Markets complete support levels re test 8230

As expected the sudden downside moves witnessed last week tested the lower boundaries for major global indices. This week should see the start of the […]

As expected the sudden downside moves witnessed last week tested the lower boundaries for major global indices. This week should see the start of the […]

As expected the sudden downside moves witnessed last week tested the lower boundaries for major global indices. This week should see the start of the second wave towards the upside bringing the bulls back into play. The important aspect to note is if we break below the key lows of early August then the trading landscape can get potentially nasty. That would negate the short term bullish outlook for this week and see the bearish trend resume. Upside pivots need to be broken in order to stay on track for the correction to complete before the next major move to the downside takes place over the coming weeks. Key price levels are provided below:

The FTSE 100 was in line to test 4916 with a possible spike down to 4861. The index made it as low as 4938 and has seen a positive start on Monday. This week will need to see the index get above 5335 to aim for the 5445 – 5600 zones as the key resistance levels. There is likely to be further uncertainty in the markets until a direction is confirmed. The problem trader’s face is that the recent volatility has now created wide channels for support & resistance. This means that minor swings are likely to see the market both rise and fall intraday until short term price levels have been breached.

FTSE 100 Weekly

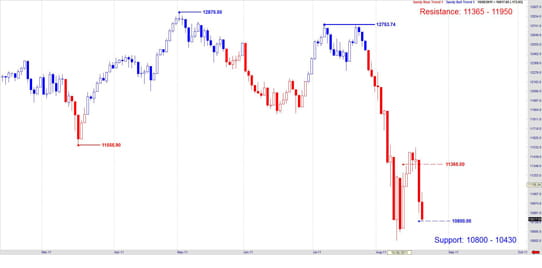

The downside objective for the Dow Jones for last week had been 10800 and Friday’s low of 10801 has satisfied the short term scenario. This week should see a move higher with an aim of clearing 10957 in order to reach for 11176 followed by 11677 as the near term objective. With the current price action an ABC corrective move to the upside should take place provide the August lows have not been violated. The intermediate term trend remains bearish hence any rallies are likely to cause more pain for the bulls. We are probably not out of the woods just yet and will continue to see the Dow move in wide ranges.

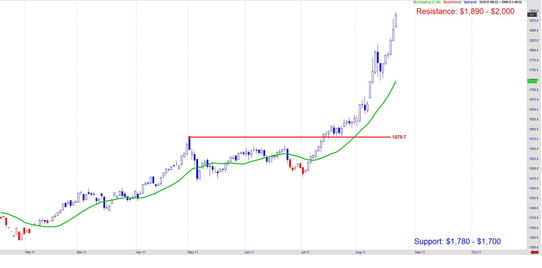

Gold Daily

Maintaining a positive momentum in last week’s trading, Gold continues to reach initial price targets. Currently the October contract rests just below $1,900 per ounce. We are not far off from the all important $2,000 and if the metal continues its bullish momentum then it is likely to surpass the $2,000 level but with the possibility of a strong correction along the way. This week may see a pullback but will need to stay above $1,780 otherwise the pullback could become a correction taking the metal down to $1,700 for support.

Dow Jones Daily