Updated 0947 BST

Marks & Spencer’s first annual pre-tax profit in years and Burberry’s robust but cautious full-year performance amid uncertainty in some of its key regions, underscored the strengths and challenges facing upmarket UK retailers.

M&S said on Wednesday it saw annual profit rise for the first time in four years, which enabled it to offer shareholders a bonus pay-out on top of dividends.

The grocery-to-clothing-to-home wares high street retailer has emerged from the UK supermarket pack with a slim but clear lead of late, with a consistent (albeit marginal) like-for-like growth in food sales, and a recent victory in its years-long battle to turn around its clothing business.

Its complete results for year to the end of March lend credence to the hope that it might well have consolidated this slight lead over its rivals further.

- Pre-tax profit (pre-exceptional items) +6.1% to £661.2m (consensus: £648m)

- Dividend raised 5.9% to 18p per share

- On-going programme of “enhanced” cash returns; £150m for 2015/16

M&S has been sure to point out that the food gross margin for the year has expanded by 30 basis points.

It might not sound like much, but it would be the envy of struggling grocery retailers like Tesco and Sainsbury’s and Marks is fully aware of that.

As are M&S’s investors.

I fully expect its shares to add a further chunk on to the already admirable advance by a third the shares have posted over the last nine months.

Likewise, one would ordinarily expect the fillip to M&S stock sentiment to underpin City index’s Daily Funded Trade in this title on Wednesday.

Although for now, trading in M&S appears to have caught some of the chill from trading in Burberry shares—which opened sharply lower, pulling Marks’ stock slightly down too, early on.

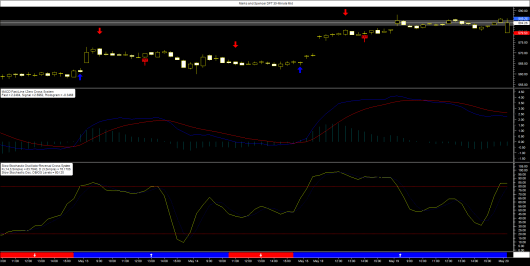

Upside sentiment in half-hourly trading had reached its peak in the latter half of the previous session anyway, and the M&S DFT was due already due for a pause.

After the drag from Burberry’s cautious full-year comments washes out—and sentiment in retail names becomes more accurately targeted—M&S’s DFT can be expected to reach for a high from yesterday afternoon, above 588.

It’s not happening yet though, and we do not have to look very far for why.

Burberry needs a raincoat amid headwinds overseas

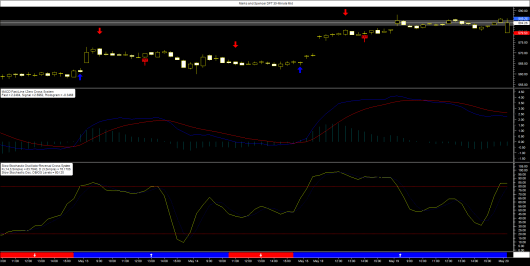

Burberry shares opened the day reflecting its investors’ deep disappointment with the firm’s full-year results.

The British maker of clothing, fragrances, accessories and cosmetics, best known for its raincoats, has slashed expectations for 2016 retail and wholesale profit.

It’s essentially the culmination several months of warnings, some measured, some quite emphatic about both the business environment and the foreign exchange impact of the firm’s sizeable presence overseas, namely in the Asia Pacific region.

It said underlying pre-tax profit rose 7% to £456m, beating analyst forecasts.

But Burberry immediately moved to damp investor hope of a turnaround by noting “increased uncertainty in some markets”.

It’s a key reason why the company downgraded its 2016 retail and wholesale profit forecast by around £40m.

Furthermore, any currency-related benefits and gains from tightened cost control would be “offset by (the) geographic and channel” mix, Burberry said on Wednesday, perhaps the most neutral language it could have chosen to describe the unfavourable pressures it’s facing in Asian markets.

There’s nothing in the statement accompanying the firm’s preliminary results this morning that should improve the outlook for a “deceleration” in Asia highlighted by the firm last month.

Burberry is also seeing a moderate downside impact from its apparent on-going drive to continue tidying-up certain revenue structures.

Having already warned of a 40% hit on licensing revenues in April from ending a long-standing license in Japan so it can be brought in house, Burberry said on Wednesday it booked a charge of £14.9m in reported operating expenses relating to sliding value of a fragrance and beauty license “intangible asset” (perhaps a contractual agreement).

The overall picture shows Burberry has accurately encapsulated the ‘uncertain’ atmosphere overhanging at least the first half of its financial year.

With its stock still little more than 10% off an all-time peak reached in February, the stage looks set for a significant correction, with Wednesday morning’s 5% loss possibly extending a further two percentage points before the session is done.