Soft deadlines may not matter that much, but sterling’s recovery bid is living on borrowed time

Even after three years of elevated volatility, traders and perhaps hedgers continue to show that they’re still capable of being wrong-footed by Brexit twists and turns. Sterling’s moves over Thursday to Tuesday were little short of ebullient, spanning almost 5%, one of the most impressive ramps over such a time frame for years. There was a sense that many market participants were throwing caution to the wind. One specialised options strategy, called a risk reversal, is a reliable gauge of the extent of appetite for buying or selling an asset. Last week, sterling risk reversals flashed signals suggesting one of the biggest swings to bullishness on the pound ever. Perhaps such an apparently incautious reaction is understandable. And with Brexit-sensitive assets staging a definite though, so far, fairly contained retreat, as headlines inevitably begin to put a dampener on optimism, perhaps the market’s prevailing instincts may yet be vindicated. Still, the risks of an ugly correction if Brexit optimism turns sour are obvious; and the likely reversal has been well-rehearsed several times in recent months.

Latest developments

- The Financial Times reported early in the afternoon that the Democratic Unionist Party had privately accepted UK Prime Minister Boris Johnson’s customs plan. DUP support will be pivotal for getting Johnson’s deal through Parliament. However, regardless of possibly giving way on the ‘fudge’ that would move customs away from the border, the paper’s correspondent noted that the main sticking point is a way of providing democratic consent about any special arrangements that would be acceptable to the DUP and other Northern Ireland parties

- DUP leader Arlene Foster later accused some EU officials of “talking nonsense”, noting that talks between her party and Boris Johnson’s representatives continue. Sterling notched incremental new highs for the day in reaction

- The FT report followed headlines quoting unnamed EU officials stating that a deal was “impossible” unless the UK ‘moved’ its stance again, in order to seal an agreement. Earlier bulletins suggested the EU sees the difficulty in bridging the gap as due to Boris Johnson’s intent to secure DUP backing first

- Further EU commentators said they now saw an agreement before the bloc’s summit begins on Thursday as impossible, with a statement from the meeting probably noting that talks remain ongoing

- Even UK representatives have begun to conclude that late Tuesday comments from the EU were “too optimistic”

So it looks like the coming hours will tell whether pullbacks of the pound and related assets will gather pace. As has been demonstrated once again on Wednesday, missed deadline do not necessarily trigger heightened volatility in themselves. (Remember the EU’s ‘by midnight ultimatum’?) So, confirmation that an agreement will not happen anywhere near this week’s summit need not trigger a wholesale correction for the pound, UK-dependent stocks and beyond. However, downside risks will increase if that message is conveyed, or even just signalled. And some market participants will soon decide that it’s already time to get real - again.

Chart thoughts

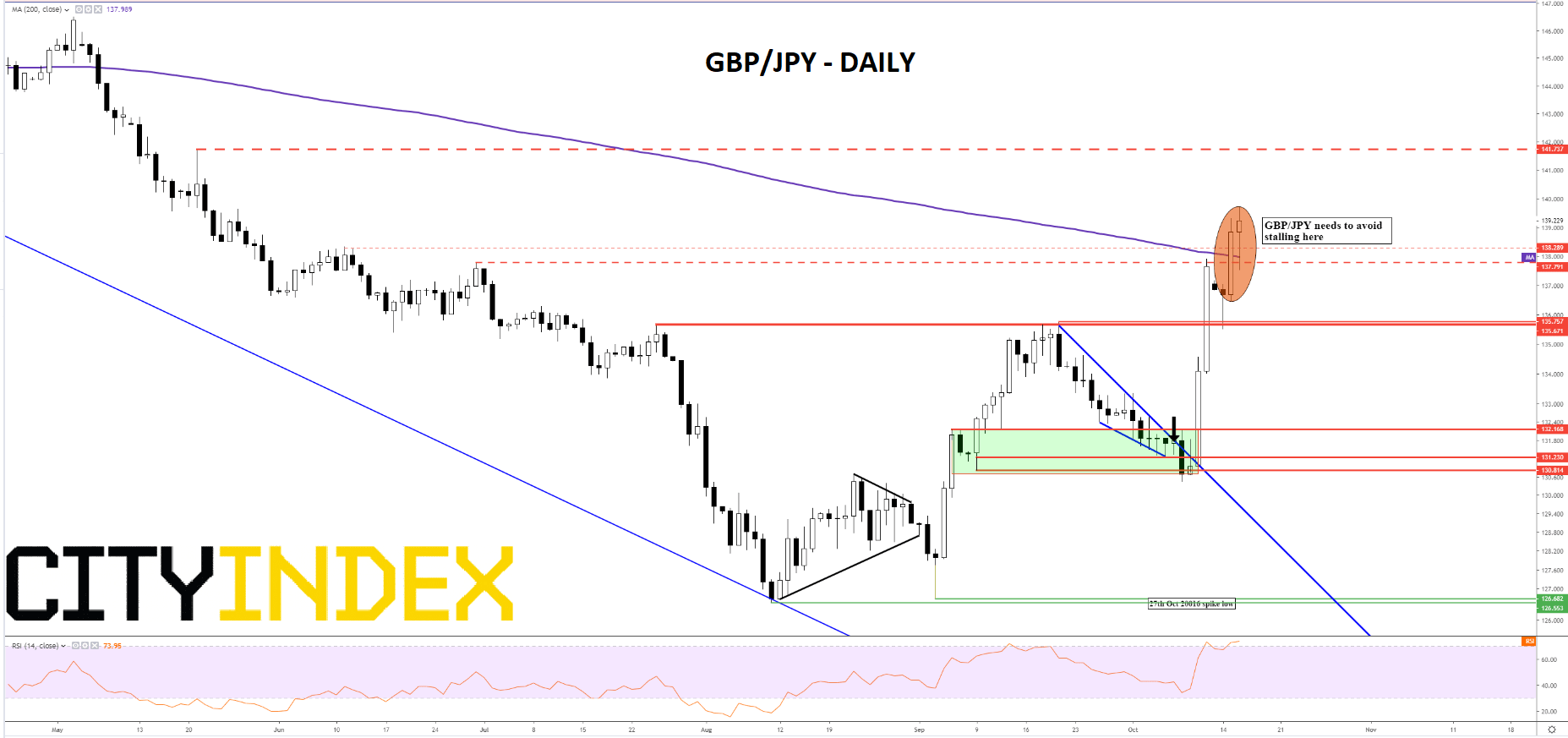

Sterling’s pairing with the yen is back in focus as wider risk aversion again appears to be waiting in the wings. If anything, sterling’s progress looks to have been more sure-footed here than against the dollar or the euro. This week, the rate cleared and held above the nearest key resistance, unlike GBP/USD which has only tiptoed—and rather feebly—over its own on Wednesday, and not for the first time. Yet GBP/JPY is also losing altitude. 141.73 looming overhead is a deterrent. It’s the high of one of the pair’s clearest rising days in a long run of losses last May. Although achieving a break above the 200-day average on Tuesday points to implicit and technical support, the chances that sterling will need to view the underside of that support, before continuing higher is rising. A slip could bring nearby 138-137 minor supports back into the frame and in turn, major former resistance that’s now support at 135.67/75 would then have to be considered.

GBP/JPY – Daily

Source: City Index