Markets Still Excited from Election, FOMC Up Next: USD/JPY, AUD/JPY, EUR/JPY

Stocks continue to move higher and the US Dollar continues to move lower as Joe Biden seemingly is going to win the US Presidential Election. To put a narrative to the move, the markets like the possibility for more stimulus than would be provided by a Trump administration, but they also like that the Senate will still be controlled by Republicans, limiting the amount Biden can raise taxes. The FOMC is up next, but don’t expect much from Powell with the election drama. A surprise would be a less dovish Powell.

But are some of these post-election day moves in the Yen pairs a little overdone?

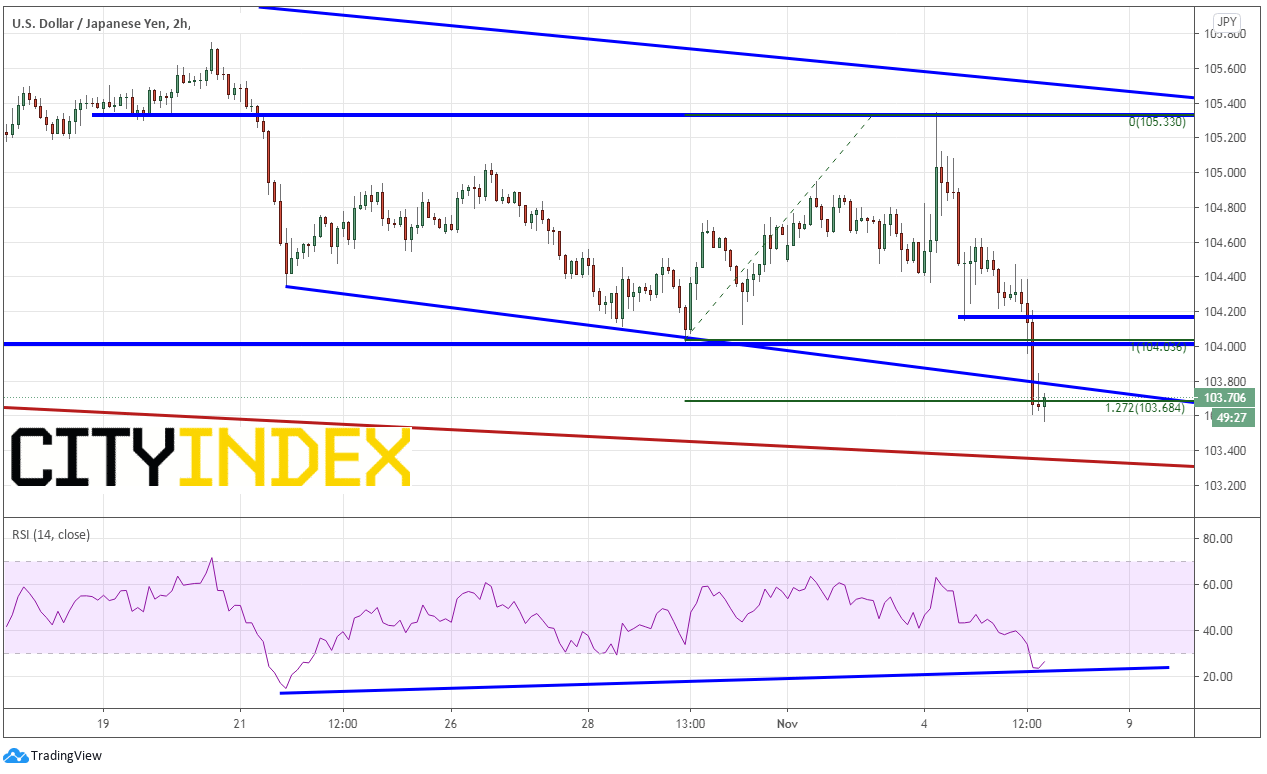

USD/JPY

On a 120-minute timeframe, USD/JPY moved from a high of 105.33 to today’s lows near 103.66 since election night. The pair is just below a downward sloping trendline from October 21st and the 127.2 Fibonacci extension from the low on October 29th to the highs on November 4th. The RSI is diverging with price! Watch for a bounce back into the 103.80/104.00 area where likely sellers will be waiting. Horizontal resistance above there near 104.20. Next support is the long-term trendline from May near 103.30

