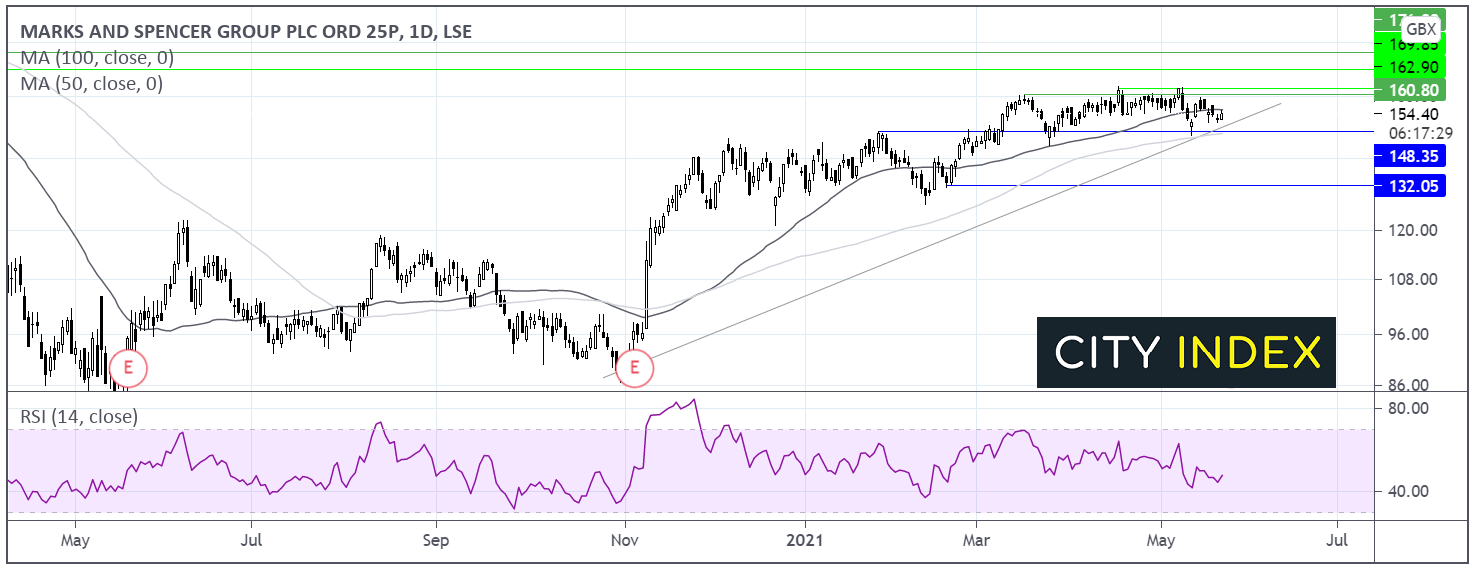

Marks and Spencer share price has picked up firmly since November. It trades above its ascending trendline dating back to then. Momentum has slowed considerably since mid-March and the price has formed a holding pattern, capped on the upside by 163p and on the lower side by around 150p.

The price currently trades below the 50 sma and above the 100 sma showing a neutral bias. The RSI is confirming the neutral bias at 50 as investors await the next catalyst.

A post earnings break out trade could be worth watching for. Disappointing number and outlook from Marks and Spence could see the share price fall below its ascending trendline support and the lower band the horizontal channel, which os also the 100 sma at 150p to prompt a deeper selloff.

Upbeat numbers could see Marks & Spencer break out above 163p the upper band of the channel and head towards 170p high March 3rd.

Learn more about trading equities

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.