Source: Tradingview, City Index

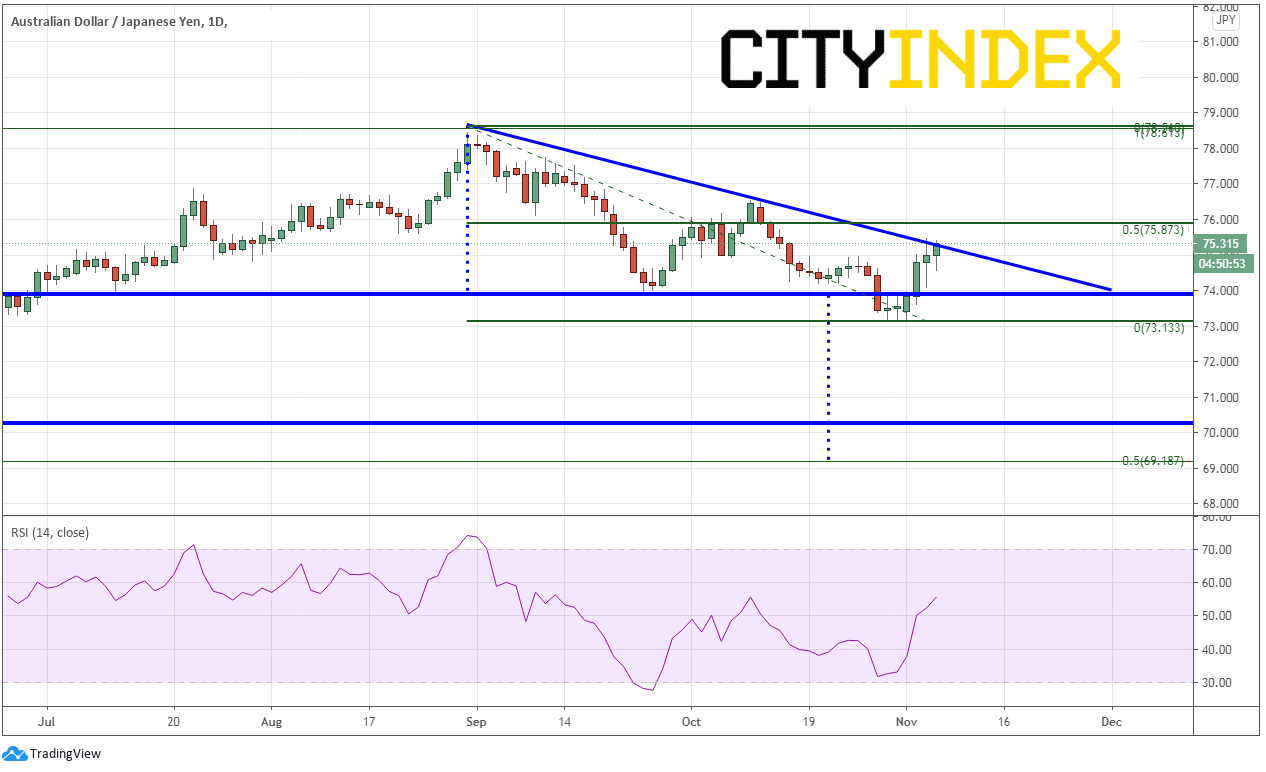

AUD/JPY

The US Dollar weakness has been dragging the Aussie higher (despite more QE from the RBA) and AUD/JPY along with it. On a 240-minute timeframe, the pair has been in a descending triangle since September 1st. The pair briefly broke down through horizontal support before bouncing to test the downward sloping trendline of the triangle. Sellers may be looming near here looking for another push lower. The target for the breakdown of the triangle is down near 69.30, which is also the 50% retracement level from the lows in March to the highs on September 1st. Keep an eye on the 76.00 level. A move above there would invalidate the triangle, as it’s a 50% retracement of the triangle and horizontal resistance.

Source: Tradingview, City Index

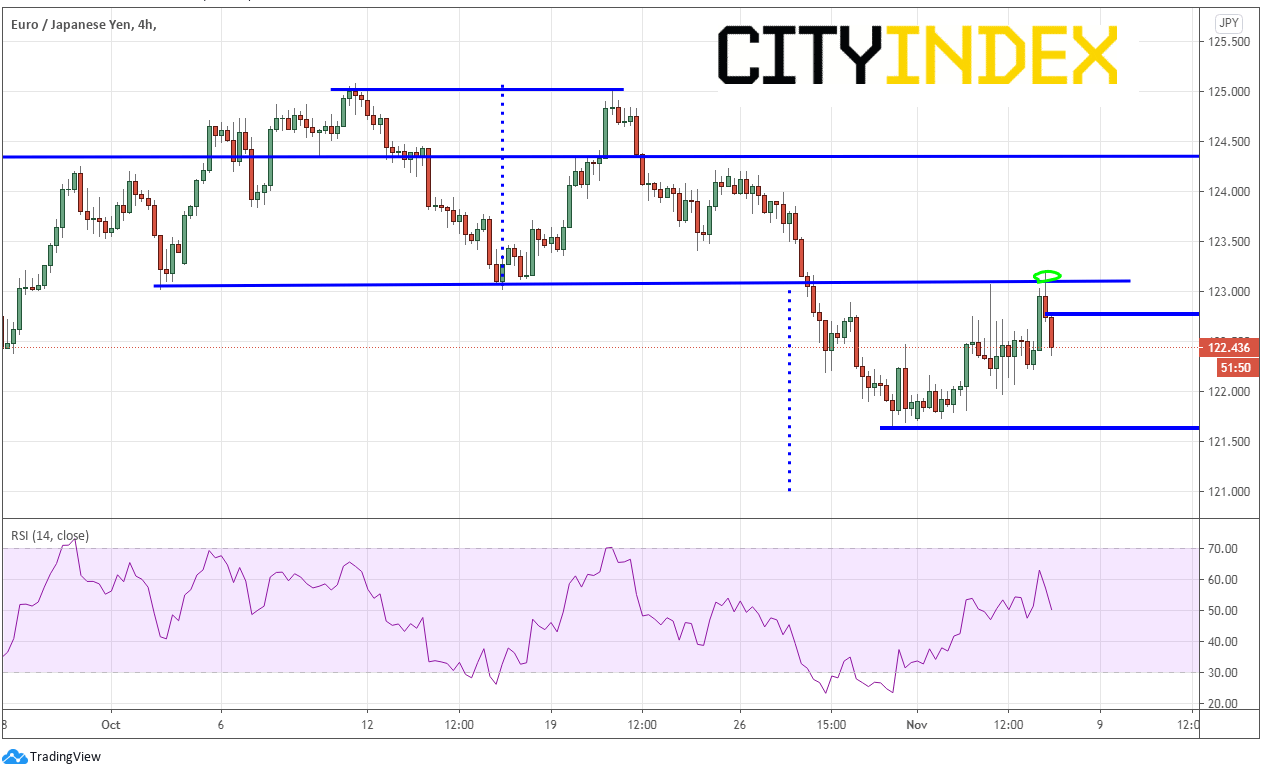

EUR/JPY

EUR/JPY has not done much since the election, however EUR/USD has moved higher with the weak USD. A reversal there could cause EUR/JPY to quickly move lower in line with USD/JPY. Earlier, the pair posted a false breakout through resistance near 123.10 and has been moving lower since. Watch for bounces to 122.80 where sellers may be waiting to enter the trade. The target from the previous double top is still in play near 121.00, however previous lows act as support near 121.60. Strong resistance at today’s highs near 123.20.

Source: Tradingview, City Index

Some of the Yen pairs have had some large volatility since the election, others not so much. But they also look ready for the next move!